Premium Only Content

TradeStation EasyLanguge Tutorial 184 | SuperTrend strategy framework and indicator

Tutorial 184 is based on the Markplex SuperTrend indicator which is a stop and reverse (SAR) indicator that trails price action (See the original indicator here: https://markplex.com/free-tutorials/tutorial-173-markplex-supertrend/ )

This implementation calculates the Average True Range (ATR) of the average price using the exponential moving average. A user input multiple of the ATR is added to or subtracted from the average price to give Upper and Lwr respectively, depending on the direction. Direction is determined by the Close of a bar relative to the value of the SuperTrend, Upper and Lwr.

There are many different interpretations of the so-called SuperTrend indicator. In this Markplex version the SuperTrend value is also tightened (i.e. moved closer to price) by using an acceleration factor which increases incrementally each bar by user input: AFStep up to a a maximum value of user input: MaxAF.

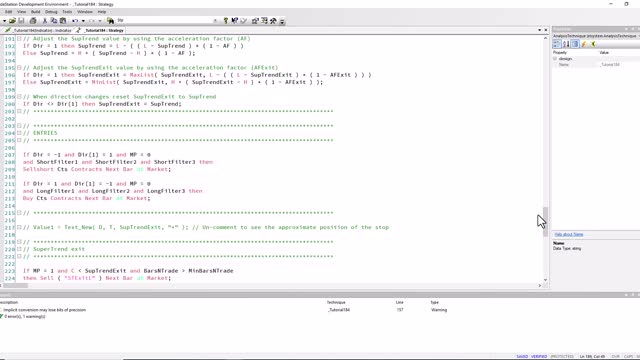

In addition a 'Supertrend' stop is calulated (SupTrendExit). The value of this is set to the value of SupTrend when direction changes and is then calculated using:

SupTrendExit = MaxList( SupTrendExit, L - ( ( L - SupTrendExit ) * ( 1 - AFExit ) ) )

when Dir = 1, otherwise by:

SupTrendExit = MinList( SupTrendExit, H + ( SupTrendExit - H ) * ( 1 - AFExit ) )

A buy market order is generated when Dir changes from -1 to 1, provided that LongFilter1, LongFilter2 and LongFilter3 each evaluate to true and the program is not currently in a trade. A sell short market order is generated when Dir changes from 1 to -1, provide that ShortFilter1, ShortFilter2 and ShortFilter3 each evaluate to true and the program is not currently in a trade.

When in a long position and the close crosses under SupTrendExit a market order to exit the trade next bar is generated provided the trade has been in the trade more than the user input: MinBarsNTrade number of bars. Similarly, when in a short position and the close goes above SupTrendExit a market order to exit the trade next bar is generated provided the trade has been in the trade more than the user input: MinBarsNTrade number of bars. The user could experiment with replacing this functionality will other types of stop, for example a trailing stop.

The tutorial gives an example of LongFilter1 and ShortFilter1 using an implementation of the Moving Average Gap Ratio. If this is used, the user will need to change the strategies' "Maximum Number of Bars Study will reference" to be equal to the value of SlowLength. The user can experiment with replacing this filter with their own as the strategy tends to get 'whipsawed' in non-trending markets.

For more details go to: https://markplex.com/free-tutorials/tutorial-184-supertrend-strategy-framework-and-indicator/

-

1:46:14

1:46:14

Roseanne Barr

4 hours ago“The Over Emotional Are Always Under Informed” | The Roseanne Barr Podcast #121

62.9K32 -

LIVE

LIVE

Nerdrotic

6 hours ago $7.51 earnedThe WitcHER DOA | Box Office Massacre | Massive Industry Layoffs - Friday Night Tights 378

1,319 watching -

14:54

14:54

IsaacButterfield

14 hours ago $2.14 earnedShe Called Out “Creepy Men It Didn’t End Well

12.8K38 -

LFA TV

22 hours agoLIVE & BREAKING NEWS! | FRIDAY 10/31/25

179K46 -

1:08:42

1:08:42

vivafrei

4 hours agoEric Swalwell in Trouble Again? RFK Jr. "Reverses Course" on Tylenol & Autism? Arctic Frost & MORE!

76K33 -

1:19:51

1:19:51

DeVory Darkins

6 hours agoNewsom EXPOSED after latest bombshell and Democrats pulls shocking stunt regarding shutdown

75.8K37 -

25:29

25:29

Stephen Gardner

5 hours ago💣 Trump White House UNEXPECTED Move + Thune DESTROYS Schumer on Senate Floor!!

32.8K30 -

3:31:15

3:31:15

Drew Hernandez

16 hours agoSPOOKY WOKE HAG CALLS FOR DEMS TO EMBRACE CELEBRATING EXECUTION OF CHARLIE KIRK?!

19.1K14 -

![MAHA News [10.31] - HHS Coup, Big Food Documentary, SNAP Scams, Microplastic Solutions](https://1a-1791.com/video/fwe2/d9/s8/1/w/q/m/v/wqmvz.0kob-small-MAHA-News-10.31.jpg) 1:28:13

1:28:13

Badlands Media

17 hours agoMAHA News [10.31] - HHS Coup, Big Food Documentary, SNAP Scams, Microplastic Solutions

26.3K10 -

1:10:12

1:10:12

The Quartering

6 hours agoFood Wars Begin! Terror Plot Foiled & Much More!

90.8K35