How To Scale A Multi Family Real Estate Portfolio And Raise Money: The Right Strategy

Michael Ponte is a real estate investor and entrepreneur who specializes in the acquisition, renovation, and appreciation of real estate properties. He is the founder and president of Prosperity Real Estate Investments and has been in real estate for over 20 years.

Join us in this interview as Michael shares the vast knowledge he’s accumulated throughout his years as a real estate investor. Watch until the end as he discusses some of his strategies for increasing the value of real estate properties and what to watch out for at the start of the investment.

Schedule a FREE coaching call: coaching.freedomchaserspodcast.com

Don’t Forget To Reach Out To Michael Ponte

Facebook: Savvy Investor | Facebook

Website: http://www.prosperityinvestments.ca/

Linkedin: https://www.linkedin.com/company/prosperity-real-estate-investments

Quotes -

“One of the things that I would recommend for those that are investing in other markets, other states, other provinces, other areas is always make sure you go out to see your property physically if you can or at the very least virtually every 6 months.”

“Real estate investing is not passive at all. 0 passive, unless you are just more of a money investor and in some cases, I still think it’s still very active, in making sure your partners are still doing what they say they are doing.”

“When you’re buying a single-family home or a property, you are technically buying a property. But when you’re buying multi-family, and when I say multi-family it’s not fourplexes, I’m looking at 5+, you are buying a business. And in that business, it is all about the Net Operating Income.”

“The biggest difference that I like about real estate versus the stock market is I can see what’s going on in the market. I can determine what rent rates are, I can really be more involved in the business and I can make things actually happen to increase the valuation of the property.”

“You might have the most amazing building, but the area is gonna dictate your tenant base and that’s just the reality of it.”

“You always need to be in the position where you need to be constantly raising your capital because there’s that percentage that it may fall by the wayside.”

Concepts -

Net Operating Income (NOI) is a calculation used to analyze the profitability of income-generating real estate investments. It’s equal to all the revenue the property makes minus the operating expenses, not including the mortgage.

With real estate, you have a lot more control over how you can grow your investment whereas, with stocks, you just have to watch.

With real estate, you have to be actively looking for ways to increase your value and profits like looking into rent rates and utilities hence why it is not considered a passive income.

Finding the trends of migration, the number of jobs being made within the area, and asking for plans from the local government for the area can help you determine how many tenants you can accommodate within the area.

It is also important to consider the longevity of the jobs that are being created, to see if the increase in population is short-term or long-term.

When looking for partners, you’re not selling the deals, you’re selling yourself. Project yourself as someone reliable and trustworthy so no matter what the deal is, your potential partner will trust you that this deal will work out.

Don’t short-change your investments, always have healthy reserve funds as a long-term strategy will involve a lot of expenses. Never overestimate, always assume the worst-case scenario is going to happen, so when that happens you are ready for it.

Pay close attention to what’s happening within your markets, if there are any opportunities that may arise or if there are problems that need to be solved or you need to be prepared for so you can predict what the next steps are for your business.

Time Stamps

0:00 Introduction

5:30 Is Real Estate Investment a passive income?

12:47 What does your due diligence process look like?

14:50 Checking migration patterns and jobs within the area

18:00 Minimum jobs per capita for a safe investment

19:45 Red flags to look for in properties

23:50 Projections and Strategies for the future

29:45 How do you get into cash?

35:25 How are you staying happy after being in real estate for so long?

41:00 Top three lessons learned in your 20-year career

46:10 Keeping things challenging and fun after so long in real estate

50:40 No Contacts, No Credibility, how would you raise 1 million dollars in 1 week?

55:10 Expanding your network

58:00 Visions for the next 12 months

👍 Keep up with The Freedom Chasers

Subscribe to our YouTube: https://www.youtube.com/channel/UC4_Wkdt-M2rKLmfucReIneg?sub_confirmation=1

Follow us on Instagram: https://www.instagram.com/podcast_tfc/

Follow us on Twitter: @tfcp_podcast

https://www.facebook.com/groups/freedomchaserspodcast

-

56:42

56:42

Candace Owens

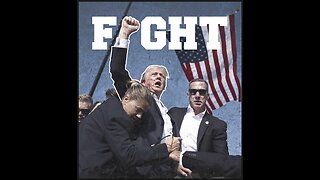

6 hours agoLIVE! Second ASSASSINATION ATTEMPT on President Donald Trump

180K731 -

3:10:08

3:10:08

vivafrei

12 hours agoEp. 228: Self-Defense ILLEGAL? Kamala - Trump Debate FALLOUT! Corrupt Cops, Vaccine Updates AND MORE

167K158 -

3:03:53

3:03:53

Benny Johnson

8 hours ago🚨 EMERGENCY: Second Trump Assassination Attempt Right NOW, Secret Service OPENS FIRE, Trump Shot At

279K1.07K -

4:20:52

4:20:52

Drew Hernandez

7 hours agoBREAKING: ANOTHER TRUMP ASSASSINATION ATTEMPT?!

127K104 -

LIVE

LIVE

Vigilant News Network

8 hours agoWhistleblower Reveals How Big Tech Is ALREADY Rigging the 2024 Election - Media Blackout

1,411 watching -

1:46:52

1:46:52

BaldBrad

7 hours agoBreaking News: Donald Trump Had Another Assassination Attempt On His Life

128K89 -

4:35:26

4:35:26

LumpyPotatoX2

11 hours agoSunday Funday - #RumbleGaming

113K4 -

10:27

10:27

Vigilant News Network

2 days agoTop Democrat Warns Americans Will Be SHOCKED by Secret Service's Failures | Beyond the Headlines

137K26 -

10:39:13

10:39:13

Barstool Gambling

12 hours agoPardon My Take and Company Sweat Out the Sunday Slate | Barstool Gambling Cave

114K -

LIVE

LIVE

Major League Fishing

3 days agoLIVE! - General Tire Team Series: Heritage Cup - Day 1

201 watching