Premium Only Content

This one tells you what will happen to their CBDC'S. Listen out for when they introduced the second currency. https://anchor.fm/theamateureconomist/episodes/French-Double-Currency-Collapse-e1gq73s

Money has to have a store of value. Money is a commodity. Not a blip on a screen. The money the market chose as the best store of value is gold, silver and copper.

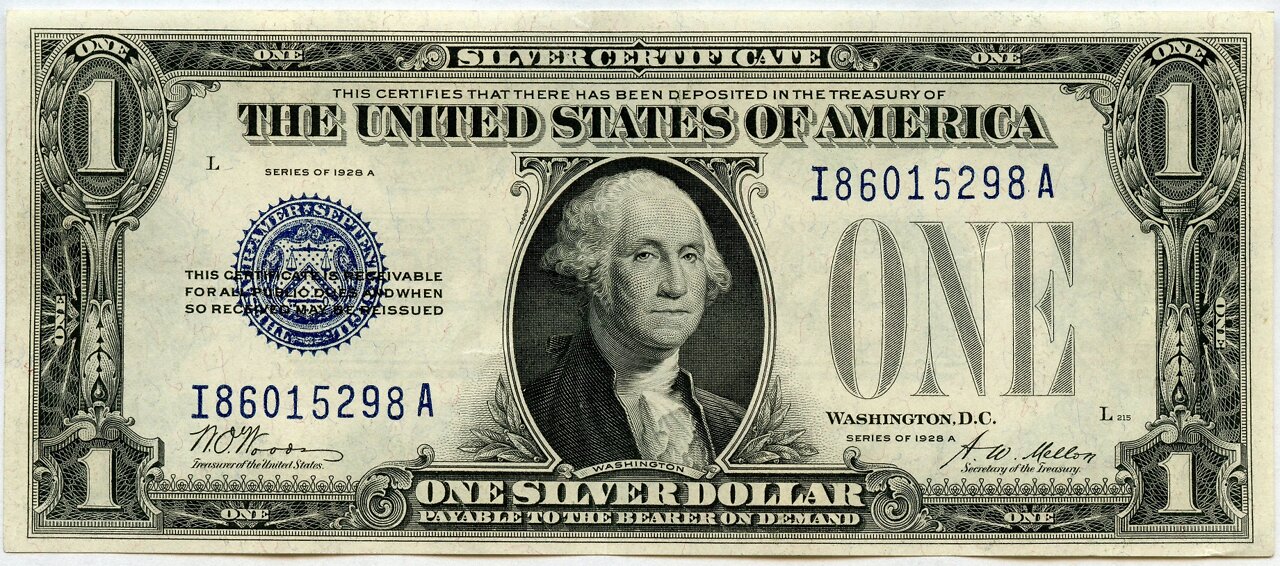

We did not always have central banks and governments issuing the currency, we had paper that had a claim on money (see attached).

The note is redeemable in money, it is not the money itself.

Regardless of where I have put my money, I know a man who has all of his wealth in silver 1kg's, 1 ounce coins, and one ounces of gold, just bullion as close to spot price as possible.

My super fund looks the same as my personal holdings, exactly the same companies. When I receive a settlement, I just allocate funds to companies I own shares in, and buy physical silver. I do not look to see what the dollar price of a share in a debt free, free cash flow, dividend paying company is on a particular day. I only care about how many shares I have in that company, because the dividend is paid per share, not on the amount of dollars the company is worth. Why, because the dollars are made up crap. The company's stock is a portion of the company you own. Buildings, production, vehicles, etc.

For a Reverse The Reserve Bank of Australia T shirt, go to https://theamateuraustrian.com/collections/all

-

26:53

26:53

CatfishedOnline

15 hours agoOnline Scammer Swore He’d Call Her Every Day

681 -

8:33

8:33

ARFCOM News

16 hours agoIs This The END For Silencer Restrictions? | Homemade Bomb Class | 30th Permitless Carry State

1471 -

59:41

59:41

Trumpet Daily

19 hours ago $2.29 earnedOnly Europe Cares About the ‘Signal’ Messages - Trumpet Daily | Mar. 26, 2025

2.28K2 -

7:45

7:45

DropItLikeItsScott

2 days agoTHE FOSTECH DRONE PREDATOR / For The Alien Invasion

1042 -

30:07

30:07

Degenerate Plays

14 hours agoI See London, I See France, I See Suzie's... - Marvel Rivals: Part 2

541 -

17:17

17:17

RealReaper

15 hours ago $0.03 earnedSnow White Is Worse Than AIDS

1143 -

1:39

1:39

Gun Drummer

20 hours agoSlipknot - TANK COVER

352 -

2:10:11

2:10:11

Badlands Media

1 day agoDevolution Power Hour Ep. 340

145K81 -

47:21

47:21

Stephen Gardner

12 hours ago🔥The DEEP STATE is still covering up this HUGE LIE!! Trump MUST release MORE!!

39.9K104 -

2:36:13

2:36:13

TimcastIRL

11 hours agoTrump Announces 25% Tariff On ALL CARS, Canada Begins MASS LAYOFFS Over Tariffs | Timcast IRL

312K203