Premium Only Content

Find the Right Auto Insurance Company for You!

Find the Right Auto Insurance Company for You!

If you’re shopping for auto insurance, it’s important to find a company that’s right for you. There are a few things to consider when choosing an insurer, including budget, coverage, and discounts. It’s also important to read the fine print so you understand what is and is not covered by your policy. By doing your research, you can find the perfect auto insurance company for your needs.

Consider your budget.

Decide how much coverage you need.

Before you start shopping for auto insurance, it’s important to know how much coverage you need. The amount of coverage you need will depend...

https://finetimer.site/find-the-right-auto-insurance-company-for-you/

If you’re shopping for auto insurance, it’s important to find a company that’s right for you. There are a few things to consider when choosing an insurer, including budget, coverage, and discounts. It’s also important to read the fine print so you understand what is and is not covered by your policy. By doing your research, you can find the perfect auto insurance company for your needs.

Consider your budget.

Decide how much coverage you need.

Before you start shopping for auto insurance, it’s important to know how much coverage you need. The amount of coverage you need will depend on a number of factors, including the value of your car, your driving history, and the state in which you live. If you have a loan on your car, your lender will require that you have full coverage insurance.

Full coverage insurance includes collision and comprehensive coverage, which will pay for damages to your car if it’s damaged in an accident or stolen. It also includes liability insurance, which will pay for any damages or injuries that you cause to another person in an accident.

The amount of coverage you need will also depend on your driving history. If you have a good driving record, you may be able to get by with less coverage. But if you have had accidents or traffic violations in the past, you’ll likely need more coverage.

Finally, the state in which you live will also affect how much auto insurance coverage you need. Each state has its own minimum requirements for liability insurance, so be sure to check with your state’s Department of Insurance before buying a policy.

Compare rates from different companies.

Once you know how much auto insurance coverage you need, it’s time to start shopping around for rates from different companies. There are a few ways to do this:

– Use an online comparison tool: You can enter your information into an online comparison tool and get quotes from multiple insurers instantly. This is the easiest way to compare rates and find the best deal on auto insurance.

– Call insurers directly: Another option is to call insurers directly and ask for quotes based on the amount of coverage you’re looking for. This option may take more time than using an online comparison tool, but it can be worth it if you want to speak with an insurer directly about their policies and discounts.

– Visit local agents: Finally, if there’s an insurer thatyou’re interested in working with but they don’t have an online quoting system,you can visit their local agent and request a quote in person.

No matter which method you choose, be sure to compare rates from multiple insurers before making a decision.

Look for discounts.

See if you qualify for any discounts.

Auto insurance companies offer a variety of discounts, so it pays to shop around. You may be able to get a discount if you have a good driving record, are over a certain age, or belong to certain professional organizations.

Ask about bundling discounts.

If you need more than one type of insurance (e.g., auto and home), you may be able to get a discount by bundling them together with the same company. Ask about this when you’re getting quotes from different companies.

Read the fine print.

Make sure you understand the policy.

When you’re shopping for auto insurance, it’s important to read the fine print and make sure that you understand the policy. There are a lot of different policies out there, and they all have different features. Some policies will cover more than others, and some will have higher deductibles. It’s important to find a policy that fits your needs and budget.

Know what is not covered by the policy.

It’s also important to know what is not covered by your policy. This can help you avoid any surprises down the road. For example, most auto insurance policies will...

-

5:29

5:29

FineTimer

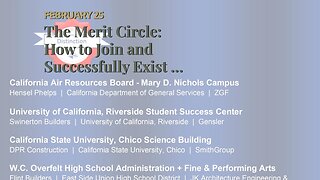

1 year agoThe Merit Circle: How to Join and Successfully Exist in this Competitive World

476 -

1:02:40

1:02:40

Man in America

8 hours agoThe Elites Are Losing Their War on Our Children w/ Robert Bortins

18.4K7 -

LIVE

LIVE

I_Came_With_Fire_Podcast

11 hours agoGovt' Shutdowns, VA Scandals, MORE Drones, Syrian Strikes and staged rescues , and The DHS!

3,152 watching -

56:55

56:55

The StoneZONE with Roger Stone

6 hours agoTrump Should Sue Billionaire Governor JB Pritzker for Calling Him a Rapist | The StoneZONE

44.9K8 -

59:21

59:21

Adam Does Movies

6 hours ago $1.24 earnedMore Reboots + A Good Netflix Movie + Disney Live-Action Rant - LIVE

35.5K1 -

36:28

36:28

TheTapeLibrary

15 hours ago $7.86 earnedThe Disturbing True Horror of the Hexham Heads

57.8K5 -

6:08:00

6:08:00

JdaDelete

1 day ago $1.22 earnedHalo MCC with the Rumble Spartans 💥

42.1K7 -

3:52:22

3:52:22

Edge of Wonder

9 hours agoChristmas Mandela Effects, UFO Drone Updates & Holiday Government Shake-Ups

33.8K8 -

1:37:36

1:37:36

Mally_Mouse

8 hours agoLet's Play!! -- Friends Friday!

39.3K1 -

57:45

57:45

LFA TV

1 day agoObama’s Fake World Comes Crashing Down | Trumpet Daily 12.20.24 7PM EST

35K15