Premium Only Content

Why Gilts and sterling increase on Monday? Is the GBP going to lose value against USD longer term?

When Jeremy Hunt who is the new UK chancellor took steps to eliminate Kwasi Kwarteng’s tax-cutting scheme this provided the market with some assurance that the interest rate rises might not come quite as fast as projected.

Since interest rate increases cause bond prices to decrease this explains why there was a slight improvement for Gilts and sterling on Monday of last week.

However, fundamentally, if looked at over decades not the time horizon of a few weeks or months there is nothing yet that is going to reverse the trend of sterling losing value against the dollar. Many smart investors are trying to reduce their exposure to sterling and want to trade for US dollars.

If you are in the situation where you have £ and normally would want to purchase gilts but are looking at all of this inflation and the £ endlessly losing value against the $, then Alamo Mortgage Holdings, Ltd has a solution for you.

The answer is that Alamo Mortgage Holdings bonds in addition to paying hundreds of basis points more than UK gilts also give institutional and accredited investors the option of converting out of GBP to USD. Alamo Mortgage Holdings, Ltd works with institutional and accredited UK investors looking to find the fastest way out of gilts into something that pays income and also gets them into US dollars.

The US dollar has for decades been gaining value against the British pound sterling. Many family offices in the United Kingdom are looking for investments that let them reduce the concentration of their investments denominated in sterling.

If a family office in the United Kingdom purchases Alamo Mortgage Holdings, Ltd backed bonds the benefits are passive income and being able to get out of sterling quickly before it potentially loses more value.

Our focus at Alamo is to work with family offices, institutional and UK accredited investors that would like to get into an asset that pays out US dollars. USA mortgage notes are an excellent investment choice.

There are many reasons that mortgage note investing is excellent since it allows someone to purchase immediate income. The only downside to mortgage note investing is there is a bit of a learning curve to do it properly.

By purchasing Alamo Mortgage Holdings, Ltd bonds an investor is able to obtain the passive income they are seeking. However, they also avoid having to do front line negotiation to find deals and go through the time consuming and rigorous due diligence that Alamo Mortgage Holdings performs on our acquisitions.

If you are an institutional or UK accredited investor thinking of reducing your gilt holdings but want to replace it with something with more potential upside, Alamo Mortgage Holdings, Ltd has a solution for you.

Alamo Mortgage Holdings, Ltd a privately held United Kingdom company, offers corporate income bonds that offer higher rates of return than UK gilts.

If you would like to learn more go to www.alamomortgageholdings.co.uk/ and fill out the contact form to request some free information to schedule a Zoom or Google Meet introductory call.

I wish you good luck with your investing!

Benjamin Z Miller, Managing Director

Alamo Mortgage Holdings, Ltd.

[email protected]

www.alamomortgageholdings.co.uk/team.html

-

0:48

0:48

thesessionca

3 years agoIncrease your value and increase your options!

-

2:02

2:02

theKingdomGovernment

3 years agoGoing Against the Odds

2 -

0:15

0:15

Last World News Channel

3 years agoGermany Monday protests against the dictatorship 10/24/22.

11 -

0:09

0:09

garciadesousa

3 years agoME GOING TO WORK ON MONDAY

2 -

3:26

3:26

ACE1918

3 years agoHelp Me End The Genocide Against Jim Sterling

201 -

11:53

11:53

SalivateMetal

3 years agoIs Silver No Longer A Hedge Against Inflation?

25 -

1:39

1:39

KNXV

3 years agoIncrease in threats and acts of violence against FBI

13 -

4:20

4:20

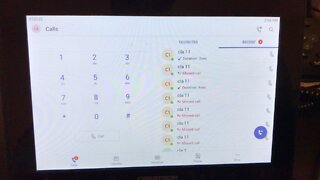

CCC1968

3 years agoMissed call value increase

16 -

2:06:16

2:06:16

TimcastIRL

15 hours agoTrump Calls For NUCLEAR OPTION, END Filibuster Over Food Stamp Crisis | Timcast IRL

221K186 -

3:58:54

3:58:54

SavageJayGatsby

13 hours ago🎃 Friend Friday – Halloween Edition! 👻🕷️

56.1K4