Premium Only Content

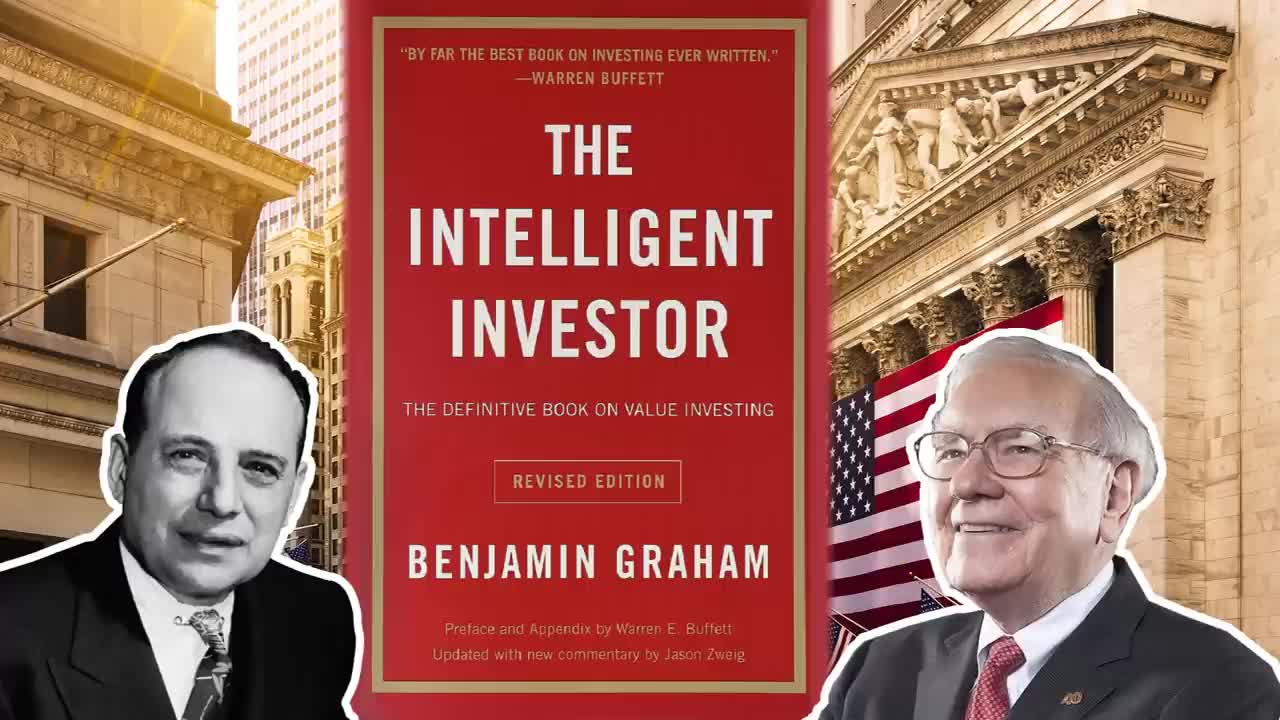

The Intelligent Investor by Benjamin Graham | Full audiobook | Investing made easy

The Intelligent Investor is based on value investing, an investment approach Graham began teaching at Columbia Business School in 1928 and subsequently refined with David Dodd. This sentiment was echoed by other Graham disciples such as Irving Kahn and Walter Schloss. Warren Buffett read the book at age 20 and began using the value investing taught by Graham to build his own investment portfolio.

The Intelligent Investor also marks a significant deviation to stock selection from Graham's earlier works, such as Security Analysis. Which is, instead of extensive analysis on an individual company, just apply simple earning criteria and buy a group of companies. He explained the change as:

The thing that I have been emphasizing in my own work for the last few years has been the group approach. To try to buy groups of stocks that meet some simple criterion for being undervalued -- regardless of the industry and with very little attention to the individual company... I found the results were very good for 50 years. They certainly did twice as well as the Dow Jones. And so my enthusiasm has been transferred from the selective to the group approach. What I want is an earnings ratio twice as good as the bond interest ratio typically for most years. One can also apply a dividend criterion or an asset value criterion and get good results. My research indicates the best results come from simple earnings criterions.

Commentary on the Introduction

Investment versus Speculation: Results to Be Expected by the Intelligent Investor

The Investor and Inflation

A Century of Stock Market History: The Level of Stock Market Prices in Early 1972

General Portfolio Policy: The Defensive Investor

The Defensive Investor and Common Stocks

Portfolio Policy for the Enterprising Investor: Negative Approach

Portfolio Policy for the Enterprising Investor: The Positive Side

The Investor and Market Fluctuations

Investing in Investment Funds

The Investor and His Advisers

Security Analysis for the Lay Investor: General Approach

Things to Consider About Per-Share Earnings

A Comparison of Four Listed Companies

Stock Selection for the Defensive Investor

Stock Selection for the Enterprising Investor

Convertible Issues and Warrants

Four Extremely Instructive Case Histories and more

A Comparison of Eight Pairs of Companies

Shareholders and Managements: Dividend Policy

"Margin of Safety" as the Central Concept of Investment

-

UPCOMING

UPCOMING

Robert Gouveia

1 hour agoDemocrats FAIL to APPEAR! Time for WARRANTS?? Victim Speaks Out! Habba FIGHTS!

6.1K -

13:49

13:49

Bearing

10 hours agoSydney Sweeny’s N@ZI Jeans?! 💥 Woke Crybabies MELT DOWN Over Pants 🤣

7.88K67 -

LIVE

LIVE

Jamie Kennedy

11 hours agoControlled Collapse: How They Normalize the End of the World | Ep 216 HTBITY w/Jamie Kennedy WOF#44

89 watching -

LIVE

LIVE

The Amber May Show

3 hours agoGlobal Peace, Pharma Shakeups & Historic Deals – w/ Andy Hooser

97 watching -

LIVE

LIVE

Rallied

3 hours ago $0.64 earnedWARZONE CHALLENGES WITH DRDISRESPECT & BOB

95 watching -

LIVE

LIVE

StoneMountain64

5 hours agoAnswering BATTLEFIELD 6 Questions and Reviewing TOP Clips (BETA DOWNLOADED)

99 watching -

1:18:33

1:18:33

vivafrei

5 hours agoPride Goeth Before the Fall! Derelict Democrats! Tucker Cover-Up? Charlamagne the Blasphemer & MORE!

129K74 -

LIVE

LIVE

The Rabble Wrangler

5 hours agoRimWorld with The Best in the West!

18 watching -

1:52:15

1:52:15

The Quartering

4 hours agoTrump ENDORSES Sydney Sweeney, Sad Epstein Files Update, Gen Z Microsoft Worker Self Own

122K66 -

LIVE

LIVE

LFA TV

20 hours agoLFA TV ALL DAY STREAM - MONDAY 8/4/25

1,008 watching