Premium Only Content

Bitcoin Banking in 2050 with Eric Yakes

SHOW NOTES:

https://www.whatbitcoindid.com/podcast/bitcoin-banking-in-2050

Eric Yakes is the author of ‘The 7th Property’. In this interview, we discuss the possible Bitcoin banking systems that could emerge when Bitcoin reaches maturity. We consider the forms of banking that developed in the past, and the new forms of banking Bitcoin and the Lightning Network could engender.

THIS EPISODE’S SPONSORS:

Gemini - https://www.gemini.com/

Wasabi- https://www.wasabiwallet.io/

Ledn - https://www.ledn.io/

Pacific Bitcoin - http://pacificbitcoin.la/

Ledger - https://www.ledger.com/

Texas Blockchain Summit - https://www.texasblockchainsummit.org/

BCB Group - https://hubs.ly/Q011cb730

TIMESTAMPS:

00:00:00 Introduction

00:02:56 Bitcoin banking systems

00:09:29 The evolution of a Bitcoin banking system

00:22:04 2050: Hyperbitcoinisation & the Lightning Network

00:36:26 Full reserve banking on Bitcoin

00:48:53 Limitations of a Bitcoin full reserve system

00:58:34 A side track into politicians and films

01:23:19 The distribution of Bitcoin, Cantillon effect & the broker system

01:34:28 Will Bitcoin kill fractional reserve banking?

WHERE TO FIND THE SHOW:

→ My website: https://www.whatbitcoindid.com/podcast/

→ iTunes: https://apple.co/2OOlzVV

→ Spotify: https://spoti.fi/2ygc4W1

→ Stitcher: https://bit.ly/2IQO8fX

→ SoundCloud: https://bit.ly/2CGSVQR

→ YouTube: https://bit.ly/3nyi9Ez

→ TuneIn: https://bit.ly/2ywystr

LISTEN TO OLD EPISODES:

→ By guest: https://www.whatbitcoindid.com/guests/

→ By topic: https://www.whatbitcoindid.com/topics/

→ Transcriptions: https://www.whatbitcoindid.com/transcriptions/

SUPPORT THE SHOW:

→ https://www.whatbitcoindid.com/sponsorship/

→ Become a Patron: https://www.patreon.com/whatbitcoindid/

→ Subscribe on iTunes

→ Leave a review on iTunes

→ Share the show out with your friends and family on social media

→ Drop me a line on hello@whatbitcoindid.com

WHERE TO FOLLOW ME:

→ Twitter: https://twitter.com/whatbitcoindid/

→ Medium: https://medium.com/@whatbitcoindid/

→ Instagram: http://instagram.com/whatbitcoindid/

→ Facebook: https://www.facebook.com/whatbitcoindid/

→ YouTube: https://www.youtube.com/whatbitcoindidpodcast

→ Website: https://www.whatbitcoindid.com/

→ Email list: https://www.whatbitcoindid.com/subscribe/

LEARN ABOUT BITCOIN:

→ Step by Step Guide: https://www.whatbitcoindid.com/beginners-guide

→ Training: https://www.whatbitcoindid.com/training/

→ Resources: https://www.whatbitcoindid.com/resources/

#Bitcoin #Finance #Economics

****

“Now that we have this peer-to-peer payment network, where normally that value is being captured by credit card companies and applications and things like that in our current system, now that it’s peer-to-peer, that value can be captured by individuals peer-to-peer…that 5% fee going to your credit card company, that’s going to you baby.”

— Eric Yakes

Eric Yakes is the author of ‘The 7th Property’. In this interview, we discuss the possible Bitcoin banking systems that could emerge when Bitcoin reaches maturity. We consider the forms of banking that developed in the past, and the new forms of banking Bitcoin and the Lightning Network could engender.

- - - -

One of the major changes brought about by Bitcoin is that it encourages those who discover it to study and question money. It is an awakening, which changes the concept of finance, and the balance of power between the state and individuals. Not only does this upend the confidence in state control monetary systems, it also makes people question state-regulated banking systems.

The idea that there are alternatives gives optimism to those who have railed against fractional reserve banking. Expanding the money supply beyond that covered by reserves was deemed by some to have been a primary driver of the global financial crisis. Further, it has given rise to a generation of central bankers who are more comfortable with printing money.

The promise of Bitcoin is the return to full reserve banking: a balance between deposits and lending. However, whilst this mitigates the chaos of deleveraging from unsustainable debt, it may also hinder long-term investment. These are the basic outlines of the major economic arguments that have separated the Austrians from the Keynsians, which have defined the push and pull of western monetary policies in the post-war period.

Irrespective of the merits of either side of the debt around the usefulness of credit, Bitcoin could be expected to work in a spectrum of societal approaches to credit. The question, therefore, is what banking systems will Bitcoin and the Lightning Network facilitate?

Will the nature of banking remain similar to the present, will there be a renaissance of old forms of banking, or will the market evolve new forms of banking? Each scenario is complete with a set of tradeoffs. But, Bitcoin’s scarcity, combined with its utility as a digital permissionless uncensorable global monetary system, opens up a world of possibilities.

-

1:15:36

1:15:36

The Peter McCormack Show

3 months agoAre Nigel Farage and Reform Britain’s Next Government | Matt Goodwin x Peter McCormack Show

198 -

LIVE

LIVE

I_Came_With_Fire_Podcast

9 hours agoRevelations from the Ukrainian Front Lines

420 watching -

52:56

52:56

X22 Report

5 hours agoMr & Mrs X - Big Pharma Vaccine/Drug Agenda Is Being Exposed To The People - Ep 7

67.1K31 -

1:41:59

1:41:59

THE Bitcoin Podcast with Walker America

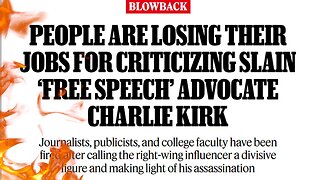

11 hours ago $17.40 earnedThe Assassination of Charlie Kirk | Walker America, American Hodl, Erik Cason, Guy Swann

53.9K31 -

21:33

21:33

marcushouse

5 hours ago $1.19 earnedSpaceX Just Revealed the Plan for Starship Flight 11! 🚀

20.5K6 -

35:03

35:03

Clownfish TV

8 hours ago'Live by the Sword, Die by the Sword.' | Clownfish TV

28.3K78 -

8:15

8:15

Sideserf Cake Studio

3 hours ago $0.34 earnedA Hyperrealistic TAKIS Cake?

19.2K2 -

55:49

55:49

SGT Report

15 hours agoFAKED TRAGEDY, LONE GUNMAN OR PATSY? -- Jeffrey Prather

42.2K170 -

9:30

9:30

Adam Does Movies

14 hours ago $0.32 earnedThe Long Walk - Movie Review

13.9K2 -

2:28

2:28

WildCreatures

14 days ago $1.10 earnedNature's struggle for survival: Water snake devours mudpuppy

16.4K4