Premium Only Content

Greed is Good--and the Bull Market is Back?

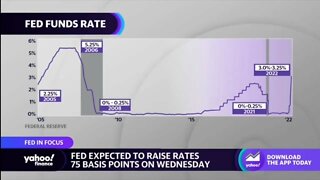

(12/1/22) Fed Chairman Jerome Powell Wednesday implied concern about over-tightening the economy, a very different tack than was expressed just a month ago, when he said he WASN'T worried about over-tightening because the Fed had "tools to solve that problem." What's changed? Employment is showing signs of weakening, manufacturing is showing signs of slowing, so NOW he's worried about over-tightening. That's all market bulls needed to hear to surge 3.1%. But to put that into perspective, we rallied 5.5% following the release of October CPI on anticipation the Fed would slow the pace of its rate increases. But that's not what Powell said: The Fed may need to hike even more next year, raising the potential for a terminal rate of over 5%. Markets didn't hear that, however. Markets are getting a bit over-bought, the MACD Buy-signal is still in place, and markets have gotten above the 200-DMA. But with markets over-bought, it may be a little late to be chasing them; be careful!

Hosted by RIA Advisors' Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton

--------

Get more info & commentary:

https://realinvestmentadvice.com/insights/real-investment-daily/

-------

Watch the video version of this report by subscribing to our YouTube channel:

https://www.youtube.com/watch?v=LKEJHJAXIYM&list=PLVT8LcWPeAujOhIFDH3jRhuLDpscQaq16&index=1

-------

Visit our Site: www.realinvestmentadvice.com

Contact Us: 1-855-RIA-PLAN

--------

Subscribe to RIA Pro:

https://riapro.net/home

--------

Connect with us on social:

https://twitter.com/RealInvAdvice

https://twitter.com/LanceRoberts

https://www.facebook.com/RealInvestmentAdvice/

https://www.linkedin.com/in/realinvestmentadvice/

-

19:12

19:12

TheoTRADE

2 years ago $0.02 earnedAre We Back in a Bull Market?

20 -

2:20

2:20

CryptoMiles

2 years agoCryptocurrency Bull Market 2022

21 -

15:16

15:16

CryptoFrontier

2 years agoA Bull Market in 2023?

142 -

0:51

0:51

Crypto and Marty

2 years agoBull Market versus Bear market

1 -

4:19

4:19

CryptoFrontier

2 years agoLife changing Bull Market???

-

52:03

52:03

CryptoFrontier

2 years agoCrypto Bull Market Possibilities 🤔

-

0:41

0:41

FinancialEducation101

2 years agoBull VS Bear Market #shorts

15 -

0:32

0:32

FinancialEducation101

2 years agoWhat is a Bull Market? #shorts

3 -

0:24

0:24

FinancialEducation101

2 years agoBull market vs Bear market - BULL and BEAR Market Explained #shorts

17 -

57:09

57:09

Kitco NEWS

18 hours agoFiat Collapse Ahead Gold to $8,900 in Global Monetary Shift

60.8K7