Premium Only Content

35% of Americans would save up $200,000 before buying a house

More than a third of Americans (35%) won’t even think about purchasing a house until they have at least $200,000 saved up, according to new research.

A survey of 1,000 homeowners and 1,000 general population Americans looked at some of the most common misconceptions and experiences of purchasing a home for the first time.

Among those looking to purchase a home, respondents believed the top items needed to secure a home loan are money (52%), a steady job (49%) and good credit (48%).

Conducted by OnePoll in partnership with loanDepot, the survey also uncovered some of the most common home-buying myths. Many believe they need a near-perfect credit score (30%) - while the average respondent erroneously believed they have to make a down payment of at least 25% to purchase a home.

“In this market, it’s easy to get caught up in just trying to get a house, but don’t let all of that lead you down the wrong path,” said loanDepot’s vice president of community lending Jesus Cruz. “Make sure you know your priorities, and that you’ve really thought through your budget and planned for different scenarios that could arise in the future. There are a lot of programs and loan options available to first-time home buyers, so it’s important to keep a cool head and work closely with your lender to understand the different mortgage options that are right for you.”

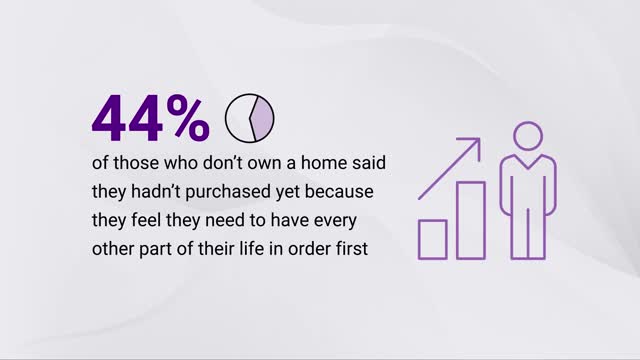

Higher interest rates, rising home prices and common myths aren’t the only reason non-homeowners have shied away from searching for a home; forty-four percent of those who don’t own a home said they hadn’t purchased yet because they feel they need to have every other part of their life in order first.

As part of their criteria for choosing a home, those surveyed consider their income (34%) and total cost (32%) as the most important factors – stressing the importance of budget in the process.

With the highly competitive housing market making home buying a challenge, one in seven respondents considering a home purchase said their decision not to enter the market came after hearing negative stories from other homeowners about their purchasing experience.

Surprisingly, those who have purchased reported the process was smoother than anticipated (64%), with a remarkable two-thirds sharing that the paperwork and legalities were actually quite easy.

Regardless of whether the process itself was easier than expected or overwhelming (27%), others ultimately found the homebuying journey to be exciting (35%) and joyous (28%) because they landed in a home.

Homeowners offered advice to those looking to purchase a home: One respondent suggested to “be patient and don’t settle.” Others said to “be smart about budgeting for your mortgage and the total cost of housing” and “find out everything that is involved [in the closing], especially fees and hidden costs.”

“The advice homeowners passed on to would-be home buyers is sound – especially as it relates to the cost of purchasing and owning a home,” said loanDepot’s chief credit officer Brian Rugg. “It’s so important to work with a reputable lender, who will make you comfortable and take the time to walk you through all aspects of the purchase – especially if you’re a first-time homebuyer.

It’s also really important to think beyond the purchase price itself. You have to pay close attention to the home’s condition and factor in the cost of maintenance and future upgrades. For most people, owning a home is the bedrock of the American Dream, but you need to go into it with your eyes wide open and understand what it means for you and your budget. Don’t be afraid to ask questions.”

Nearly half of homeowners (46%) wish they had bought their homes earlier, but 59% felt the process was a rushed experience. Meanwhile, most parents surveyed shared that they needed to buy a home so their kids can inherit it and be comfortable later in life (59%).

-

0:57

0:57

SWNS

6 days agoWhy many men suffer from haircut anxiety

341 -

1:17:26

1:17:26

Katie Miller Pod

1 hour agoEpisode 3 - Senator Katie Britt | The Katie Miller Podcast

5.34K -

1:05:24

1:05:24

BonginoReport

3 hours agoTrump Protects Old Glory in New EO! - Nightly Scroll w/ Hayley Caronia (Ep.119) - 08/25/2025

59.2K32 -

LIVE

LIVE

The Jimmy Dore Show

2 hours agoSnoop Dogg Is DONE w/ LBGTQ+ Propaganda In Kids Movies! Trump Outlaws Burning the U.S. Flag!

8,051 watching -

LIVE

LIVE

Quite Frankly

5 hours ago"Weekend News, All-Time Physical Feats, Mixed Reels" 8/25/25

465 watching -

LIVE

LIVE

The Mike Schwartz Show

2 hours agoTHE MIKE SCHWARTZ SHOW Evening Edition 08-25-2025

4,162 watching -

1:43:44

1:43:44

MTNTOUGH Podcast w/ Dustin Diefenderfer

17 hours agoEddie Penney: DEVGRU to Single Dad of 3 Overnight | MTNPOD #130

4.36K1 -

1:28:57

1:28:57

Kim Iversen

3 hours agoSomeone Stole Kim's Identity — And Bought a Car! | Dr Drew Pinsky On Sex, Drugs & Censorship

34.7K21 -

1:07:00

1:07:00

TheCrucible

3 hours agoThe Extravaganza! Ep. 26 (with special guest host Rob Noerr) 8/25/25

65.1K6 -

7:35

7:35

Tundra Tactical

2 hours ago $0.55 earnedI Can’t Believe I’m Saying This… 2011’s Are Actually COOL Now?! 🤯

10.7K1