Premium Only Content

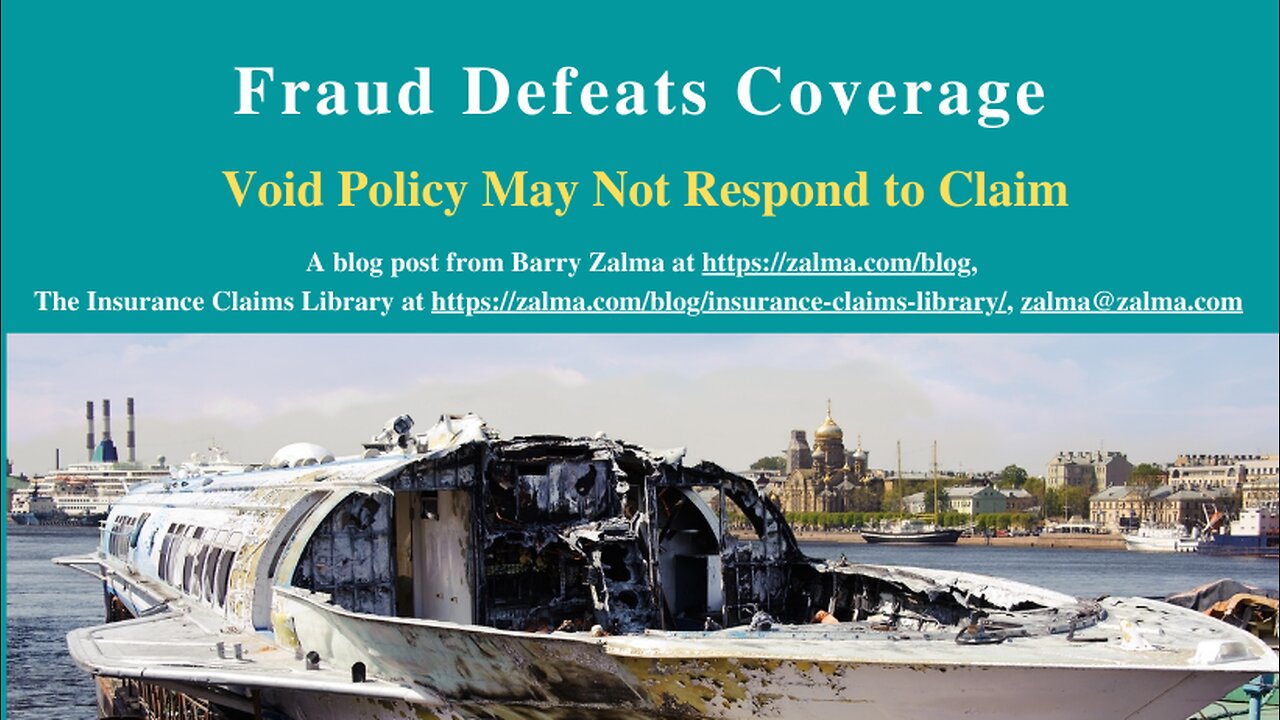

Fraud Defeats Coverage

Void Policy May Not Respond to Claim

Douglas McKenzie and Jeffery Bigsby (collectively, “Plaintiffs”) filed this insurance dispute action against GEICO Marine Insurance Company (“GMIC”) in the Superior Court of Washington for Snohomish County on April 7, 2022. GMIC moved to dismiss the complaint. In Douglas McKenzie and Jeffery Bigsby v. GEICO Marine Insurance Company, Civil Action No. 2:22-cv-00647-BJR, United States District Court, W.D. Washington, Seattle (November 2, 2022) the USDC resolved the dispute.

BACKGROUND

GMIC issued a marine insurance policy that is the subject of this lawsuit to Mike Schladetzky for his boat that was moored at the Port of Everett Marina. A fire occurred on Schladetzky's boat on October 8, 2018, causing extensive damage to the boat and a portion of a boathouse in the immediate vicinity of the boat. Plaintiffs allege that the fire also destroyed personal property and marine equipment that they owned.

Schladetzky notified GMIC of the fire and GMIC retained attorney Anthony Gaspich to represent Schladetzky against any liability claims. However, on March 8, 2019, GMIC sued Schladetzky alleging that Schladetzky had breached the insurance contract and requested that the contract be voided due to fraud and misrepresentation. Trial Judge Robart entered default judgment against Schladetzky concluding that the insurance policy was void as a matter of law and Schladetzky was not entitled to coverage.

Schladetzky was subsequently criminally charged for submitting a fraudulent insurance claim to GMIC and he ultimately pled guilty and was sentenced to serve jail time of 60 days.

Plaintiffs McKenzie and Bigby each submitted claims for damages on May 23, 2019. On August 22, 2019, Gaspich filed a motion to withdraw as attorney for Schladetzky, which Judge Robart granted and Schladetzky proceed pro se thereafter.

Judge Robart granted summary judgment to Plaintiffs, awarding McKenzie a judgment against Schladetzky in the amount of $23,360.00 and Bigsby a judgment against Schladetzky in the amount of $12,537.75.

Plaintiffs submitted the judgments to GMIC and demanded payment; GMIC refused to pay Plaintiffs' demands because the insurance policy had been voided for fraud nearly two years earlier. Plaintiffs then sued GMIC's claiming it violated the Washington Consumer Protection Act (“WCPA”), the Washington Insurance Fair Conduct Act (“WIFC”), and breached the insurance contract. Thereafter, Plaintiffs voluntarily dismissed the IFCA and breach of contract claims. They also dismissed the per se WCPA claim, but the non-per se WCPA claim remained. GMIC now moves to dismiss the non-per se WCPA claim pursuant to Rule 12(b)(6) for failure to state a claim upon which relief can be granted.

DISCUSSION

In Washington, a non per se WCPA claim is proved by establishing the following five elements:

an unfair or deceptive act or practice,

occurring within trade or business,

affecting the public interest,

injuring the plaintiff's business or property, and

a causal relation between the deceptive act and the resulting injury.

GMIC argued that the non per se WCPA claim must be dismissed because the complaint has not sufficiently pled facts to support a reasonable inference that GMIC engaged in an unfair or deceptive act.

The Plaintiffs alleged that GMIC engaged in unfair or deceptive actions by:

having Plaintiffs submit “claims for review and payment and then not responding”,

“initiating” the April 2019 exoneration action,

“initiating” Attorney Gaspich's withdrawal from the exoneration action “based on secret reasons”,

seeking a default order to void the insurance policy due to fraud without notifying Plaintiffs, and

obtaining the default order without giving Plaintiffs an opportunity to object.

None of these alleged actions constitute an unfair or deceptive act.

Plaintiffs complain that GMIC filed the exoneration action “when [it] had no intent to pay any claims established” in that action. First, Schladetzky, not GMIC, filed the limitation of liability lawsuit, GMIC was not a party to the action. Second, it is undisputed that Schladetzky had the legal right to file such an action in an attempt to limit any liability to the value of the vessel. Schladetzky's decision to file a lawsuit he is legally entitled to bring cannot be the basis for an unfair or deceptive act by GMIC. Nor does Attorney Gaspich's withdrawal from the exoneration action constitute an unfair or deceptive act by GMIC. Once again, this is an action between Schladetzky and Gaspich, not GMIC and the Plaintiffs. Moreover, it is difficult to see how Gaspich's withdrawal from the exoneration action harmed Plaintiffs when they each successfully received judgments against Schladetzky for the total of their demands in that action.

Plaintiffs' assertion that GMIC acted deceptively when it sought to void the insurance contract for fraud was misplaced. GMIC had the legal right to seek to void the contract between it and its insured based on Schladetzky's fraud, and Plaintiffs certainly had no standing to dispute the fraudulent nature of Schladetzky's actions.

Plaintiffs do not cite to any legal authority that gives Plaintiffs the right to receive notice of or object to a contract dispute to which they are not a party. GMIC's failure to give Plaintiffs notice of its lawsuit against its insured cannot be the basis for a CPA claim.

Because Plaintiffs failed to allege factual allegations sufficient to establish the first element of a WCPA claim-an unfair or deceptive act or practice by GMIC, the claim must be dismissed.

ZALMA OPINION

A person who is convicted of insurance fraud in the presentation of a claim must result, a priori, in the voidance of a policy of insurance. Schladetzky's fraud voided the policy. The Plaintiffs, who could not collect from the felon, tried to collect from the insurance policy issued to Schladetzky. Although the court gave consideration to the plaintiffs arguments it had no choice but to grant GMIC's motion since there was no policy to respond to their claims. They have a judgment against the person responsible for their losses and they should spend their efforts to collect from him, not try to bludgeon an insurer who was the victim of a fraud to increase the cost of the fraud imposed on GMIC by the felon.

(c) 2022 Barry Zalma & ClaimSchool, Inc.

Barry Zalma, Esq., CFE, now limits his practice to service as an insurance consultant specializing in insurance coverage, insurance claims handling, insurance bad faith and insurance fraud almost equally for insurers and policyholders. He practiced law in California for more than 44 years as an insurance coverage and claims handling lawyer and more than 54 years in the insurance business.

He is available at http://www.zalma.com and [email protected].

Subscribe and receive videos limited to subscribers of Excellence in Claims Handling at locals.com https://zalmaoninsurance.locals.com/subscribe.

Subscribe to Excellence in Claims Handling at https://barryzalma.substack.com/welcome.

Write to Mr. Zalma at [email protected]; http://www.zalma.com; http://zalma.com/blog; daily articles are published at https://zalma.substack.com. Go to the podcast Zalma On Insurance at https://anchor.fm/barry-zalma; Follow Mr. Zalma on Twitter at https://twitter.com/bzalma; Go to Barry Zalma videos at Rumble.com at https://rumble.com/c/c-262921; Go to Barry Zalma on YouTube- https://www.youtube.com/channel/UCysiZklEtxZsSF9DfC0Expg; Go to the Insurance Claims Library – https://zalma.com/blog/insurance-claims-library.

-

7:40

7:40

Barry Zalma, Inc. on Insurance Law

1 year agoLoss of Inventory by Bankruptcy

196 -

1:02:55

1:02:55

VINCE

3 hours agoThey're Coming For You Next | Episode 163 - VINCE 11/06/25

152K193 -

LIVE

LIVE

Right Side Broadcasting Network

15 hours agoLIVE: President Trump Makes an Announcement - 11/6/25

6,546 watching -

1:42:05

1:42:05

Graham Allen

3 hours agoTrump And Vance Show The Path For Winning!!! WE MUST FIGHT! + Erika Kirk Reveals All!

117K40 -

LIVE

LIVE

LadyDesireeMusic

2 hours ago $0.02 earnedLive Piano & Convo - Rumble Rants and Sub Request

195 watching -

1:10:27

1:10:27

Chad Prather

18 hours agoThe Secret To Pleasing The Lord Over Man!

82.5K53 -

LIVE

LIVE

LFA TV

13 hours agoLIVE & BREAKING NEWS! | THURSDAY 11/6/25

4,402 watching -

52:16

52:16

American Thought Leaders

20 hours agoIs There a Link Between Mass Shootings and SSRIs?

63.3K59 -

17:12

17:12

World2Briggs

21 hours ago $0.09 earnedTop 10 Towns You Can Retire or Live on $1900 a month in the Midwest #1

46.2K26 -

17:25

17:25

BlackDiamondGunsandGear

1 day agoCustom Building the Cheapest MP5

52.7K2