Premium Only Content

DO THIS When Crypto Crashes to Save $1000s (seriously)

Crypto wash sale. Crypto tax-loss harvesting.

👴iTrust Capital Crypto Roth ($100 free) https://itrust.capital/maher

🔗Join Finova! (formerly Patreon): https://finova.finance/plans/

✨ Kucoin (exchange I use): https://www.kucoin.com/ucenter/signup?rcode=rJMS45S

Binance Exchange: https://accounts.binance.us/en/register?ref=54440935

💵Get up to $250 in Bitcoin from Blockfi https://blockfi.com/MaxMaher

💻Free Discord Link: https://discord.gg/9wSVmT2ewU

📚 My YouTube School: https://max-maher.teachable.com/p/complete-guide-to-building-an-audience-and-wealth-on-youtube

💵LIMITED: Get 2 FREE Stocks: https://act.webull.com/k/X1eTd9ityFvU/main

🚚My in-depth moving company course: https://max-maher.teachable.com/p/moving-company-millionaire

📷ALL of my camera and recording equipment: https://www.amazon.com/shop/maxmaher

Stake your Cardano in my stakepool! Ticker Symbol: MAX1 https://www.stakewithmax.com

✉️Join my newsletter: http://eepurl.com/gWantb

My Instagram: https://www.instagram.com/maxwell_maher/

Full crypto tax tutorial: https://youtu.be/IND_WQkoxlE

My free crypto tax calculator: https://docs.google.com/spreadsheets/d/170Y1SwZTbN3VRtl1FPHsrwlI4Ib7vgvYjfFUUDjWmmE/copy

Best altcoins

Crypto tax

Avoid tax

Crytpo tax methods

Crypto Wash Sale Rule:

For financial securities, like stocks or bonds, there’s a time window within which you can’t buy back the assets you’ve sold.

The IRS saw people pulling this trick in the past and put a rule in place saying if you sell a security, like a stock, you can’t buy the same security or a “substantially identical” security 30 days before OR after your sale and use that sale as a tax-deductible loss. No artificial losses.

BUT, this rule doesn’t. apply. to. crypto. holdings…

And why is that?

Because the SEC doesn’t see crypto as financial security – not yet anyway.

That means you can buy and sell as much crypto as you want, allowing you to report your crypto losses as tax deductions.

By selling at a loss and buying back in you are realizing losses for tax purposes that can then be written against any capital gains you made in the year.

You can even deduct this against your regular income up to $3000 per year!

This is one of the easiest ways to save tax on crypto or avoid crypto taxes.

Schedule one-on-one business consulting with me here: https://max-maher.teachable.com/p/1hr-consultation-call

*I am not a financial advisor. This is not financial advice*

-

9:42

9:42

Max Maher

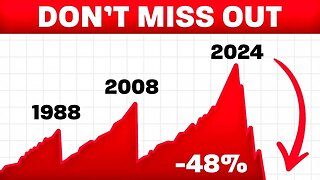

1 year ago $0.01 earnedIs the Big Short ACTUALLY happening again?

141 -

11:37

11:37

tactical_rifleman

1 day agoRare Breed BEATS THE ATF | FRT-15 | Tactical RIfleman

44.2K17 -

LIVE

LIVE

LumpyPotatoX2

1 hour agoWhere Winds Meet: New Level Cap + Rumble Wallet - #RumbleGaming

695 watching -

5:23

5:23

Memology 101

22 days ago $9.25 earnedReporter HUMILIATES Kamala Harris over "WORLD-CLASS" dodge during interview

6.93K32 -

12:32

12:32

MetatronGaming

15 hours agoBLIGHT looks AMAZING - Trailer Reaction

5.04K6 -

LIVE

LIVE

The Sufari Hub

1 hour ago🔴WE ARE FEATURED - BLACK OPS 7 EXTRACTION MODE - LEVEL GRINDING

97 watching -

44:51

44:51

American Thought Leaders

15 hours agoHow This Tech Can Break China’s Rare Earth Monopoly | Dr. James Tour

10.9K4 -

9:46

9:46

MattMorseTV

17 hours ago $27.16 earnedTrump just SHUT DOWN a $287,000,000 FRAUD RING.

44.5K102 -

LIVE

LIVE

JakRazGaming

1 hour agoPlaying Hogwarts Legacy!! Playthrough Stream 4

138 watching -

1:16

1:16

From Zero → Viral with AI

22 hours ago $1.16 earnedAI Isn’t Killing Work. It’s Killing the Wrong Kind of Work.

5.96K14