Premium Only Content

IS A RECESSION GUARANTEED?. ETH SHANGHAI DELAYED & CRYPTO READY TO FIGHT.

#CARDANO #CRYPTO #ETHEREUM

Could we POTENTIALLY avoid a recession? Sure. I'm not 100% (and neither is ANYONE else) but maybe we're all looking at the recession as a SURE THING when it might not be. Also, the crypto market is ready to take on the SEC (finally) and Eth Shanghai upgrade gets delayed and I'm happy about that.

TURBULENCE! - https://www.zerohedge.com/markets/bra...

COINBASE - ACT NOW! - https://actnow.io/z31xN5P

WHY & WHEN I'M SELLING 80% of my CRYPTO -

• WHY & WHEN I'M SE...

●▬▬▬▬▬▬CRYPTO ESSENTIALS▬▬▬▬▬▬▬●

🟧 (100% FREE!) Simplified Crypto Education (EASY!)

🟧 DAN Website ► https://danteachescrypto.com/

🔹🔷 DAN CARDANO STAKE POOL: https://bit.ly/danpool 🔷🔹

🙏 HELP OTHERS THROUGH MICRO-LOANS

🙏 WHY I RECOMMEND & GIVE - http://bit.ly/whykiva

🙏 LINK - http://bit.ly/kivaDANgroup

💰iTrust CRYPTO IRA channel sponsor

💰💰 $100 Sign-Up BONUS & NO MONTHLY FEES!

💰💰I RECOMMEND & HAVE a ROTH IRA with iTRUST

💰💰🛑 Why a CRYPTO IRA? VIDEO 👉 https://bit.ly/danIRA

💰💰💰💰💰 *affiliate LINK - https://itrust.capital/dan

🖌INVEST IN SHARES OF MULTI-MILLION DOLLAR PAINTINGS! channel sponsor

🖌UNCORRELATED Asset w/ 16% Yield Historical Track Record & SEC Compliant!

🖌DEEP DIVE VIDEO Explains Everything 👉 https://bit.ly/DANmasterworks

🖌PLAYLIST OF ALL Q&A's - https://bit.ly/mworksplaylist

🖌Legal Disclosure - https://www.masterworks.com/about/dis...

🖌SKIP WAITLIST *affiliate LINK - https://www.masterworks.art/digitalas...

🚀 Ben's INTO THE CRYPTOVERSE Site (On-Chain, Macro & Strategy)

🚀 LINK - https://intothecryptoverse.com/ref/da...

🚀10% OFF 1st MONTH ANY PLAN (excluding LIFETIME) with CODE: DAN10

⑆ TAKE YOUR CRYPTO OFF EXCHANGES!

⑆ LEDGER (THE ONE I USE) LINK - https://bit.ly/danledger

⑆ HOW TO USE LEDGER - https://bit.ly/DANTEACHESLEDGER

📙 KEEP all your Seeds & Passwords SAFE in a STONEBOOK

📙 Water/Tear/Tamper Resistant + WRITE IN INVISIBLE INK!

📙 WHY I have a StoneBook-

• What I Personally...

📙 (20% OFF!! ) ► https://shieldfolio.com/discount/DAN

🇺🇸CRYPTO TAXES MADE SIMPLE!!! affiliate link

🇺🇸 HOW TO USE Video - http://bit.ly/dantaxes

🇺🇸20% OFF - https://bit.ly/coinledgerdan

(Coupon Code: DAN)

🚶♂️🏃♂ 😅SWEATCOIN App! Walk/Run and EARN SWEATCOIN

🚶♂️🏃♂️ FREE to sign up. Earn tokens affiliate link

🚶♂️🏃♂️ DEEP DIVE Vid - https://bit.ly/DANSweatcoin

🚶♂️🏃♂️ DOWNLOAD APP! - https://danteachescrypto.com/sweatcoin

📈 FREE BITCOIN CHARTS - https://www.lookintobitcoin.com

🧐 Think it's a SCAM EMAIL? Check it here ⬇️

🧐 https://toolbox.googleapps.com/apps/m...

🧐 How to Use Email Analyzer - https://bit.ly/danscamemail

●▬▬▬▬▬▬▬▬FOLLOW D.A.N.▬▬▬▬▬▬▬▬▬▬●

🐦🔵 Twitter - https://twitter.com/NewsAsset

🆘 DAN DEGEN (2nd YouTube Channel) https://bit.ly/danclips

🆘 DAN DEGEN channel is all about NEW crypto projects - RISKY!!

●▬▬▬▬▬▬▬▬STRATEGIES▬▬▬▬▬▬▬▬▬●

► 5% DEGEN PLAYS - https://bit.ly/DEGEN

► ALL CRYPTO EXITS (OLD) - http://bit.ly/allexits

► 2024/2025 EXIT (NEW) - https://bit.ly/2025EXIT

⭐️4 YEAR CYCLES - https://bit.ly/4yearCycle

⭐��DCA 5 Examples - https://bit.ly/dcafive

●▬▬▬▬▬RECOMMENDATIONS▬▬▬▬▬●

MINDSET - https://dailystoic.com/

●▬▬▬▬▬▬▬▬DISCLAIMER▬▬▬▬▬▬▬▬▬●

#BITCOIN #ETHEREUM #CRYPTO #CARDANO

***NOT FINANCIAL, LEGAL, OR TAX ADVICE! This channel is for entertainment purposes only and is just my opinion as I am not an expert or a financial planner. Please perform your own research.

hey everybody Welcome to last that news my name is Rob today what I want to talk about is sometimes when we are so sure that we are right maybe in actuality we are wrong so I want to take a look at is uh to go against my thesis which is I believed or believe that a recession is upon us I don't know if it's going to be a hard Landing or a soft Landing but I've been on the Assumption for quite some time you know that if you've been on the channel now the recession is here or is coming and what I'm talking about is

00:31

it seems like every time that we take a look around us there is a consensus and there are people out there that say you know what this is a guarantee this is gonna happen this is definite and I mean just look back I mean how many people talked about how bitcoin's own 150k how many times we hear ethereum's gonna go to 10K okay maybe that'll just that maybe that was just my price predictions but we saw how things were a guarantee and it didn't work out like that so we'll see articles such as

01:01

this is from Zero Hedge and he says Hey brace yourself there's extreme economic turbulence and the article is Well written as usual and I'll link down in the description so you can check it out yourself and when you read these things you're like man this is this is gonna be pretty awful you know you got a board senior director of Economics adaman al-zildrian nailed it is warning that you as consumers are planning to do far less spending in the months ahead ahead home sales are going down home prices have now declined for

01:31

six months in a row higher rates are really hurting the Auto industry and uh also talks about the UK and of course in Europe how the inflation rate is just spiraling out of control and we're facing a global crisis for such a long time central banks and politicians all over the world try to achieve the system and now it's time to pay the piper so those are type articles that we're going to get hit with over and over and over again I can understand because I look at these things and I'm like wow that looks pretty awful but

02:00

let's brat let's back up maybe maybe we're wrong so there's a great website called trueflation truflation.com I think I'll link in the description as well and if you take a look at the inflation rate which is what we're all concerned about here in the states and everywhere else well in the states we'll say like that uh it's actually uses chain link as an oracle to pull outside data and pull that in through multiple data sources and take a look at what the actual inflation rate is and when the

02:33

government came out and said yeah we're at like eight nine percent trueflation was like no you're not you're like way we're way way above that and now we're looking at it and it just keeps going down which looks pretty good now that is just in the U.S I must say in the UK not looking so hot I must tell you I mean 16 is ridiculous but I mean you guys were at 20 and higher so we're looking at that we're like okay that's looking that's looking okay not too bad and then there's a couple of economic factors I

02:59

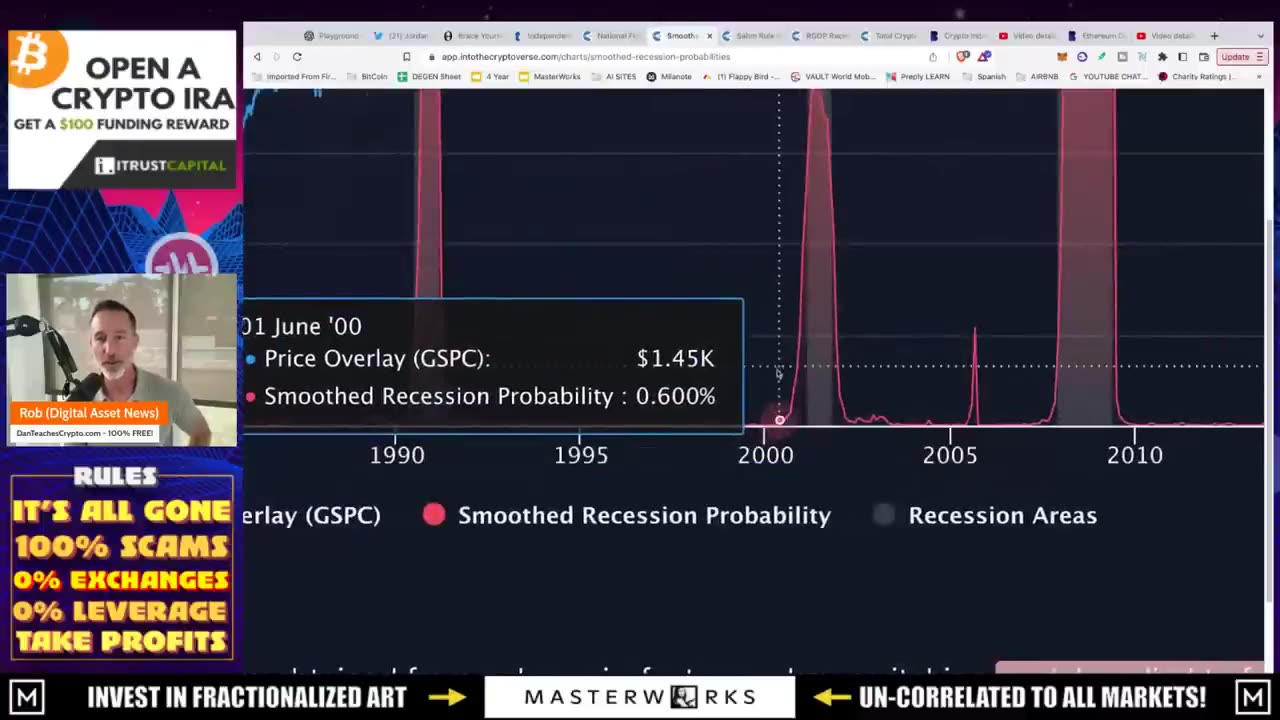

found on Ben's website and we're gonna go over these different ones the Chicago fed National Financial conditions index or the nfci we're gonna take a look at the smooth recession probabilities uh Sam rule recession indicator and the rgdp recession indicator as well and when I took a look at this I'm like okay well these first of all recessions they always call them retrospectively so they're always like okay we're into this recession and the recession started four or five months ago so when you take a

03:37

look at these indicators like for this one Chicago fed it's not all about right now so what is this it's a good question the Chicago fed National Financial conditions Anzac is a measure of overall Financial conditions in the U.S economy it's a weighted average of 105 measures of financial activity it's widely used by economists policy makers and financial Market participants to gain insight into the state of the US economy recessions occurred many times whenever the nfci was above zero positive values indicate financially

04:12

tough times and you can see in this gray area it's looks awful quite awful quite awful and you can see that it's just it's just uh you know peaking here nfci 3.92 this is in the 70s it's uh peaked out of 4.72 again positive numbers are bad negative numbers are good I like uh colors and simple things because I'm a simple 10 3.

04:38

43 you can see here it's above here and the positive is the positives 2008 financial crisis positive 2.61 where are we well if we take a real look here this was when the coronavirus happened I'm sure you've heard of it and uh there was a small recession per se well GDP two quarters of economic growth were decreased and it peaked now we're looking at negative numbers and again positive numbers bad negative numbers good and we can see that it's gone up but it hasn't really done much and then now we're trailing back down and that's just one

05:21

so now if we take a look at the smooth recession probabilities what's this this is interesting model applying to four monthly coincident variables non-farm payroll employment index of industrial production real personal income excluding transfer payments real manufacturing and trade sales recessions are usually determined retrospectively obviously and it states the Sam rule in rgtb rgdp recession indicators can give a head start and the speculation that a recession has already started will not officially declared so again those in a

05:53

second but the smooth recession probability or are we well again we're down here to not too much and we're actually declining has that happened before it has happened before but usually we see something like this there's a little bit of a blip and then it just starts to take off like a rocket and then we're in recession same thing over here in 2000 nothing really happened doesn't decrease actually you skip them up sending over here 1989.

06:25

little flat line action and then straight off to the Moon and so on and so forth actually this one is interesting in 1980 it did actually go up a little bit and then a little reduction then bam it came off so you could make the case for that over here but as it talked about the Sam Rule and rgdp recession indicator those would be a little bit forward-looking so those two the sandwich recession it's based on the ID based on the idea that changes and the unemployment rate can be used to identify the onset of a

06:57

recession if the three-month moving average or the unemployment rate increases by 0.5 percentage points or more above its low for the previous year it's considered a recession signal and again you can see this happens over and over again and that's a big indicator for unemployment fortunately you're unfortunately I don't know what you want to call it uh our unemployment numbers are not going up and again what happens here we see come here hits the recession takes off we see over here a little bit of a blip up a

07:32

little little decrease then it takes off here in 2008 it wasn't even there was no reduction whatsoever just kind of came here and kept calling and then whom recession and of course over here we had a massive number because people were unemployed because of the coronavirus and now what do we have here it's the same thing again it's like it drops off it increases everybody's panicking and then it goes down again so that's forward-looking and the last one rgdp gross domestic product taken out for inflation

08:08

what is this it's based on the idea of the annualized rate of change in the rgdb can be used to identify the onset of recession model assigns a probability between zero percent and a hundred percent depending on the current quarter's growth is indicative of a recession or not values rise above 67 then it has historically been a reliable indicator that the economies in a recession threshold has been passed and it falls below 33 percent it means that other recession is over so all you got to know is this when the

08:38

when the value goes above 67 percent it's been a pretty good bet that we've entered in a recession where are we well you can see over here again we seem to just take off like a rocket ship here we are 45 and then you know off it goes now nothing nothing then a big increase 10 percent and then 77 then over here nothing too much it goes down a little bit but we're still like 39 80 cheese at least 40 and it just takes off this one was closed 29 25 over here in 1980s it's the same thing over and over

09:15

again and I don't want to keep going over this but it's uh 26 here drops off a little bit 27 38 and off it goes now here we are over here and we see them keep going down again now just like in 2008 where it went up and then just reduced and I was like okay it's okay and then I started to Peak again 27 38 and then it takes off it could happen here but I got to tell you right now in this point in time and I can't predict anything I know what he can and whoever says they can or is full of it I can't predict a recession or not but I

09:55

will say this we are heavily undervalued here in the crypto Market so I have to be honest with everybody which is this I feel like we should go through a recession because I feel like we're due for a recession and if we get this recession and it helps to wipe out inflation I think that's actually a good thing unfortunately people are going to lose their jobs it's going to suck I also would like a recession because that would affect the crypto market and it would go down I guess I'm being honest I've been down across averaging for

10:31

quite some time if we start to see a reduction in prices that's great because I still think we got two years and what I'm talking about is we're just taking a look at the value itself this is the crypto market cap and trend line and you can just see that this red this red line here is the fair market value and one thing you'll notice is that rarely on it we're rarely on a fair market value but it gives us to see where things are going and we can see that a lot of times actually for quite some time

11:04

now we're actually below it and when does it happen well it happens in the time when you're when I would say it's a good time to accumulate for me I don't know what you want to do not Financial advice but you can see right here it takes like two years so like in 2011 um topped off and it came back down now we're below the fair market value line in November 2011.

11:28

2013 it goes above it that's about two years sending over here 2015. it goes below the fair market value line how long did it take to get above it yeah about two years 2017. let me come over here oh sweet sweet times 2018 November it falls below the fair market value line now it did go above it for a small amount of time a little blip here actually a good amount of time couple months three months four months but what it do it goes right back down fooled you so from 2018 to what 2020 okay it's about two more years that's two years

12:09

it's always seems like it's two years and here we are again when did it go below 2022 so let me do some quick math yeah it's 2024. so if a recession comes great because I think that's a great time for for accumulation not great times for people in their jobs I'm sorry but again great times for those of us you probably watching this video to potential dollar cost average and that's the real story I don't know what it's going to be but there's some indicators that say like maybe we don't have a

12:42

recession which would kind of suck but that's where we're at so anyhow let me know what you think about that in the comments section I just try to give you a different look of things because just to pile on and keep talking and have an echo chamber of like it's gonna be a recession it's going to be recession it gets old and it gets monotonous baby I'm wrong and that's it so look uh that takes care of that piece and then just to quickly go over a couple of pieces of information I thought was

13:08

great I feel like this is the most bullish news I've seen in quite some time uh Kraken and coinbase want to want to get into a tussle with the SEC essentially that's what it is and I gotta applaud these guys that's great a couple weeks ago we put this nice little video out and I said someone's lying it's either it's either Brian Armstrong or it's Gary Gensler and in that video I said we need to that's what we got to do uh we're gonna get regulation whether we like it or not and we're going to get clarity because

13:43

we need it I know no one likes that when I talk about it but it's just the truth and then I said is we got to do we got to go at the SEC and we need to sue them that was it and now it looks like that's gonna happen potentially so crypto industry is more appetite to fight Kraken exact says so the SEC is after correct is after crypto I think we all know that coinbase and Kraken say their operations are sound I like that they're saying look if you think it's a security come at me bro and uh we'll

14:13

settle this in court we're comfortable that the products we're offering in the US are not Securities Scott bogus nailed it vice president of global regulatory policy at coinbase the tokens on coinbase do not behave like Securities pointing the lack of dividends and residual interest but and this is I think the most important thing I've said this before but he said even if all the tokens on coinbase were ruled Securities coinbase could make it work how would we do that the simple answer is it could be done meaning we'll make

14:46

this happen because there's so much money in the space we're not going to get out of it and miss our piece of the pie and he says we're going to make this happen with sensible rules I think it goes like this what if it comes down to Securities all is Columbia is going to say okay fine we're celebrating unregistered serious whatever let's just give us the fine like you did with EOS we'll pay the fine we'll pay the finally crack and did and uh we'll register with the SEC and now

15:12

we're in the game of registered Securities great Robin Hood did that they they're slinging Securities all day long they're called stocks so I don't see the problem here moving forward uh Jonathan Jacob he's the global head nailed it Global head of policy to crack and agreed he says look disclosures Market Integrity conflict of interest rules it's not Reinventing the wheel these policies have existed for a long time but there are nuances and we can get this done I just find it interesting

15:47

that now they're like everybody was so standoffish with the SEC now they're coming out and they're like well we can make it happen this is what they should have done before but again I'm not I mean I this is what I believe of course I don't have you know billions of dollars in the line it's not like you want to go against the SEC just for funsies it would suck but I think they're getting to the point like okay we need to do this anyhow so let's just make this happen so we can thrive

16:12

but this is what gets me I think this is the this is where it comes from the decision to settle was a business decision Jacob said he goes and remember the if you don't remember Kraken their their staking pools got shut down because the SEC said it was a security Kraken bent the knee and said we will shut this down and never offer it again which is what they signed for that document and they paid a 30 million dollar penalty with I think what they should have done is like oh you think it is we'll see you in court Jack but they

16:43

said look a 30 million penalty is about three percent of our business right now due to the settlement terms we are not able to directly discuss or debate the contents of the settlement I will say this it may have been only three percent but I'm telling you that Revenue that they're going to miss out on staking is substantial coinbase put out an Investor's letter not too long ago and they said look we're getting 47 to 48 of our revenue from subscription services from coinbase one which is like 19.99 a month I pay

17:16

for that a lot of people pay for that that's almost half of their revenue right now because the trades aren't really happening right now uh but people are paying for coinbase one the second highest one or one of the highest ones staking 20 so if you're telling me that it's not a big blow to you to lose 20 of your Revenue and that's false but again I'm not the legal counsel and it's a good thing I'm not because I would probably not do a good job so uh there is that piece and then to finish up

17:47

uh ethereum developers push back Shanghai upgrade to early April just so everybody knows this is the upgrade that it's a lot of people do on stake and unstake their ethereum and you know some people might be like oh Rob's gonna gang up on ethereum no I applaud them good job if you think there was a problem and you say like we need a couple more weeks or however long it's going to be to make sure that we're safe Bravo that's exactly how you should do things so I have no problems with this and uh look

18:15

early April that's close enough to end of March or Middle March when they set it in the original one so I'm happy with this and that's it for today so look that concludes the news and me rambling on about regulation and blah blah blah nobody cares about but that's it so if you like today's video thumbs up consider subscribing everything we talk about is time sensitive now what we'll do because it's Sunday everybody likes this part let's go into the Q a I'll answer all your burning

18:39

questions the best of my abilities and we'll go from there and get out of here do everything else that's it all right everybody what do we got

-

Robert Gouveia

2 hours agoAmerican Soldier DEAD! Trump Furious! Afghan 'Vetted by CIA'! Third World FREEZE!

24.4K18 -

48:48

48:48

The Culture War with Tim Pool

2 hours agoThe West Is COLLAPSING Under Mass Migration | The Culture War's Across The Pond

9.8K37 -

LIVE

LIVE

The Mel K Show

2 hours agoMORNINGS WITH MEL K - We Have Not Yet Begun to Fight - The Clock is Ticking! 11-28-25

986 watching -

LIVE

LIVE

Film Threat

14 hours agoHOLLYWOOD FOR SALE! BLACK FRIDAY BLOW OUT! | Film Threat Livecast

123 watching -

LIVE

LIVE

The Shannon Joy Show

2 hours agoSJ Show Nov 28 - The SJ Friday Matinee Watch Party With Commentary Featuring The Big Short!

33 watching -

35:39

35:39

Grant Stinchfield

4 hours agoThe Medical Deep State Exposed — And McCullough Has the Receipts!

3.48K -

DVR

DVR

Trumpet Daily

1 hour agoTrumpet Daily LIVE | Nov. 28, 2025

2.84K2 -

LIVE

LIVE

LFA TV

15 hours agoLIVE & BREAKING NEWS! | FRIDAY 11/28/25

5,025 watching -

2:00:18

2:00:18

Badlands Media

12 hours agoBadlands Daily – Nov. 28, 2025: DC Chaos, CIA Ties & Trump’s Border Crackdown

90.1K16 -

2:18:44

2:18:44

Nikko Ortiz

3 hours agoVR Ghost Of Tabor... | Rumble LIVE

12.2K2