Premium Only Content

The Benefits of Life Insurance Premium Financing - A Tool for the Uber Rich

Amongst us the wealthiest are often the cheapest and the financially wisest. They have money because they followed the oldest rule in the book: spend less than you make. These individuals that we’re all familiar with don’t like to spend money unless it is absolutely essential.

A key component for their wealth accumulation, wealth preservation, wealth distribution and wealth generational continuance is to own the highest quality life insurance policy possible while paying the least for it.

Premium-financed life insurance is a concept that is both simple and yet complex. The idea of borrowing money to fund the premiums for a life insurance policy makes sense in many situations. No matter how wealthy individuals are, large life insurance premium payments can use assets that they would rather not have to liquidate.

Opportunity costs are not the only reason premium financing makes sense. By utilizing this strategy Individuals can avoid forgoing life insurance or the appropriate amount of life insurance.

In businesses, premium financing can eliminate the strain of cash flow considerations and fund buy/sell and key man obligations.

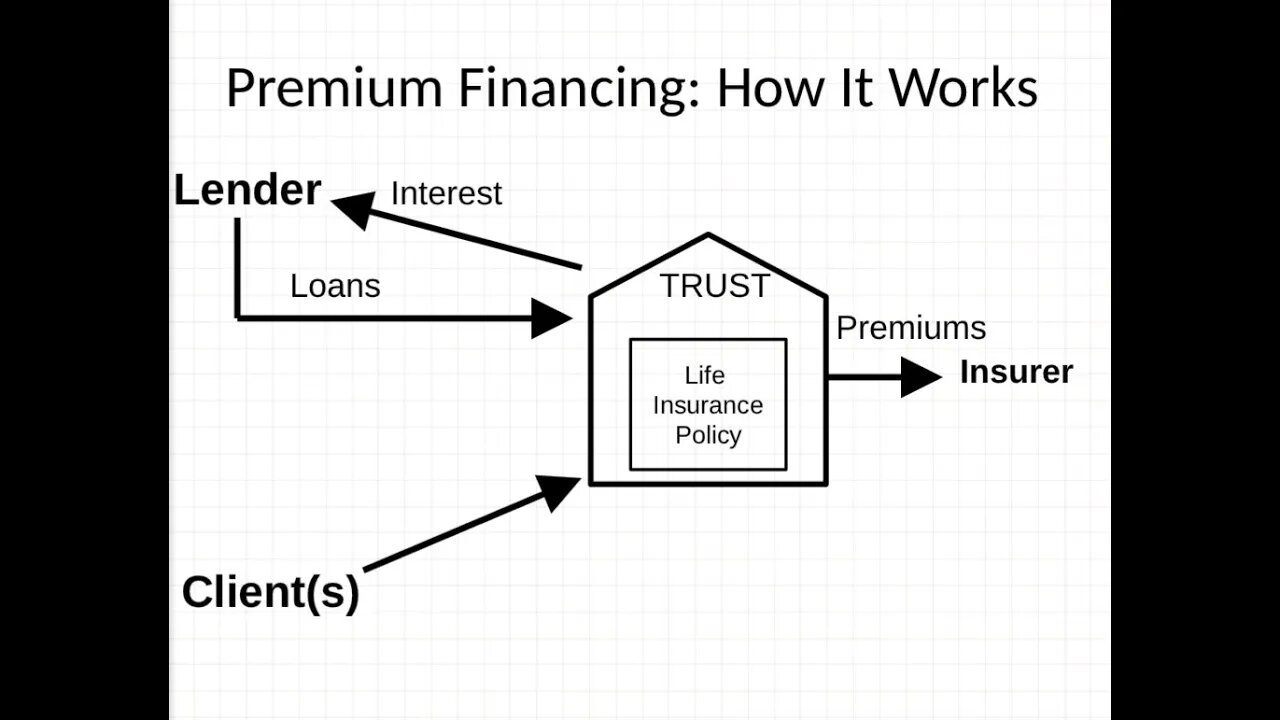

With all premium finance scenarios there are some basic drivers, meaning the potential insured, the policy, and a loan to pay premiums.

In a nutshell, premium finance is when an individual or business borrows money from a third-party lender to pay life insurance premiums. It is then paid back in the future by either the death benefit, cash values in the policy, outside assets or a combination of these sources.

This is not a way to obtain ‘free’ life insurance, but it is cash-flow free. The insurance is paid for through a loan with interest. This loan and the capitalized interest are paid back after the death of the insured. The life insurance policy is issued after a thorough underwriting process for both health and financials and an appropriate insurable interest has been established.

The purchase of life insurance should never be secondary to financing. The transaction should be for the insurance first, not entirely for the arbitrage between the policy crediting rate and interest rate.

Who can benefit?

In the most basic of criteria, it’s someone who has a net worth of at least $10 million, and most typically has a life insurance need for estate planning purposes or key man/ buy sell insurance. Individuals with large estates who need large amounts of insurance, but do not have liquidity, or do not want to liquidate other assets are ideal candidates.

The individual might be heavily illiquid but have assets that can be used as collateral. Of course, general good health and insurability come into play in the equation and clearly need to be evaluated at the beginning of the process. Lastly, it is important that the individual considering insurance premium financing understand the idea of financial leverage and be at ease with the premium finance concept.

Several sources for premium financing are available. Among them are traditional national banks, private investment groups, brokerage firms, and in some cases insurance companies themselves. These lenders have requirements based on the size of the loan and the financial profile of the borrower, as well as the net worth of the individual and the term/funding schedule of the lender.

When weighing the options and risks involved with premium financing there are key factors and questions that must be considered:

•Interest rate risk. During the time continuum of the loan and policy there will be the possibility of the policy growth not keeping pace with the loan.

• Loans may be callable under provisions of the loan agreement.

• Loans may not be renewable or renewable at favorable terms.

• Loans may be required to have additional collateral posted if there is any shortfall in the policy values.

• Is there a personal guarantee required?

• There may be a requirement to infuse personal funds to keep a policy from lapsing.

• Have a plan to exit the policy if rates become unfavorable.

• Structure the initial funding in a way that takes advantage of maximizing cash value.

Insurance premium financing is a solution for individuals that understand the idea of financial leverage and are at ease with the premium finance concept. It is the role of the trusted advisor to educate and to match solutions that best match our clients’ goals, capabilities and needs.

#investing #insurance #premium #estateplanning #keyman #successionplanning #retirement #legacy

-

LIVE

LIVE

Reidboyy

7 hours ago $0.55 earnedNEW FREE FPS OUT ON CONSOLE TODAY! (Delta Force = BF6 Jr.)

81 watching -

29:20

29:20

Stephen Gardner

1 hour ago🔥YES! Trump unleashes Democrats’ worst nightmare!

6.42K4 -

![[Ep 731] Trump Leading the World | Islam NOT Compatible with West | Guest Sam Anthony [your[NEWS](https://1a-1791.com/video/fww1/93/s8/1/c/n/K/a/cnKaz.0kob-small-Ep-731-Trump-Leading-the-Wo.jpg) LIVE

LIVE

The Nunn Report - w/ Dan Nunn

1 hour ago[Ep 731] Trump Leading the World | Islam NOT Compatible with West | Guest Sam Anthony [your[NEWS

179 watching -

2:05:30

2:05:30

Side Scrollers Podcast

5 hours agoEveryone Hates MrBeast + FBI Spends $140k on Pokemon + All Todays News | Side Scrollers Live

74.4K2 -

46:56

46:56

The White House

5 hours agoPress Secretary Karoline Leavitt Briefs Members of the Media, Aug. 19, 2025

43.5K58 -

1:11:36

1:11:36

Sean Unpaved

4 hours agoFootball Flashpoint: Bengals' D in Distress, Colts' Bet on Jones, & Micah's Trade Talks

34.5K2 -

LIVE

LIVE

The Robert Scott Bell Show

1 hour agoVaccine Lawsuits & Legal Fights, Autism–ADHD Link to Tylenol, MAHA Action, Caitlin Sinclair, Fat Jabs for Pets - The RSB Show 8-19-25

74 watching -

2:57:22

2:57:22

Right Side Broadcasting Network

8 hours agoLIVE REPLAY: White House Press Secretary Karoline Leavitt Holds a Press Briefing - 8/19/25

90.1K47 -

1:03:48

1:03:48

Timcast

5 hours agoGavin Newsom SURGES In Polls, COPIES Trump's Style

158K120 -

4:37

4:37

Michael Heaver

10 hours agoBusted France Faces UPRISING

23.9K5