Premium Only Content

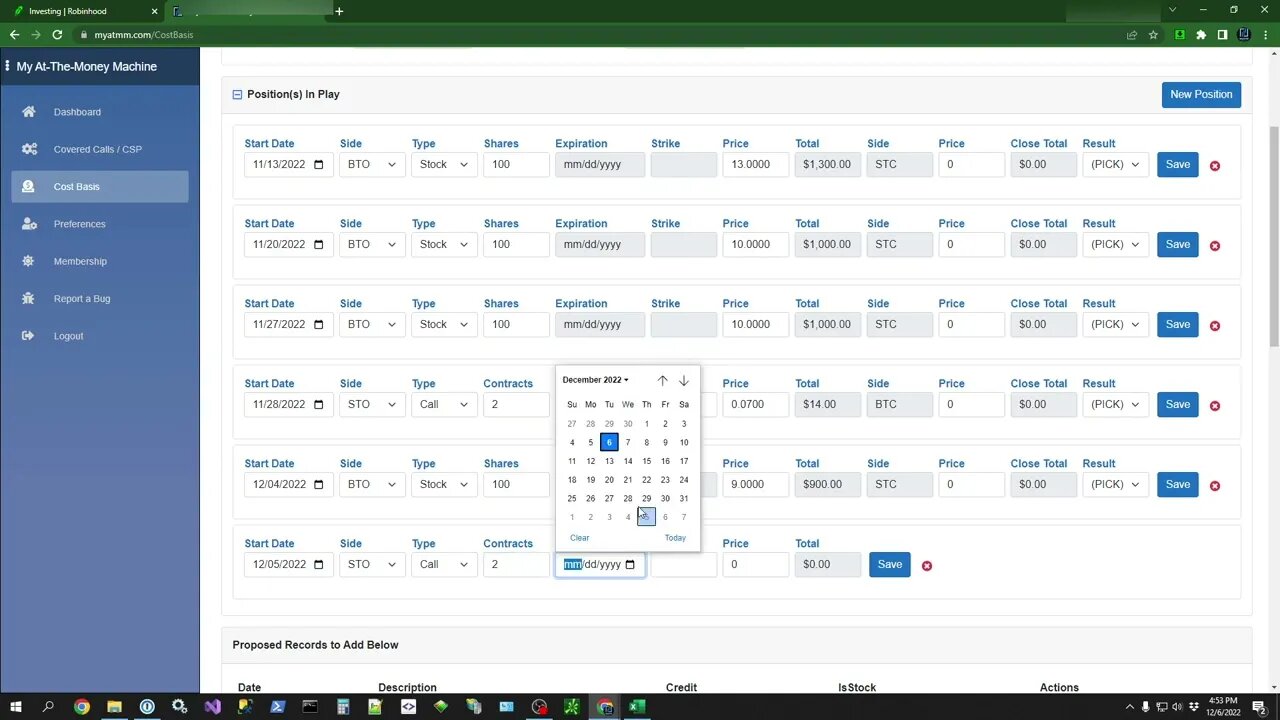

NVAX & RUM Down - Selling Puts to Lower Cost Basis | Cash Secured Puts | 2022.12.06 Follow-up

In this weeks follow-up video, we enter our transactions that executed as usual. But one thing to note is how we are selling puts on NVAX and RUM to pull our overall cost basis down, since selling Calls no longer offers any decent amount of weekly premium.

Pulling our cost basis down will enable us to get the strike price down to a level where we can start selling calls for a decent amount of premium once again, as opposed to just sitting on the stock hoping it'll come back up in value. This way we also don't take the chance of selling calls for below our cost basis and risk getting called out and losing money.

Having a tool to closely track our cost basis with and without premium is vital to being able to play this to our advantage.

Get Your FREE Account today at MyATMM.com - 2022.12.06 Follow-up

-

18:42

18:42

At-The-Money Options Trading Strategy

11 months agoUse Extrinsic Value to Roll Options - Change Strike & Expiration - Avoid Early Assignment #cashflow

2042 -

LIVE

LIVE

FreshandFit

10 hours agoAfter Hours w/ Girls

17,457 watching -

LIVE

LIVE

Badlands Media

4 hours agoBaseless Conspiracies Ep. 152

7,436 watching -

LIVE

LIVE

Inverted World Live

3 hours agoTrump's Medbeds | Ep. 115

3,287 watching -

2:03:41

2:03:41

TimcastIRL

4 hours agoTrump To Deploy National Guard To Chicago, Federal TAKEOVER Begins | Timcast IRL

184K140 -

LIVE

LIVE

PandaSub2000

9 hours agoLIVE 10pm ET | SILENT HILL F w/TinyPandaFace

217 watching -

1:26:00

1:26:00

Glenn Greenwald

9 hours agoNick Fuentes On Censorship, Charlie Kirk's Assassination, Trump's Foreign Policy, Israel/Gaza, the Future of the GOP, and More | SYSTEM UPDATE #523

109K292 -

LIVE

LIVE

StevieTLIVE

5 hours ago#1 Kar98 Warzone POV Monday MOTIVATION

154 watching -

a12cat34dog

5 hours agoTHE *NEW* SILENT HILL :: SILENT HILL f :: IS IT GOOD!? {18+}

9.13K3 -

1:00:21

1:00:21

Akademiks

3 hours agonba youngboy live show.

35.7K2