Premium Only Content

Trade Wins: How to Make the Most of Your Trading Experience

Trade Wins: How to Make the Most of Your Trading Experience

Have you ever wondered how some people seem to make a killing in the stock market, while others can’t seem to make a dime? The answer lies in understanding how to trade and making the most of your trading experience.

In this blog post, we’ll discuss five key ways you can make the most of your trading experience. First, we’ll discuss why trade and what you can trade. Then, we’ll talk about developing a trading plan and managing risk. Finally, we’ll touch on the importance of staying disciplined and review your performance.

By following these simple tips, you’ll be well...

https://finetimer.site/trade-wins-how-to-make-the-most-of-your-trading-experience/

Have you ever wondered how some people seem to make a killing in the stock market, while others can’t seem to make a dime? The answer lies in understanding how to trade and making the most of your trading experience.

In this blog post, we’ll discuss five key ways you can make the most of your trading experience. First, we’ll discuss why trade and what you can trade. Then, we’ll talk about developing a trading plan and managing risk. Finally, we’ll touch on the importance of staying disciplined and review your performance.

By following these simple tips, you’ll be well on your way to becoming a successful trader! Photo by Anna Nekrashevich on Pexels Make the Most of Your Trading Experience.

Why Trade?

The foreign exchange market, also known as forex or FX, is the world’s largest financial market. With a daily trading volume of over $5 trillion, it is by far the most liquid market in the world. This means that there are always buyers and sellers in the market, so you can trade 24 hours a day, 5 days a week.

There are many reasons why people trade forex. Some people trade to make a profit, while others trade to hedge against currency risk. Some people trade for both reasons. No matter your reason for trading, the goal is always the same: to make money.

What Can You Trade?

In the forex market, you can trade currencies from all over the world against each other. The most popular currency pairs are those involving the US dollar (USD), such as EUR/USD (euro/dollar), GBP/USD (pound/dollar), and USD/JPY (dollar/yen). These pairs account for more than 80% of all forex trading activity.

You can also trade other currency pairs that involve emerging markets currencies, such as USD/MXN (dollar/Mexican peso) or USD/TRY (dollar/Turkish lira). These pairs tend to be more volatile than major currency pairs and can offer opportunities for larger profits – but they also come with greater risks.

How to Trade

If you want to start trading forex, you will need to open an account with a broker that offers forex trading services. Most brokers offer demo accounts which allow you to practice trading with virtual money before risking your own capital.

When you’re ready to start trading for real, you will need to fund your account with a deposit of real money. Once your account is funded, you can start placing trades using the broker’s online platform.

Develop a Trading Plan.

What is a Trading Plan?

A trading plan is a written document that outlines your trading strategy. It should include your goals, risk tolerance, time frame, and methods for entry and exit. A trading plan can help you make more informed and systematic decisions when trading.

How to Develop a Trading Plan.

There are several things to consider when developing a trading plan:

1) Your goals: What do you hope to achieve through trading? Are you looking to generate income, grow your capital, or both? What is your timeframe? Short-term or long-term?

2) Risk tolerance: How much risk are you willing to take on? This will determine the types of trades you make and how much money you invest in each trade.

3) Time frame: How much time do you have to dedicate to trading? If you only have a few hours per week, then day trading may not be suitable for you. Conversely, if you have more time available, then you can consider swing or position trading.

4) Methods for entry and exit: There are various technical indicators that can be used to enter and exit trades. Some common indicators include moving averages, support and resistance levels, and trend lines. You will need to experiment with different indicators to find what works best for you.

Manage Your Risk.

What is Risk?

In trading, risk is the potential of losing money or other assets. It can be caused by many factors, such as p...

-

5:29

5:29

FineTimer

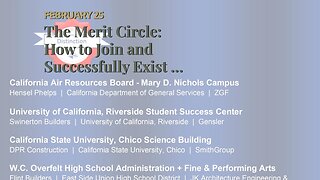

2 years agoThe Merit Circle: How to Join and Successfully Exist in this Competitive World

481 -

LIVE

LIVE

megimu32

2 hours agoOFF THE SUBJECT: Reddit Meltdowns, Music Takes & Bodycam Breakdowns

565 watching -

LIVE

LIVE

The Rabble Wrangler

7 hours agoRedSec with Mrs. Movies | The Best in the West Carries His Wife to Victory!

158 watching -

LIVE

LIVE

DLDAfterDark

1 hour agoTrans Man's Death Threats To Christian Conservatives - Whistlin' Diesel Tax Evasion

112 watching -

23:42

23:42

Robbi On The Record

2 days ago $5.55 earnedWhat's happening in the republican party?? BTS of Michael Carbonara for Congress

47.8K9 -

4:53

4:53

PistonPop-TV

2 days ago $0.02 earnedThe G13B: The Tiny Suzuki Engine That Revved Like Crazy

2.27K -

LIVE

LIVE

GritsGG

3 hours ago#1 Most Warzone Wins 4000+!

223 watching -

LIVE

LIVE

Joker Effect

1 hour agoSTREAMER NEWS: WHAT IS JOKER DOING?! Where is the streamer space going now?! Q & A

233 watching -

LIVE

LIVE

Eternal_Spartan

4 hours ago🟢 Eternal Spartan Plays Arc Raiders - New Updates! | USMC Veteran

72 watching -

LIVE

LIVE

CODZombieGod115

9 hours ago $0.13 earned🟢 Live - Ashes Of The Damned Round 100 Attemp or Easter Egg Attempt! Black ops 7 Zombies

35 watching