Premium Only Content

Texas Auto Insurance Quotes Online 2017: The Most Comprehensive Guide to Getting the Best Rates

Texas Auto Insurance Quotes Online 2017: The Most Comprehensive Guide to Getting the Best Rates

If you’re looking for the most comprehensive guide to getting the best texas auto insurance rates online in 2017, look no further. In this blog post, we’ll give you all the tips and tricks you need to get the best rates possible. We’ll also discuss the different types of texas auto insurance, and what factors can affect your rates.So whether you’re a first-time buyer or just looking to switch companies, be sure to read on for everything you need to know about texas auto insurance quotes in 2017.

The most comprehensive guide to getting the best texas auto insurance rates...

https://finetimer.site/texas-auto-insurance-quotes-online-2017-the-most-comprehensive-guide-to-getting-the-best-rates/

If you’re looking for the most comprehensive guide to getting the best texas auto insurance rates online in 2017, look no further. In this blog post, we’ll give you all the tips and tricks you need to get the best rates possible. We’ll also discuss the different types of texas auto insurance, and what factors can affect your rates.So whether you’re a first-time buyer or just looking to switch companies, be sure to read on for everything you need to know about texas auto insurance quotes in 2017.

The most comprehensive guide to getting the best texas auto insurance rates online in 2017.

Where to get quotes.

There are a few different places to get texas auto insurance quotes online. The most popular website is probably www.texasquotes.com, but there are also other websites that can give you quotes from multiple companies, such as www.netquote.com or www.insurancequotes.com.

How to compare rates.

The best way to compare rates is to use a comparison website like www.texasquotes.com that allows you to get quotes from multiple companies at once. This way, you can see how much each company charges for the same coverage and compare them side-by-side.

Tips for getting the best rates.

There are a few tips that can help you get the best texas auto insurance rates:

-Shop around and compare rates from multiple companies before buying a policy.

-Choose a higher deductible if you can afford it, as this will lower your monthly premium.

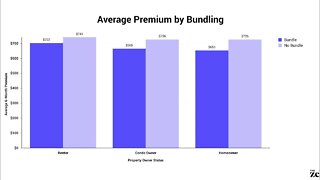

-Consider bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, as this can often give you a discount.

-Make sure to keep your driving record clean, as this will make you eligible for the best rates.

The different types of texas auto insurance.

Liability insurance.

Liability insurance is the most basic type of car insurance, and is required by law in Texas. It covers bodily injury and property damage caused by you to other people. It does not cover your own injuries or damage to your own vehicle.

Collision and comprehensive insurance.

Collision insurance covers damage to your own vehicle caused by collision with another object, such as another car or a tree. Comprehensive insurance covers damage to your vehicle from other causes, such as fire, theft, or vandalism. Both collision and comprehensive insurance are optional in Texas, but may be required by your lender if you have a loan on your vehicle.

Uninsured and underinsured motorist insurance.

Uninsured motorist insurance covers bodily injury caused by an uninsured driver. Underinsured motorist insurance covers bodily injury caused by a driver who does not have enough insurance to pay for all of your medical expenses and lost wages. Both types of coverage are optional in Texas.

Medical payments and personal injury protection insurance.

Medical payment insurance covers medical expenses for you and your passengers regardless of who is at fault in an accident. Personal injury protection insurance provides additional coverage, including lost wages and funeral expenses. Both types of coverage are optional in Texas.

Factors that affect your texas auto insurance rates.

Your driving record.

Your driving record is one of the most important factors that insurers consider when setting rates. If you have a clean driving record, you can expect to pay lower rates than someone with accidents or traffic violations on their record. Insurers typically use a point system to determine rates, so minor infractions may not have a big impact on your premium while more serious offenses could result in significantly higher rates.

The type of vehicle you drive.

The type of vehicle you drive also plays a role in determining your premium. Some veh...

-

3:58

3:58

FineTimer

2 years agoTheHotBit Exchange – Get Your Trading Tips from the Pros!

1.07K -

10:21

10:21

HowAmINotFamousYet

3 years agobuy car insurance online |auto insurance quotes | auto insurance | car insurance | vehicle insurance

38 -

9:20

9:20

bhstwo

2 years agoFind a better auto insurance rates

14 -

2:24

2:24

djf25

2 years agoStop Buying Insurance Online

3 -

2:25

2:25

djf25

2 years agoStop Buying Insurance Online Part 2

3 -

13:28

13:28

Insurance Frequently Asked Questions

2 years agoIntro to Car / Auto Insurance - Beginners Guide to Automobile Insurance Coverage

887 -

1:53

1:53

djf25

2 years agoStop Buying Insurance Online Part 3

8 -

3:00

3:00

WMAR

3 years agoAuto insurance rates expected to increase

1 -

3:00

3:00

Best Contents for Better Living,

2 years agoBest quotes, Most Famous Quotes of All Times, universal quotes,

7 -

LIVE

LIVE

The Bubba Army

21 hours agoImmigrant Truck Driver.. Who's To Blame?! - Bubba the Love Sponge® Show | 8/20/25

12,824 watching