Premium Only Content

Candle Stick Patterns: A Guide to the Best Ones

Candle Stick Patterns: A Guide to the Best Ones

If you’re interested in learning about different ways to trade using technical analysis, then you’ll want to know about candle stick patterns. In this blog post, we’ll introduce you to the different types of candle stick patterns and how you can use them to your advantage. We’ll also discuss the benefits and drawbacks of using candle stick patterns. By the end of this post, you should have a good understanding of how to trade using these patterns. Photo by Karolina Grabowska on Pexels The Different Types of Candle Stick Patterns.

The Three Main Types of Candle Stick Patterns.

There are...

https://finetimer.site/candle-stick-patterns-a-guide-to-the-best-ones/

If you’re interested in learning about different ways to trade using technical analysis, then you’ll want to know about candle stick patterns. In this blog post, we’ll introduce you to the different types of candle stick patterns and how you can use them to your advantage. We’ll also discuss the benefits and drawbacks of using candle stick patterns. By the end of this post, you should have a good understanding of how to trade using these patterns. Photo by Karolina Grabowska on Pexels The Different Types of Candle Stick Patterns.

The Three Main Types of Candle Stick Patterns.

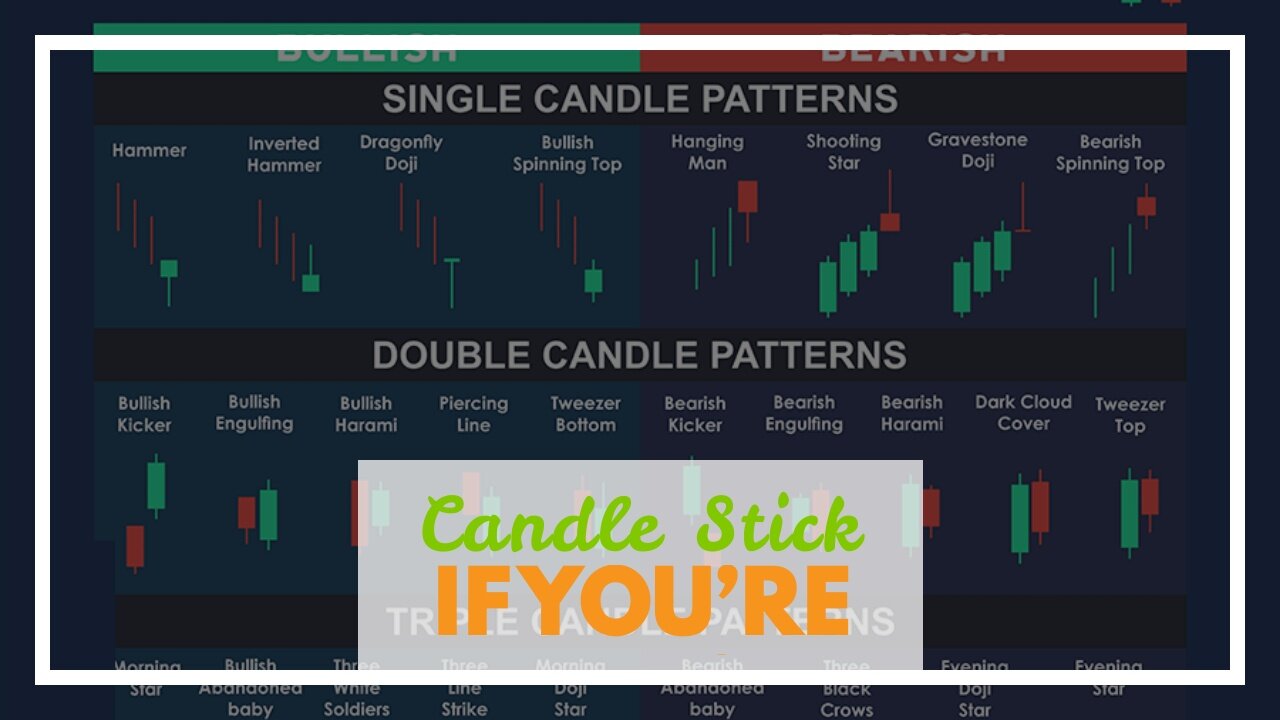

There are three main types of candle stick patterns: bullish, bearish, and neutral. Bullish candle stick patterns indicate that the market is moving up, while bearish candle stick patterns indicate that the market is moving down. Neutral candle stick patterns can be either bullish or bearish depending on the context.

The Five Most Popular Candle Stick Patterns.

The five most popular candle stick patterns are: the hammer, the inverted hammer, the shooting star, the doji, and the gravestone doji. Each of these patterns has a specific meaning and can be used to predict future market movements.

The hammer is a bullish pattern that indicates that the market is starting to move up. The inverted hammer is a bearish pattern that indicates that the market is starting to move down. The shooting star is a bearish pattern that indicates that the market is about to reverse course and start moving down. The doji is a neutral pattern that can be either bullish or bearish depending on the context. The gravestone doji is a bearish pattern that indicates that the market is about to reverse course and start moving down.

How to Use Candle Stick Patterns to Your Advantage.

How to Read Candle Stick Patterns.

Candlestick patterns are a form of technical analysis that can be used to predict future price movements in the markets. They are created by taking the opening and closing prices of a security, and then plotting them on a chart to create a candlestick. Candlesticks can be used to identify trends, reversals, and continuation patterns in the market.

There are three main types of candlestick patterns: single candlesticks, multiple candlesticks, and complex candlesticks. Single candlesticks are the most basic type of pattern and can be used to identify trend reversals and continuations. Multiple candlesticks patterns are more complex and can be used to predict trend changes or reversals. Complex candlestick patterns are the most advanced type of pattern and can be used to predict both trend changes and reversals.

Tips for Using Candle Stick Patterns.

When using candle stick patterns for trading, it is important to remember that these patterns are best used in conjunction with other forms of technical analysis such as support and resistance levels, Fibonacci levels, or moving averages. Candlestick patterns should not be used as the sole basis for making trading decisions; rather, they should be used as part of a larger strategy. It is also important to keep in mind that no one pattern is 100% accurate all the time, so it is important to use multiple patterns to confirm your trading signals before entering into a trade.

The Benefits of Using Candle Stick Patterns.

The Advantages of Using Candle Stick Patterns.

Candle stick patterns can be a helpful tool for traders, providing valuable information about potential price movements. Some of the main advantages of using candle stick patterns are:

-They can help to identify trend reversals, continuation signals and potential support/resistance levels

-They provide clear and concise visual information that is easy to interpret

-They can be used in conjunction with other technical indicators for further confirmation

The...

-

6:21

6:21

FineTimer

2 years agoHuobi Global: How to Get Ahead in the Digital World

4151 -

LIVE

LIVE

Dr Disrespect

5 hours ago🔴LIVE - DR DISRESPECT - ARC RAIDERS - AGAINST ALL DANGER

2,045 watching -

1:40:36

1:40:36

The Quartering

2 hours agoKimmel Pulls Show Mysteriously, Youtube Collapse? & Much MOre

33.6K28 -

LIVE

LIVE

The Robert Scott Bell Show

2 hours agoMike Adams, Brian Hooker, Live From Brighteon Studios in Austin Texas, Kids Triple Vaccinated, Blood Sugar and Autism, Candy Fed to Cows, Nutrition Reform - The RSB Show 11-7-25

126 watching -

1:15:58

1:15:58

DeVory Darkins

2 hours agoLIVE NOW: Democrats SABOTAGE GOP effort to reopen Government

74.8K43 -

1:21:21

1:21:21

Tucker Carlson

2 hours agoThe Global War on Christianity Just Got a Whole Lot Worse, and Ted Cruz Doesn’t Care

24.3K138 -

10:50

10:50

Dr. Nick Zyrowski

2 days agoDoctors Got It Wrong! This LOWERS CORTISOL In Minutes!

2.97K3 -

24:14

24:14

Verified Investing

2 days agoBiggest Trade As AI Bubble Begins To Burst, Bitcoin Flushes Through 100K And Gold Set To Fall

1.7K -

1:12:28

1:12:28

Sean Unpaved

2 hours agoAB's Dubai Drama: Extradited & Exposed + NFL Week 10 Locks & CFB Week 11 Upsets

10.7K -

2:06:08

2:06:08

The Culture War with Tim Pool

4 hours agoDemocrats Elect Man Who Wants To Kill Conservatives, Time For An Exorcism | The Culture War Podcast

109K95