Premium Only Content

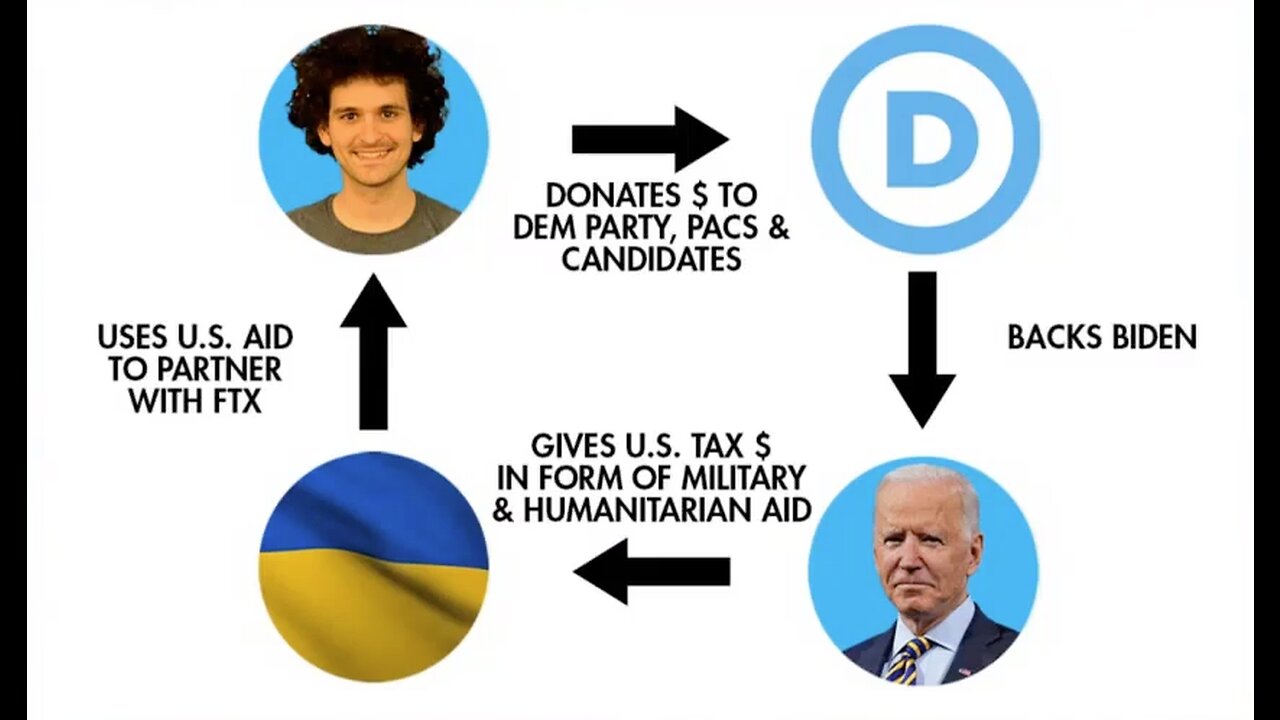

Sam Bankman-Fried bought the Senate & stopped the Red Wave

FTX faces criminal probe in Bahamas after company collapses, loses $1 billion in crypto

Fromer FTX CEO Sam Bankman-Fried is a top donor to Democratic politicians

Facebook

Did FTX meltdown turn the 'crypto winter' into a 'crypto ice age'?

D.A. Davidson director of research Gil Lauria and Duke Financial Economics Center policy director Lee Reiners debate the case for cryptocurrency as the FTX crisis continues to unfold on 'The Claman Countdown.'

The cryptocurrency exchange FTX is facing a criminal inquiry in the Bahamas after the company filed for bankruptcy and essentially collapsed last week.

FTX, co-founded by former crypto billionaire and top Democratic donor Sam Bankman-Fried, reported that roughly $1 billion in crypto funds had vanished due to "unauthorized transactions." The company is based in the Bahamas and filed for bankruptcy last week, leading to an investigation from the country's securities commission, Bloomberg reported Sunday.

"In light of the collapse of FTX globally and the provisional liquidation of FTX Digital Markets Ltd., a team of financial investigators from the Financial Crimes Investigation Branch are working closely with the Bahamas Securities Commission to investigate if any criminal misconduct occurred," a police spokesman told the outlet.

Bankman-Fried resigned as the FTX CEO last week in a letter that also filed for Chapter 11 bankruptcy.

FTX founder

Sam Bankman-Fried, founder and chief executive officer of FTX Cryptocurrency Derivatives Exchange, speaks during a Senate Agriculture, Nutrition and Forestry Committee hearing in Washington, D.C., U.S. (Photographer: Sarah Silbiger/Bloomberg via Getty Images / Getty Images)

FTX logo on phone

This illustration photo shows a smart phone screen displaying the logo of FTX, the crypto exchange platform, with a screen showing the ((Photo by OLIVIER DOULIERY / AFP) (Photo by OLIVIER DOULIERY/AFP via Getty Images) / Getty Images)

FTX was the third-largest crypto market in the world at the start of last week when it announced liquidity problems and would need a massive infusion of cash to stay afloat.

Binance, the world's largest crypto market, initially stepped in and offered to buy the company, but it backed out of the deal after looking into FTX's finances.

Reuters, citing two people familiar with the matter, reported that at least $1 billion of customer funds had disappeared and that people told the news outlet that Bankman-Fried had secretly transferred $10 billion of customer funds from FTX to his trading company Alameda Research.

The two sources told Reuters that Bankman-Fried — in a meeting he confirmed took place — shared records with other senior executives that revealed the financial hole.

Sam Bankman-Fried, founder and chief executive officer of FTX Cryptocurrency Derivatives Exchange, speaks during the Institute of International Finance (IIF) annual membership meeting in Washington, DC, US, on Thursday, Oct. 13, 2022. This year's con (Photographer: Ting Shen/Bloomberg via Getty Images / Getty Images)

Spreadsheets reportedly showed that between $1 and $2 billion dollars of the funds were not accounted for among Alameda's assets and that the spreadsheets did not indicate where the money was moved.

FTX is also reportedly facing potential investigations from the U.S. Justice Department and the U.S. Securities and Exchange Commission.

By Anders Hagstrom

-

2:35:23

2:35:23

FreshandFit

4 hours agoWhy Black Men Don't Date Black Women Debate

17.4K10 -

2:03:42

2:03:42

Inverted World Live

7 hours agoBigfoot Corpse Coming to the NY State Fair | Ep. 94

88K17 -

6:16:23

6:16:23

SpartakusLIVE

8 hours ago$1,000 Pistol Challenge || #1 ENTERTAINER of The EONS Eradicates BOREDOM

66.4K2 -

2:33:37

2:33:37

TimcastIRL

6 hours agoTrump Orders Review of Smithsonian For Being Woke & Out of Control | Timcast IRL

161K51 -

3:09:10

3:09:10

Barry Cunningham

9 hours agoPRESIDENT TRUMP HAS TAKEN THE MONSTER AWAY FROM THE LEFT! HORROR STORIES WON'T WORK ANYMORE!

69.6K72 -

1:29:55

1:29:55

WickedVirtue

3 hours agoLate Night Fortnite w/ Friends

35.5K -

3:34:06

3:34:06

This is the Ray Gaming

4 hours ago $0.29 earnedCould you be? Would you be? Won't you be my RAYBOR? | Rumble Premium Creator

20.8K -

1:46:52

1:46:52

JahBlessGames

5 hours ago🎉Come een' and come tru' - VIBES | MUSIC | GAMES

39.5K -

38:47

38:47

MattMorseTV

7 hours ago $12.09 earned🔴Tulsi just CLEANED HOUSE.🔴

59.2K97 -

6:24:06

6:24:06

Reolock

8 hours agoWoW Classic Hardcore | WE'RE BACK!!

25.1K1