Premium Only Content

Stocks Rip Higher Ignoring Everything But Hopes Of A Hard Pivot From The FED

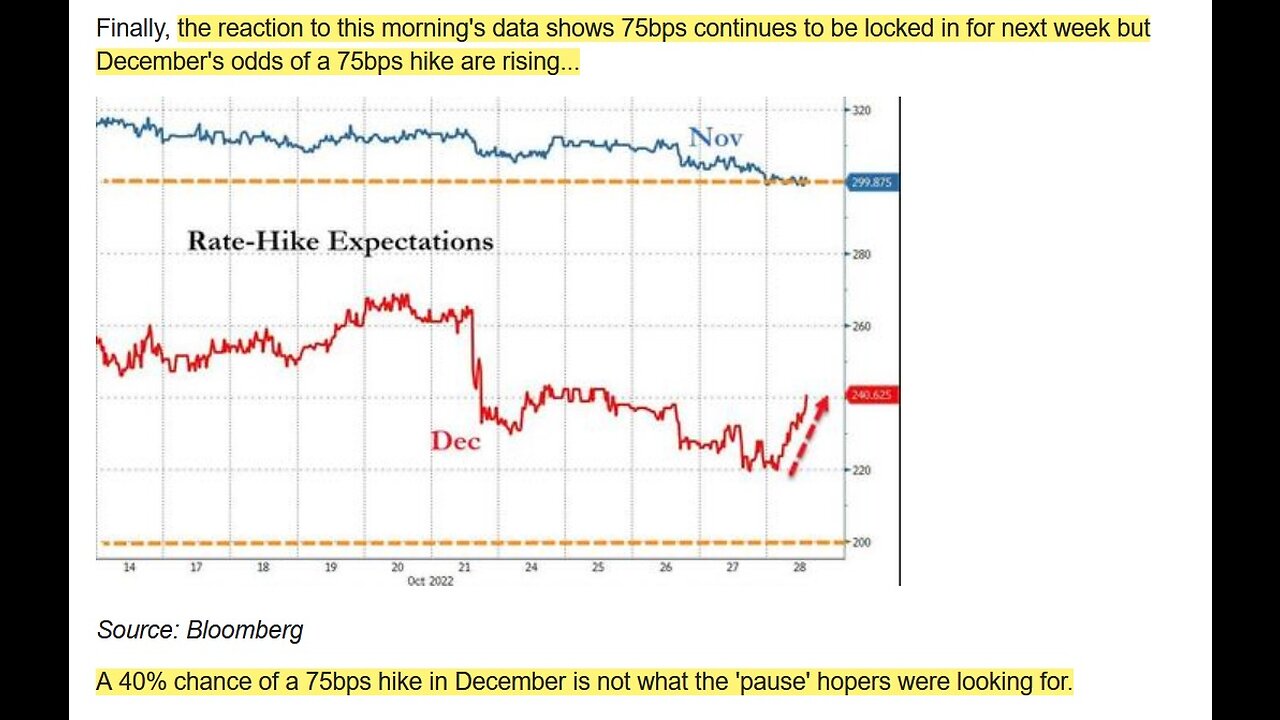

Stocks rally strongly as PCE inflation is rising along with wages growth, as the market is hoping a hard FED pivot comes on Thursday FOMC meeting.

Last week I covered how the FED was forced into a soft pivot, which continued into this week as stocks rallied most of the week.

US savings rate macro data came out showing real adjusted consumption is falling as real wages remain week, while the savings rate of Americans continue to collapse to 2004 levels.

Pending sales data also showed worse then expected falls, as the property industry is in a sharp recession fueled by soaring mortgage rates thanks to FED rate hikes.

Umich Survey inflation exceptions also saw a pick up as more Americans expect CPI to remain high for longer.

With all the weak macro data suggesting the FED will be forced to hike for longer, stocks ignored it all & ripped higher.

I cover SPX & NDX charts as well Aussie index XJO, discussing potentially weak price action could occur from FOMC if Powell disappoints. With the charts showing bearish flags or rising pendants.

Lastly I cover the massive date dump of macro news coming out this week including FOMC & NFP's on Friday.

Links:

https://www.cnbc.com/world/?region=world

https://www.zerohedge.com/personal-finance/us-pending-home-sales-collapsed-october-weakest-2010

https://www.zerohedge.com/personal-finance/umich-inflation-expectations-increase-september-hope-dips

https://www.forexfactory.com/calendar?week=this

Follow me:

Twitter: @crushthemarket

#FED #Bonds #Yields #Stocks #BOE #Pivot #Inflation #PCE #FOMC #SPX #CPI #NDX #XJO #FED #Powell #Property #RBA #NFP

-

1:15:13

1:15:13

Lara Logan

10 hours agoANIMALS UNDER ASSAULT: Vet Eva DeCozio On Pet Vaccines & Animal Sexual Abuse | Ep 44 | Going Rogue

18.3K3 -

1:00:06

1:00:06

Rebel News

2 hours agoOstrich vigil update, Carney on pipeline debate, OneBC fights land grabs | Rebel Roundtable

15.1K3 -

1:30:43

1:30:43

Steven Crowder

5 hours agoToday, Everybody Gets the Smoke

307K178 -

16:09

16:09

Professor Nez

2 hours agoEpstein Narrative COLLAPSES in Jasmine Crockett's FACE on LIVE TV!

20.7K12 -

41:25

41:25

The Rubin Report

4 hours agoBari Weiss Shocks Media Establishment with Ballsy Next Move That No One Expected

45K26 -

LIVE

LIVE

The Shannon Joy Show

3 hours agoSJ Show Nov 14 - The SJ Friday Matinee Watch Party With Commentary Featuring IDIOCRACY!

29 watching -

1:00:52

1:00:52

Trumpet Daily

3 hours ago $1.99 earnedTrumpet Daily LIVE | Nov. 14, 2025

17.6K6 -

1:02:21

1:02:21

VINCE

6 hours agoDoes The FBI Have Hillary's Missing Emails? | Episode 169 - 11/14/25 VINCE

216K198 -

LIVE

LIVE

LFA TV

17 hours agoLIVE & BREAKING NEWS! | FRIDAY 11/14/25

1,820 watching -

1:25:56

1:25:56

Graham Allen

6 hours agoThis Is How We Win The Midterms!!! No More Games….WIN OR WE LOSE EVERYTHING!

132K1.77K