Premium Only Content

Mortgage Lending Value Expertise

What is the Mortgage Lending Value?

The Mortgage Lending Value concept was first implemented when the Mortgage Banking Act (HBG) was introduced in 1900. In the course of the replacement of the HBG by the Pfandbrief Act (PfandBG) in 2005, the provisions for determining the Mortgage Lending Value was also incorporated into a uniform set of rules with the introduction of the "Ordinance on the determination of the mortgage lending values of land according to §16 (1) and 2 of the Pfandbrief Act" (Mortgage Lending Value Determination Ordinance - BelWertV).

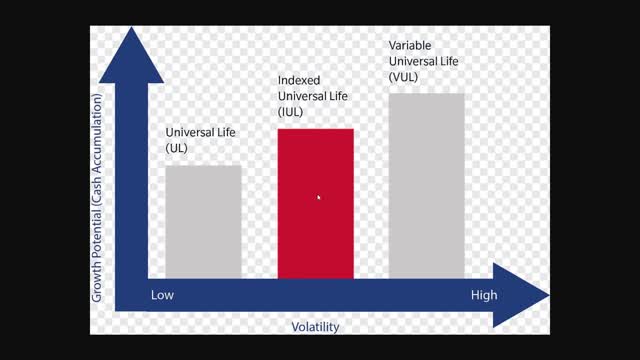

The philosophy of the Mortgage Lending Value is that such an established value must be obtained over the entire term of the loan, regardless of the natural market fluctuations, in the hands-free resale of the property. The Mortgage Lending Value is therefore significantly lower than the market value at the time of the calculation and must not be subject to a positive value adjustment during the entire loan term. Regulatory requirements require that market value and Mortgage Lending Value be monitored at regular intervals. In the event of unusually strong negative market fluctuations, the Mortgage Lending Value must also be checked and, if necessary, reduced. A subsequent increase in the Mortgage Lending Value after the market recovery is beginning is not possible.

-

4:23:50

4:23:50

Akademiks

11 hours agoDay 7/30. Lil Durk Hit with NEW Superseding Indictment. YB back! Trippie & Future Beefin over thot?

68.6K7 -

7:18:24

7:18:24

Tommy's Podcast

8 hours agoE718: Shilohmaxxing

37.5K -

2:05:58

2:05:58

TimcastIRL

11 hours agoTrump WINS, Q1 Jobs Report SMASHES Expectations, MS-13 ATTACKS Prison Guards

211K139 -

3:53:48

3:53:48

SynthTrax & DJ Cheezus Livestreams

20 hours agoFriday Night Synthwave 80s 90s Electronica and more DJ MIX Livestream Variety Edition

72.6K12 -

3:55:59

3:55:59

Fragniac

11 hours ago🔴FORTNITE w/ @GrimmHollywood & @VapinGamers ( -_•)╦ ╤─💥

57.3K2 -

51:49

51:49

Adam Does Movies

2 days ago $4.31 earnedTalking Movies With Sinners Actor Christian Robinson - LIVE!

52.9K4 -

9:36:16

9:36:16

Dr Disrespect

20 hours ago🔴LIVE - DR DISRESPECT - ARC RAIDERS - THE WAIT IS OVER

205K19 -

2:24:49

2:24:49

TheSaltyCracker

12 hours agoThey Want Her Arrested ReeEEEStream 05-02-25

149K338 -

1:58:36

1:58:36

Joker Effect

10 hours agoThis has to be the best thing to happen to the internet... https://go.mother.land/Joker

38.2K1 -

4:22:31

4:22:31

Nerdrotic

17 hours ago $49.10 earnedThunderbolts Group Therapy, James Gunn's Superman LEAKS, PolyGONE | Friday Night Tights 352

152K54