Premium Only Content

The Waiting Period for a FHA Loan Foreclosure is Long and Complicated. Heres What You Need to K...

The Waiting Period for a FHA Loan Foreclosure is Long and Complicated. Heres What You Need to Know.

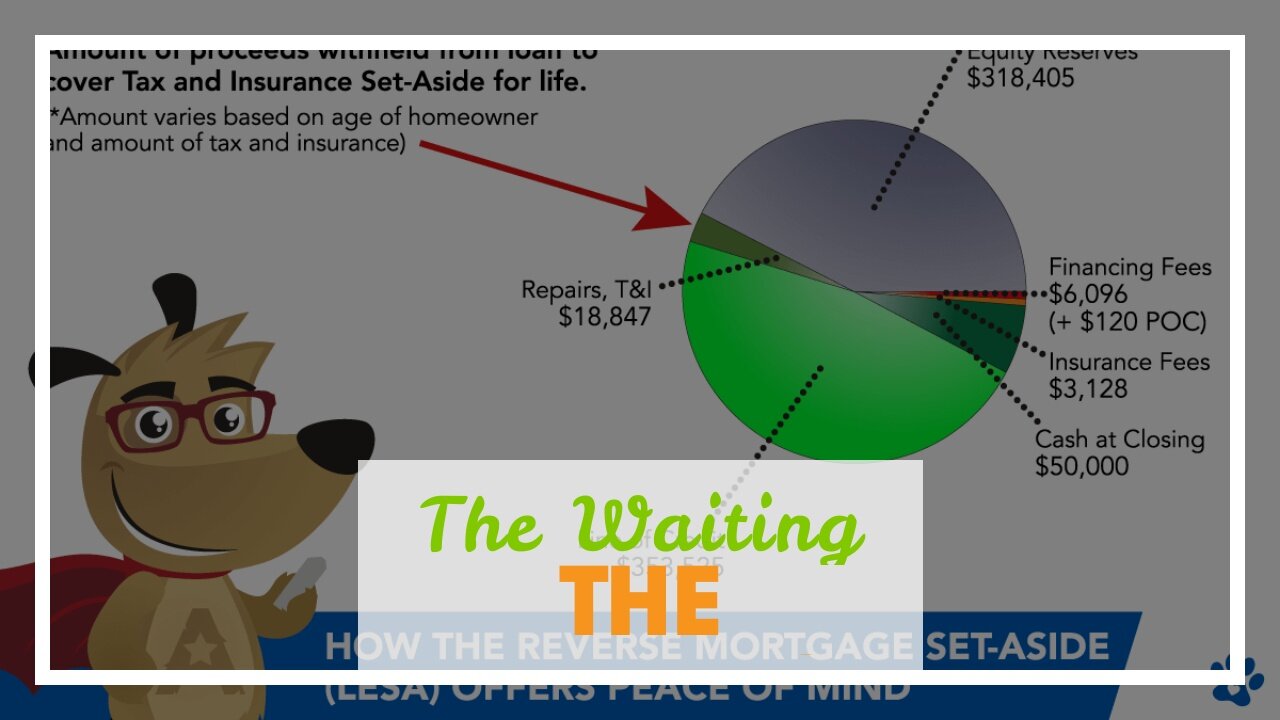

The waiting period for a FHA loan foreclosure is long and complicated. There are many different factors that go into the length of the foreclosure process, including the type of loan, the state in which the property is located, and the type of foreclosure. The borrower’s ability to cure the default, the lender’s foreclosure policies, and the type of property can also affect the length of the foreclosure process.

The waiting period for a FHA loan foreclosure is long and complicated.

The waiting period for a FHA loan foreclosure is complicated because of the many different factors that go into...

https://finetimer.site/the-waiting-period-for-a-fha-loan-foreclosure-is-long-and-complicated-heres-what-you-need-to-know/

The waiting period for a FHA loan foreclosure is long and complicated. There are many different factors that go into the length of the foreclosure process, including the type of loan, the state in which the property is located, and the type of foreclosure. The borrower’s ability to cure the default, the lender’s foreclosure policies, and the type of property can also affect the length of the foreclosure process.

The waiting period for a FHA loan foreclosure is long and complicated.

The waiting period for a FHA loan foreclosure is complicated because of the many different factors that go into it.

There are three main types of foreclosures: pre-foreclosure, foreclosure, and post-foreclosure.

The waiting period for a FHA loan foreclosure is long and complicated because of the many different factors that go into it. These factors include the type of loan, the state in which the property is located, and the type of foreclosure. The length of the foreclosure process can also be affected by the borrower’s ability to cure the default, the lender’s foreclosure policies, and the type of property.

The waiting period for a FHA loan foreclosure is long because of the many different steps involved.

The first step in the foreclosure process is the Notice of Default, which is filed by the lender.

The second step is the Notice of Sale, which is filed by the lender.

The third and final step is the foreclosure auction, which is conducted by the lender.

The waiting period for a FHA loan foreclosure can be long and complicated because of the many different steps involved. The first step is the Notice of Default, which is filed by the lender. This document informs the borrower that they have defaulted on their loan and that the foreclosure process has begun. The second step is the Notice of Sale, which is also filed by the lender. This document sets forth the date, time, and place of the foreclosure sale. The third and final step is the foreclosure auction, which is conducted by the lender. At this auction, the property will be sold to the highest bidder.

The waiting period for a FHA loan foreclosure is complicated because of the many different factors that go into it.

Some of the factors that can affect the length of the foreclosure process include the type of loan, the state in which the property is located, and the type of foreclosure.

The type of loan is one factor that can affect the length of the foreclosure process. For example, a conventional loan has a shorter waiting period than an FHA loan. The state in which the property is located can also affect the length of time it takes to foreclose on a property. For example, it takes longer to foreclose on a property in New York than it does in California. Finally, the type of foreclosure can also affect the length of time it takes to foreclose on a property. There are two main types of foreclosure: judicial and non-judicial. Judicial foreclosures take longer than non-judicial foreclosures because they involve going through the court system.

The length of the foreclosure process can also be affected by the borrower’s ability to cure the default, the lender’s foreclosure policies, and the type of property.

The borrower’s ability to cure the default can affect how long it takes to foreclose on a property. If a borrower is able to cure their default within a certain amount of time, then they may be able to avoid foreclosure altogether. The lender’s foreclosure policies can also affect how long it takes to foreclose on a property. Some lenders have policies that allow for a shorter waiting period, while others have policies that lengthen the waiting period. Finally,the type of...

-

6:44

6:44

FineTimer

2 years agoHow to Choose the Right Router Protocol for Your Network

533 -

LIVE

LIVE

Wayne Allyn Root | WAR Zone

5 hours agoWAR Zone LIVE | 2 SEPTEMBER 2025

49 watching -

1:51:40

1:51:40

Redacted News

2 hours agoHIGH ALERT! TRUMP IS COMING FOR CHICAGO, U.S. TROOPS PREPARING INVASION TO STOP MURDERS | REDACTED

80.1K100 -

LIVE

LIVE

Red Pill News

4 hours agoJustice Is Long Dead in The DC Circuit on Red Pill News Live

3,543 watching -

1:17:50

1:17:50

Awaken With JP

4 hours agoTrans Shooter is the Victim, Vaccines in Trouble, and Greta is Ugly - LIES Ep 106

40.1K21 -

2:04:31

2:04:31

Pop Culture Crisis

4 hours agoJK Rowling Calls Out HARRY POTTER Director, Sydney Sweeney Dating Scooter Braun? | Ep. 909

17.4K2 -

1:02:42

1:02:42

Sarah Westall

3 hours agoRemote Viewers: Philadelphia Experiment, Alien Abduction and Future Events w/ the Rabbit Hole Group

14.2K3 -

56:03

56:03

SGT Report

18 hours agoSILVER'S HISTORIC BREAKOUT -- Chris Marcus

41K10 -

LIVE

LIVE

LFA TV

12 hours agoLFA TV ALL DAY STREAM - TUESDAY 9/2/25

1,121 watching -

19:57

19:57

Professor Gerdes Explains 🇺🇦

4 hours agoDecoding Putin's Shanghai Narrative: The Strategic Goal Behind the Lies

3.98K1