Premium Only Content

Sharing Now Available to Larger Companies! The ICHRA gives smart CFOs an alternative to Insurance

PLEASE SUBSCRIBE: healthbizpolitics.subscribemenow.com

Steve Alley - President at JSA Group LLC

JSAgroupLLC.com

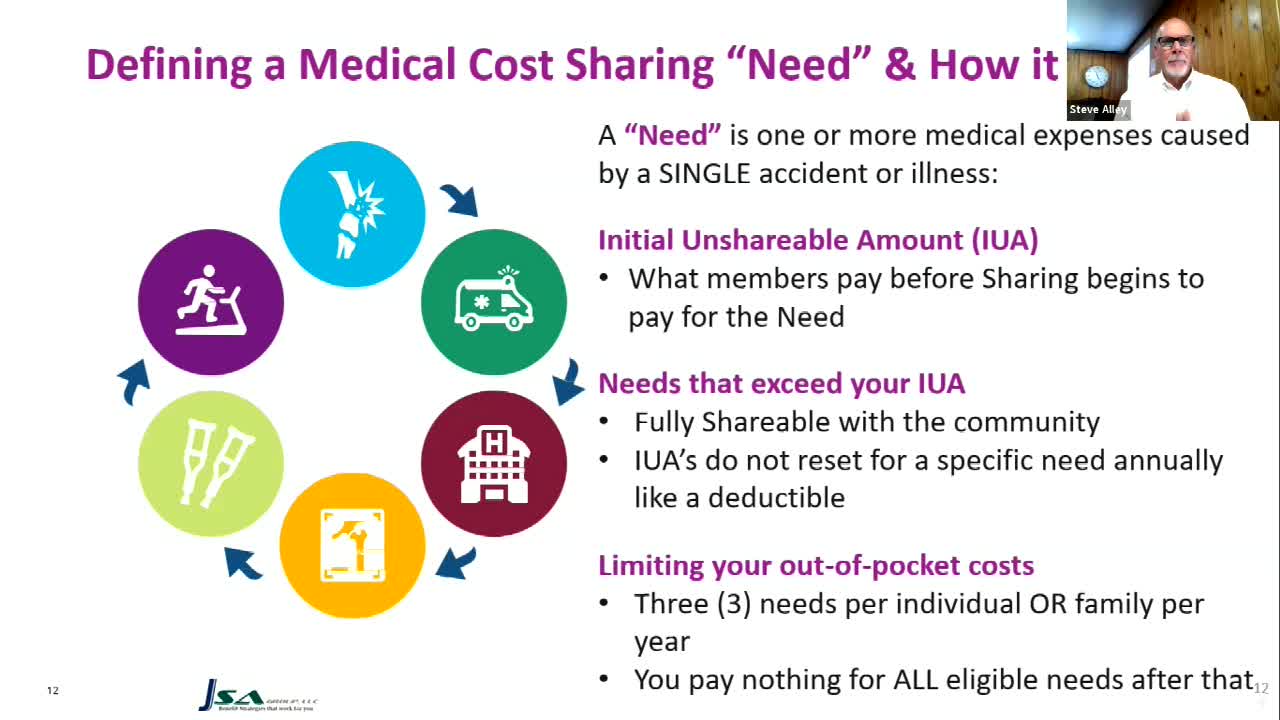

Most innovative CFOs believe funding their own employees’ health costs makes the only alternative to hiring an insurance company to pay bills. Companies with fewer than 50 workers - mostly uninsured - have been adding benefits also with an insurance alternative, called Medical Cost Sharing.

Sharing is to insurance what credit unions are to banks: a shareholder-free alternative allowing profits to be driven back into better service and pricing for members. Sharing costs half what insurance charges, and usually dispense with networks that limit doctor choice: So, Sharing expands access to any healer, worldwide.

Unlike insurance, however, Sharing phases in pre-existing conditions. So, anyone with a recent bout of cancer, heart disease, or any other condition that might blow up in the first year with a Sharing Community, has to settle for ObamaCare.

Instead of fighting ObamaCare, advisors are not coupling it with Sharing - so most employees can upgrade to a non-network Sharing option, while sicker workers get insurance. This combo is available now for businesses with more than 50 workers, via an account called the ICHRA - individual coverage health reimbursement arrangement.

Adding tax-advantaged Health Savings Accounts, Direct Primary Care, or money-doubling Health Matching Accounts, CFOs halve their costs and workers get Cadillac protection. For years Mr. Alley has been replacing insurance with innovative benefits that make for a happy workplace.

-

1:00:51

1:00:51

Health Biz and Politics

13 days agoEnsuring Safe Blood while Hospitalized

721 -

13:18

13:18

The Rad Factory

8 hours ago $0.16 earnedIs This E Scooter Worth $900?

3.56K1 -

54:38

54:38

The Dr. Ardis Show

7 hours ago $1.76 earnedThe Dr. Ardis Show | 5 Ways Alcohol Destroys Your Health | Episode 07.23.2025

4.47K5 -

LIVE

LIVE

RalliedLIVE

5 hours ago $1.47 earned10 WINS WITH THE SHOTTY BOYS

118 watching -

1:14:33

1:14:33

Dr. Drew

6 hours agoBenny Johnson & Mama June: America & Families In Crisis w/ Pumpkin & Jessica (The Double Feature Nobody Expected) – Ask Dr. Drew

25.8K1 -

4:00:56

4:00:56

Viss

5 hours ago🔴LIVE - How to Consistently Win in PUBG!

7.2K1 -

5:56:11

5:56:11

StoneMountain64

6 hours agoHIDE AND SEEK. IM GOING TO FIND YOU.

7.95K -

13:40

13:40

Preston Stewart

8 hours ago $0.78 earnedMajor Protests Erupt in Ukraine

11.4K27 -

LIVE

LIVE

LFA TV

21 hours agoLFA TV ALL DAY STREAM - WEDNESDAY 7/23/25

1,115 watching -

LIVE

LIVE

sophiesnazz

3 hours ago $0.12 earnedI AM BACKK !socials

12 watching