Premium Only Content

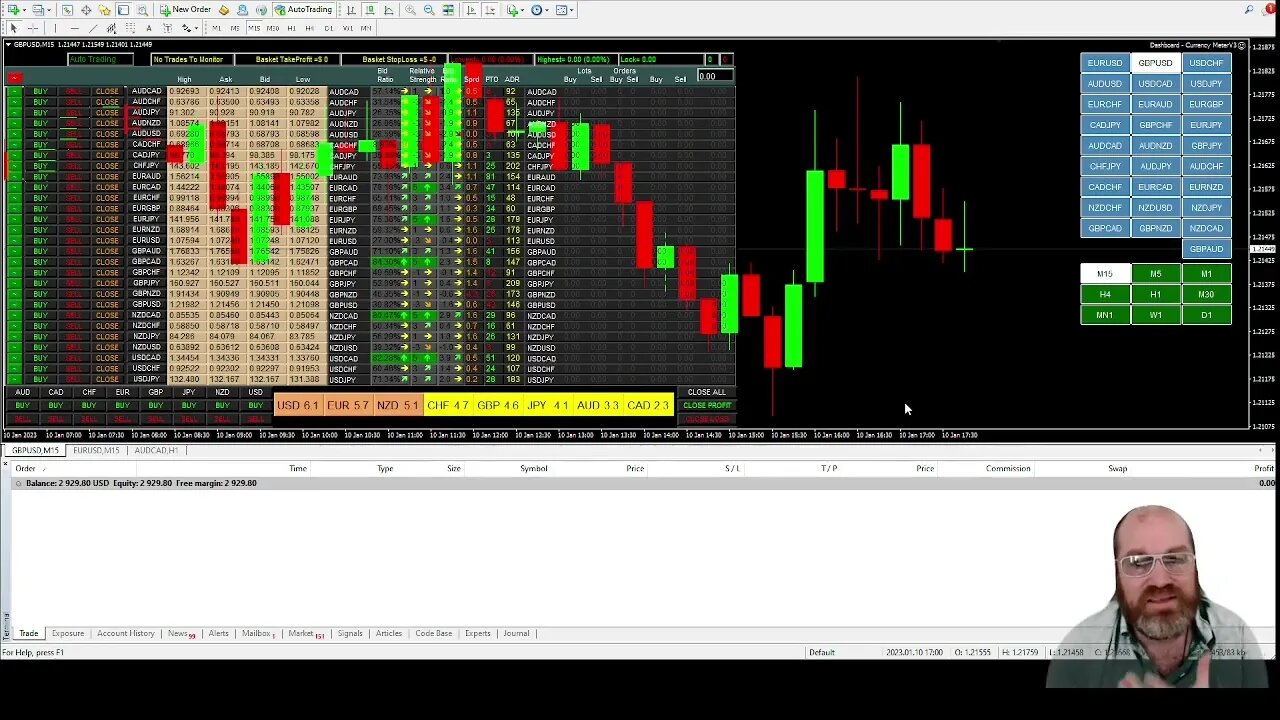

Testing Forex Robots - Lets Find One That Works 24/7 - Part 2

Testing Forex Robots - Lets Find One That Works 24/7 - Part 2

Use Same Forex Broker Like Me:

Go here: https://bit.ly/3bt2sxp

If From US use this Forex Broker: https://bit.ly/3SkBjh5

Download My Free WorldWide Binary Options Robot Alpha Master Go here: https://bit.ly/3MWYNoI

Join My Telegram Channel For Free Here: https://t.me/+KmJHGALkTPUyOGRh

Join My NewTwitter Account: https://twitter.com/alphaoneyoutube

Best Worldwide Binary Options Broker for manual trading: https://bit.ly/3SxC6dD

AlphaOne AI-BOT a Free WorldWide Binary Options Robot Go here: https://bit.ly/3T9fCjx

With Only use of my link you get to use my Robot and also deposit only 100 dollar to get started!

Use Promo code: CRAZY200 and get 200% on your first deposit! Just for Iqcent Broker.

Also Join me on Discord: https://discord.gg/wkvyWPcM2p

Testing forex robots, also known as expert advisors (EAs), is an essential step for any trader who is considering using one to trade the foreign exchange market. These automated trading programs use algorithms to analyze market conditions and make trades based on certain predetermined rules, and while they can be an effective tool for trading, it's important to thoroughly test them before using them with real money.

The process of testing a forex robot typically involves two steps: backtesting and forward testing. Backtesting is the process of running the robot on historical market data to see how it would have performed in the past. This can provide valuable insight into the robot's performance and help you identify any potential issues with its trading strategy.

Forward testing, on the other hand, involves running the robot on live market data to see how it performs in real-time conditions. This step is crucial because it allows you to see how the robot adapts to changing market conditions. Forward testing also allows you to evaluate the robot's performance in the context of real-world trading, and to assess the stability of its performance over time.

When testing a forex robot, one of the most important things to look for is profitability. A profitable robot should be able to make consistent returns over time, while a non-profitable robot will simply eat up your trading capital. Therefore, it's important to look at the robot's historical performance and make sure it has a track record of success. Additionally, you should also examine the robot's performance in different market conditions, as well as its ability to adapt to different market environments.

Another important factor to consider when testing a forex robot is its risk management capabilities. A good robot should be able to manage risk effectively and minimize losses when the market goes against it. Additionally, a well-designed robot should have built-in risk management strategies such as stop-loss orders, which limit the amount of losses that can be sustained in a single trade.

It's also important to keep in mind that no forex robot is perfect, and even the best robots will have losing trades. Therefore, it's important to have realistic expectations and not to rely solely on a robot for your trading decisions. Additionally, it's important to continually monitor the robot's performance and make adjustments as necessary to optimize its performance.

In conclusion, testing a forex robot is an essential step for any trader who is considering using one. By thoroughly evaluating the robot's performance through backtesting and forward testing, traders can gain valuable insight into its capabilities and determine whether or not it's suitable for their trading style. Additionally, it's also crucial to keep an eye on the robot's performance over time and make necessary adjustments to ensure that it continues to be a profitable and effective trading tool.

-

1:38:28

1:38:28

Glenn Greenwald

5 hours agoThe Fraudulent GOP War Against Tucker and Nick Fuentes; Dick Cheney: Hero of the Resistance; Lindsey Graham's Deranged RJC Comments | SYSTEM UPDATE #544

75K80 -

LIVE

LIVE

ThePope_Live

44 minutes agoRedsack with the boys Cheap, Jah and Nova!

51 watching -

LIVE

LIVE

Hernandez2787

4 hours agoArc Raiders - 1st Playthrough/ Celebrating My Anniversary as Sergeant First Class in the US Army

57 watching -

48:42

48:42

Donald Trump Jr.

5 hours agoCommunism vs Common Sense, What's Next for NYC? | TRIGGERED Ep.289

114K251 -

LIVE

LIVE

JahBlessCreates

41 minutes ago🎉Big Vibes - Gaming with Cheap, Pope, and Nova

23 watching -

1:31:25

1:31:25

The Charlie Kirk Show

4 hours agoTHOUGHTCRIME Ep. 104 — Post-Election Palette Cleanser + Tucker/Fuentes Interview Reaction

74.4K29 -

LIVE

LIVE

tminnzy

3 hours agoSmooth Moves Only 💨 | Naraka: Bladepoint Chill Gameplay | !gx

22 watching -

1:04:33

1:04:33

BonginoReport

5 hours agoWill The LA Dodgers Dodge WH Visit?! - Nightly Scroll w/ Hayley Caronia (Ep.172) - 11/06/2025

48.8K67 -

3:23:13

3:23:13

Tundra Tactical

6 hours ago $0.01 earnedDadlefield Game Night BF6 New Update Weapon Grind

28.5K5 -

15:39

15:39

Megyn Kelly

6 hours agoTucker Carlson on Why He Interviewed Nick Fuentes and What He Wanted to Convey To Him

63.9K86