5 Reasons Your Business Credit Applications Get Denied

Are you a small business owner, entrepreneur, or investor looking to build business credit? Do you know why your applications are getting denied when applying for business credit cards and loans?

In this video, Ari shares the top five reasons why your applications may be getting denied so that you can avoid making these mistakes in the future and get approved for the business capital your business deserves.

Check out our FREE Funding Masterclass: https://www.fundandgrow.com/ytwebinar

⏳Timestamps

0:00 - Introduction

0:40 - Reason 1: Improper Entity Setup

3:14 - Reason 2: Negative History

4:09 - Reason 3: Poor/Unestablished Personal Credit

6:55 - Reason 4: Age of Existing Business Credit

7:36 - Reason 5: Too Many Inquiries

9:00 - Closing Thoughts

Like this video? You'll love this: https://youtu.be/9hN8jQb43zI

Since 2007, Fund&Grow has helped 30,000+ business owners and real estate investors across America get access to over $1.4 Billion in growth capital. We’re on a mission to empower entrepreneurs and investors by helping them utilize the smartest form of funding — low-interest, unsecured business credit.

#businesscredit #businessfinances #loanrejected

-

1:11:53

1:11:53

Havoc

5 hours agoWhat's a Classic | Stuck Off the Realness Ep. 5

19.7K2 -

49:35

49:35

Donald Trump Jr.

5 hours agoHULK HOGAN LIVE FROM THE RNC

145K134 -

LIVE

LIVE

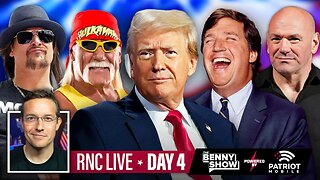

Benny Johnson

6 hours ago🚨Donald Trump, Tucker, Kid Rock, Dana White, Hulk Hogan Bring Down the House at RNC | LEGENDS 🔥

8,752 watching -

5:42:34

5:42:34

Akademiks

7 hours agoCardi B Goes Crazy on Joe Budden. Schoolboy Q Declares War on OVO. Big Sean goes at Kendrick/Haters?

127K20 -

LIVE

LIVE

Drew Hernandez

8 hours agoPRESIDENT DONALD J. TRUMP SPEAKS: RNC NIGHT 4

3,428 watching -

25:59

25:59

FrankSpeech Lindell TV

6 hours agoEmerald Robinson and Mike Lindell Live From Rumble Booth

71.9K14 -

56:06

56:06

Kimberly Guilfoyle

5 hours agoDay 4 of the RNC, Nelk Boys live!

132K81 -

1:27:15

1:27:15

Redacted News

6 hours agoThe TRUTH in Trump's Assassination Plot is Coming Out | Redacted w Natali and Clayton Morris

198K659 -

1:06:39

1:06:39

Russell Brand

6 hours agoTHE BIG FINALE at RNC: LIVE with Dan Bongino, Charlie Kirk & Nigel Farage - SF 411

250K318 -

2:27:31

2:27:31

Tucker Carlson

9 hours agoMike Cernovich on Epstein, Demons & Spirituality, and Feds Embedded in the Conservative Movement

315K296