Premium Only Content

NVAX & RUM Down - Selling Puts to Lower Cost Basis | Cash Secured Puts | 2022.12.06 Follow-up

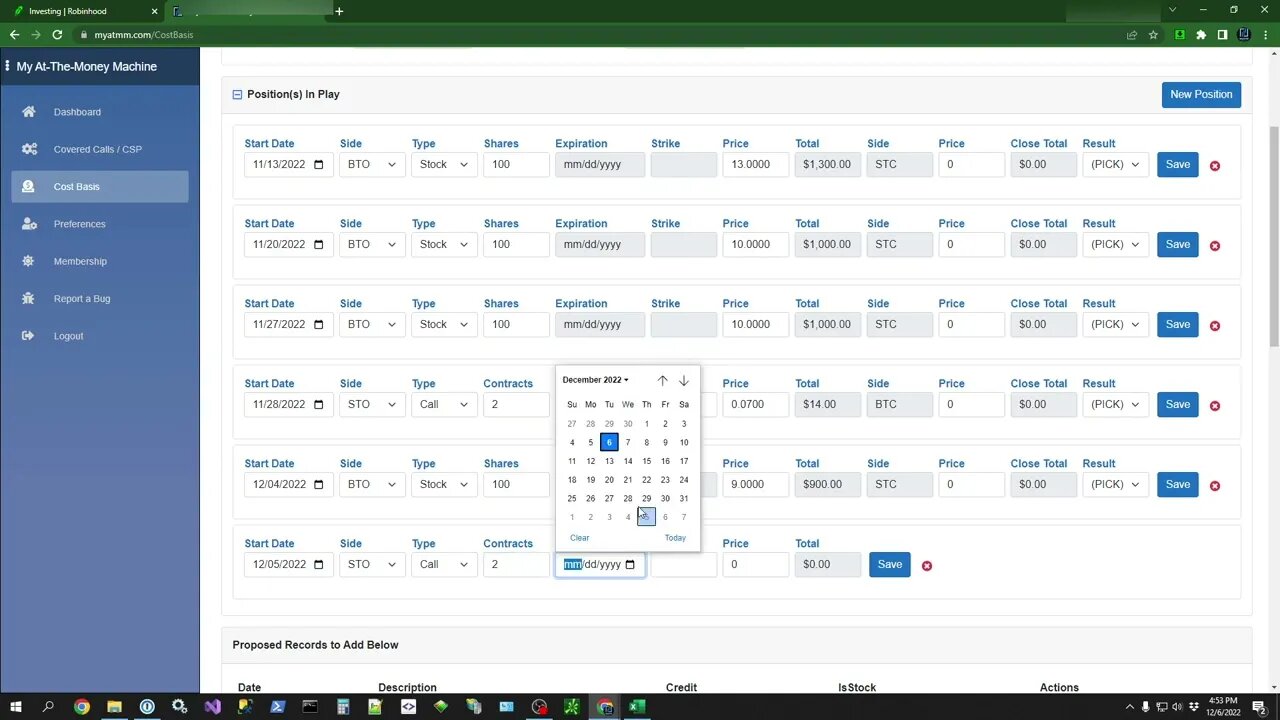

In this weeks follow-up video, we enter our transactions that executed as usual. But one thing to note is how we are selling puts on NVAX and RUM to pull our overall cost basis down, since selling Calls no longer offers any decent amount of weekly premium.

Pulling our cost basis down will enable us to get the strike price down to a level where we can start selling calls for a decent amount of premium once again, as opposed to just sitting on the stock hoping it'll come back up in value. This way we also don't take the chance of selling calls for below our cost basis and risk getting called out and losing money.

Having a tool to closely track our cost basis with and without premium is vital to being able to play this to our advantage.

Get Your FREE Account today at MyATMM.com - 2022.12.06 Follow-up

-

12:46

12:46

At-The-Money Options Trading Strategy

1 year ago $0.06 earnedBitcoin in Stock Market - BITO ETF - Using Covered Calls & Cash Secured Puts - Weekly Income

128 -

LIVE

LIVE

VINCE

1 hour agoTragedy In Minneapolis | Episode 113 - 08/28/25

32,566 watching -

DVR

DVR

Nikko Ortiz

31 minutes agoLive - Reaction Time, News, Politics, and More!

-

LIVE

LIVE

Badlands Media

6 hours agoBadlands Daily: August 28, 2025

2,818 watching -

LIVE

LIVE

Dear America

1 hour agoTrans Violence Against Christianity MUST BE STOPPED!!

3,586 watching -

LIVE

LIVE

Total Horse Channel

13 hours ago2025 URCHA Futurity | Derby & Horse Show | Thursday

35 watching -

LIVE

LIVE

Wendy Bell Radio

5 hours agoGuns Don't Kill People

7,202 watching -

LIVE

LIVE

Matt Kohrs

9 hours agoMarket Open: New Highs or Bust?! || Live Trading Futures & Options

688 watching -

LIVE

LIVE

Randi Hipper

34 minutes agoWALL STREET'S CRYPTO BET REVEALED! HINT: IT'S NOT BITCOIN!

39 watching -

LIVE

LIVE

The Mike Schwartz Show

1 hour agoTHE MIKE SCHWARTZ SHOW with DR. MICHAEL J SCHWARTZ 08-28-2025

131 watching