Premium Only Content

Investing in Volatile Markets: Strategies to Reduce Risk and Maximize Returns

Investing in Volatile Markets: Strategies to Reduce Risk and Maximize Returns

When it comes to investing, there is no such thing as a sure thing. Even the most stable markets can experience periods of volatility that can create challenges for investors. But volatile markets also offer opportunities for those who are willing to take on some risk.

For example, volatile markets provide an opportunity to buy low and sell high. And while there will always be some uncertainty when investing, avoiding volatile markets altogether can lead to missed opportunities.

If you’re thinking about investing in volatile markets, here are five tips to help you get started:

1. Review your investment goals...

https://finetimer.site/investing-in-volatile-markets-strategies-to-reduce-risk-and-maximize-returns/

When it comes to investing, there is no such thing as a sure thing. Even the most stable markets can experience periods of volatility that can create challenges for investors. But volatile markets also offer opportunities for those who are willing to take on some risk.

For example, volatile markets provide an opportunity to buy low and sell high. And while there will always be some uncertainty when investing, avoiding volatile markets altogether can lead to missed opportunities.

If you’re thinking about investing in volatile markets, here are five tips to help you get started:

1. Review your investment goals and objectives. 2. Consider your risk tolerance. 3. Diversify your portfolio. 4. Have a plan and stick to it. 5. Monitor your investments. Photo by Anna Nekrashevich on Pexels Why You Shouldn’t Avoid Volatile Markets.

Volatile markets offer opportunities for investors to buy low and sell high.

In a volatile market, prices can swing dramatically in either direction. This presents an opportunity for investors to buy assets when prices are low and sell them when prices rebound. For example, during the COVID-19 pandemic, many stocks experienced sharp declines followed by strong recoveries. Investors who bought during the dip made significant profits when the market recovered.

Volatile markets are a reality of investing, and avoiding them can lead to missed opportunities.

Investing is all about taking risks in order to earn rewards. While it’s important to manage risk carefully, avoiding volatile markets altogether can lead to missed opportunities. In a well-diversified portfolio, some degree of volatility is inevitable – but that doesn’t mean it should be avoided entirely.

Volatile markets provide an opportunity to review and assess your investment strategy.

Volatile markets can be unsettling, but they also present an opportunity to review your investment strategy and make sure it’s aligned with your goals and objectives. If you’re uncomfortable with the level of risk in your portfolio, now is the time to make adjustments. This will help you stay disciplined and focused on your long-term goals, even when markets are volatile.

5 Tips for Investing in Volatile Markets.

Review your investment goals and objectives.

It is important to have a clear understanding of your investment goals and objectives before investing in volatile markets. Doing so will help you make informed decisions about which investments to make and how to manage your portfolio.

Some common investment goals include:

-Generating income: Many investors seek to generate income from their investments, either through dividends or interest payments. When investing in volatile markets, it is important to consider whether the investments you are considering will provide the income you need.

-Preserving capital: Another common goal for investors is preserving capital, which refers to protecting the initial value of an investment. This can be especially important for retirees who are relying on their investments to support their lifestyle.

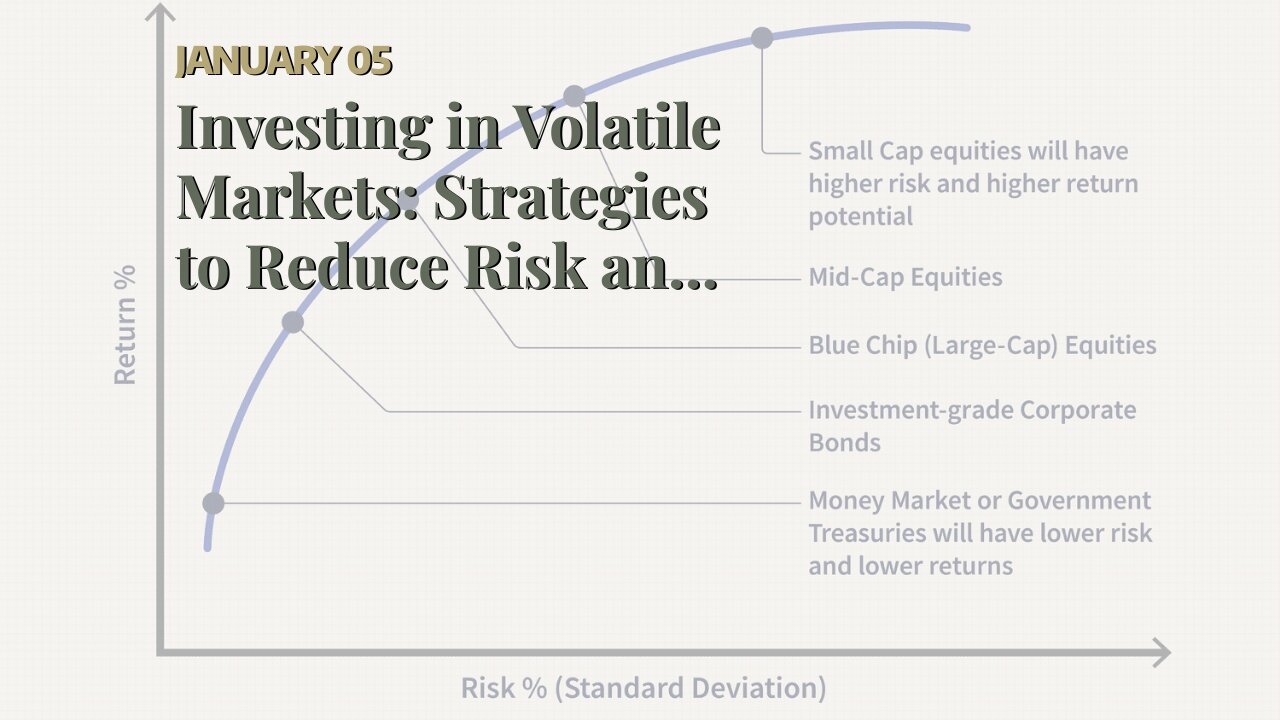

-Maximizing returns: Of course, most investors also want to maximize returns, or earn as much money as possible from their investments. However, it is important to remember that higher returns often come with higher risk. When investing in volatile markets, it is important to strike a balance between maximizing returns and minimizing risk.

Consider your risk tolerance.

Before investing in volatile markets, it is important to consider your risk tolerance—that is, your willingness and ability to lose money in pursuit of higher returns. Many factors can influence your risk tolerance, including your age, financial situation, and investment go...

-

6:44

6:44

FineTimer

2 years agoHow to Choose the Right Router Protocol for Your Network

533 -

1:19:21

1:19:21

The Shannon Joy Show

8 hours ago🔥🔥The One & Done Kill Shot? New ‘Universal Vaccine’ & Complete Inversion As Peter Hotez WARNS Of Adverse Injury While RFK Promotes! 🔥🔥

4.06K15 -

1:10:29

1:10:29

TheCrucible

2 hours agoThe Extravaganza! Ep. 25 (8/21/25)

50K4 -

40:20

40:20

The White House

2 hours agoPresident Trump Joins Law Enforcement and Military Personnel in Washington, D.C.

12.6K16 -

1:22:25

1:22:25

Kim Iversen

20 hours agoPsychic Medium Blows Lid Off "Interdimensional Beings" | Evil Spirits or Psyop?

37.8K47 -

1:04:35

1:04:35

The Officer Tatum

3 hours agoLIVE: Trump SAVES DC, Letitia James Fine THROWN OUT + MORE | EP 160

13.2K10 -

1:58:01

1:58:01

Redacted News

3 hours agoHIGH ALERT! Netanyahu Calls for Mass Censorship as Israel Prepares MASSIVE Invasion of Gaza City

85.9K47 -

36:03

36:03

Kimberly Guilfoyle

4 hours agoA New Day in DC: Appeals Court Throws Out Witch Hunt Case, Live! | Ep248

24K9 -

1:13:59

1:13:59

vivafrei

5 hours agoBig Tish Gets SPANKED! Appeal Court ANNULS $500 Million! Corruption at the FED? Trans Madness & MORE

95.4K27 -

1:53:59

1:53:59

The Quartering

5 hours agoToday's Breaking News!

83.1K17