Premium Only Content

Dividend What Is: A Review of the State of Dividend Payouts in the US

Dividend What Is: A Review of the State of Dividend Payouts in the US

Dividends are a key part of many investment strategies, but what exactly are they and what is their current state in the US? This blog post will provide a review of dividend yields, growth, and payout ratios to help you better understand the current landscape. It’s important to know where things stand so that you can make informed decisions about your investment strategy going forward. Photo by August de Richelieu on Pexels Dividend What is: A Review of the State of dividend payouts in the US.

Dividend Yields.

The dividend yield is a financial ratio that measures the amount of...

https://finetimer.site/dividend-what-is-a-review-of-the-state-of-dividend-payouts-in-the-us/

Dividends are a key part of many investment strategies, but what exactly are they and what is their current state in the US? This blog post will provide a review of dividend yields, growth, and payout ratios to help you better understand the current landscape. It’s important to know where things stand so that you can make informed decisions about your investment strategy going forward. Photo by August de Richelieu on Pexels Dividend What is: A Review of the State of dividend payouts in the US.

Dividend Yields.

The dividend yield is a financial ratio that measures the amount of cash dividends paid out by a company relative to its share price. It is simply the percentage of a company’s stock price that is paid out in dividends. For example, if a company’s stock trades for $100 per share and it pays out $2 per share in dividends each year, then its dividend yield would be 2%.

Dividend yields can be useful for income investors who are looking for stocks that will provide them with a steady stream of payments. However, it is important to remember that the dividend yield is just one factor to consider when evaluating a stock. Dividend growth, payout ratios, and the company’s overall financial health should also be considered.

Dividend Growth.

Dividend growth is simply the rate at which a company’s dividend payments increase over time. This can be measured on an absolute basis, meaning how much the dividend payments have increased over time in dollar terms, or on a relative basis, meaning how much the dividend payments have increased as a percentage of the company’s share price.

For example, if a company’s dividend payments increased from $1 per share to $2 per share over a two-year period, then its absolute dividend growth would be 100%. If the company’s share price also doubled over that same period, then its relative dividend growth would be 50%. (Note: this is not the same as the company’s dividend yield, which would remain at 2% in this example).

Dividend growth is important because it can help offset inflation and provide investors with rising income streams over time. It is also one of the key drivers of total return (the other being changes in the stock price). For example, if a company has a current dividend yield of 2% and it increases its payout by 10% per year for 10 years, then an investor who reinvested their dividends would see their original investment grow to nearly quadruple in value!

Dividend Payout Ratios.

The dividend payout ratio is simply the percentage of earnings that a company pays out in dividends each year. For example, if a company earned $5 per share last year and paid out $1 per share in dividends, then its payout ratio would be 20%. (Note: this number can vary depending on how you calculate it).

A high payout ratio may indicate that a company is close to maxing out its ability to pay dividends and may have to cut back in future years if earnings decline. A low payout ratio may indicate that there is room for future increases in dividends even if earnings stay flat or decline slightly.

Ultimately, whether or not a particular payout ratio is “good” or “bad” depends on factors such as the industry average, the stability of earnings, and management’s goals for the business.

The current state of dividend payouts in the US.

Dividend yields are at historical lows.

The dividend yield is the portion of a company’s annual earnings that is paid out to shareholders in dividends. A low dividend yield means that a company is paying out a smaller portion of its earnings as dividends. Dividend yields have been trending downward for decades, and are currently at historically low levels.

There are a number of reasons for this trend. One is that companies have been rein...

-

5:29

5:29

FineTimer

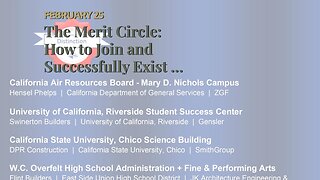

1 year agoThe Merit Circle: How to Join and Successfully Exist in this Competitive World

476 -

6:51

6:51

Colion Noir

14 hours agoI have Something To Say To Gun Owners

103K26 -

1:18:24

1:18:24

Glenn Greenwald

18 hours agoLiberals Encourage Family & Friends To Separate Over Political Disputes; Segment Debut Of System Pupdate: Profiles Of Rescued Dogs | SYSTEM UPDATE #373

158K389 -

1:24:53

1:24:53

Flyover Conservatives

1 day agoMarketing Madness or Manipulation? The War on Western Identity - Alex Newman; Economic Update - Dr. Kirk Elliott | FOC Show

77.2K7 -

1:15:05

1:15:05

PMG

1 day ago $14.23 earned"Big Pharma EXPOSED: The HIDDEN Cures They Tried to Bury"

63.7K18 -

3:26:12

3:26:12

Tundra Gaming Live

16 hours ago $3.95 earnedThe Worlds Okayest War Thunder Stream

51.2K1 -

1:49:52

1:49:52

VOPUSARADIO

23 hours agoPOLITI-SHOCK! Back To Back Guests: Rebekah Koffler & Dr. Michael Schwartz

37.9K1 -

59:44

59:44

The StoneZONE with Roger Stone

15 hours agoWill the Perps of the Russian Collusion Hoax Face Justice? | The StoneZONE w/ Roger Stone

49.7K18 -

2:25:06

2:25:06

WeAreChange

17 hours agoCOMPLETE COLLAPSE: Media Spiraling Into OBLIVION As It Tries To Take Out Elon and Trump

90K16 -

1:56:08

1:56:08

Darkhorse Podcast

22 hours agoTaste the Science: The 253rd Evolutionary Lens with Bret Weinstein and Heather Heying

90.8K88