Premium Only Content

Fiduciary Over The Trust

Unrestricted right claim under 1939's 26 USC 1341

You should become familiar with IRS code 1341 if you are paid on a W-2 or 1099 basis, or if you work for yourself. Why? Because of this code, you can stop any IRS liens, levies, or garnishments in their tracks and take advantage of two significant legal deductions that the majority of us are completely unaware of.

According to this code, we are entitled to all of our customarily permitted deductions as well as the ability to deduct all of our "COST OF LABOR AND OR SALARY" as a deduction. What does this ultimately entail for each of us?

Folks, this means that any supposedly taxable income that is left over after all of your usual deductions can be written off as your COST OF LABOR.

According to this code, we are entitled to all of our customarily permitted deductions as well as the ability to deduct all of our "COST OF LABOR AND OR SALARY" as a deduction. What does this ultimately entail for each of us?

Folks, this means that any supposedly taxable income that is left over after all of your usual deductions can be written off as your COST OF LABOR.

-

1:19:33

1:19:33

Freedom Loving Americans

2 years agoConfession And Avoidance

266 -

8:22

8:22

Nate The Lawyer

23 hours ago $0.09 earnedTikTok’s #1 Star Detained & Self DEPORTED in Trump’s Immigration Blitz!

2.08K7 -

53:21

53:21

The Chris Cuomo Project

21 hours agoHow Trump MANUFACTURED the Perfect Political Crisis

13K27 -

5:02

5:02

Sugar Spun Run

20 hours ago $2.22 earnedPasta Salad

72K6 -

8:19

8:19

The Art of Improvement

16 hours ago $6.63 earnedHow to Improve Your Decision-Making

21.1K3 -

3:55

3:55

The Official Steve Harvey

10 hours ago $2.08 earnedTop 5 Motivation Moments with Steve Harvey | Part 1

13.3K4 -

18:37

18:37

Lacey Mae ASMR

10 hours ago $3.70 earnedASMR Plucking Your Negative Energy and Sending Positive Affirmations!

26.2K8 -

1:11:12

1:11:12

Savanah Hernandez

7 hours agoIs Trump Changing His Tune on Mass Deportations & Americans Say NO WAR with Iran

123K159 -

2:42:53

2:42:53

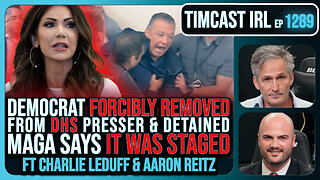

TimcastIRL

8 hours agoDemocrat Senator FORCIBLY REMOVED From DHS Presser, MAGA Says IT WAS STAGED | Timcast IRL

230K98 -

47:23

47:23

Man in America

13 hours agoThe Billionaires Are Hoarding Cash—THEY KNOW WHAT'S COMING w/ Collin Plume

47.6K7