How to Read Candlesticks for Beginners (Patterns Included!)

How to Read and Understand Candlesticks

https://successacademycourses.com/how-to-read-and-understand-candlesticks/

The Ultimate Technical Analysis Stock Market Course:

USE CODE: "SUCCESS" For 75% off!

https://www.udemy.com/course/tsaultimatechartanalysis/learn/?couponCode=SUCCESS

Introduction: 0:00-0:09

Disclaimer: 0:09-0:12

What Are Candlesticks? 0:12-0:30

Parts of a Candlestick: 0:30-1:37

Timeframes: 1:37-2:08

Types of Candlesticks: 2:08-2:30

Support and Resistance: 2:30-2:59

Head and Shoulders Pattern: 2:59-3:22

Pipe Tops and Bottoms: 3:22-4:11

Types of Individual Candlesticks: 4:11-4:15

Shooter Candlesticks: 4:15-4:27

Hammer Candlestick 4:27-4:39

Doji Candlestick: 4:39-4:51

Inside Bar Candlestick: 4:51-4:59

Consolidation: 4:59

Candlesticks are a Japanese invention thought to be developed by Munehisa Homma. Candles are used in technical analysis to identify trends and patterns in a company’s stock in more detail than just a regular line chart. They represent the emotions of traders and a more detailed look at a stock’s price.

For most charts, the green candlestick is considered bullish and the red candlestick is considered bearish. These candles can sometimes also be shown as white and black.

Quick Notes:

Parts of the candlestick include the body, the wicks, the high, the low, the open, and the close.

There are bullish and bearish candlesticks.

A bullish candle becomes bullish when the close price is higher than the open price, representing an increasing price.

A bearish candle becomes bearish when the close price is lower than the open price, representing a decreasing price.

-

5:27

5:27

Ascencore

7 months agoThe Basics Of How To Read Candlestick Patterns On Charts

15 -

2:31

2:31

Ascencore

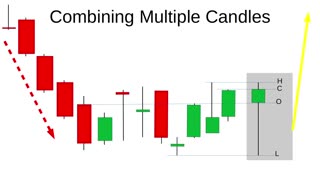

6 months agoThe Basics Of Combining Multiple Candlestick Patterns For Beginners

25 -

38:24

38:24

The God Of Trading

1 year agoULTIMATE Candlestick Patterns Trading Guide *EXPERT INSTANTLY*

33 -

9:06

9:06

SonDaniel Crypto

5 months ago $0.10 earnedUnderstanding Candlesticks for Beginners!

60 -

25:24

25:24

vektor21

1 year agoThe Perfect Beginner Candlestick Pattern That Actually Works... (Become A Pro Instantly)

2 -

2:12

2:12

Ascencore

7 months agoIntroduction To Candlestick Pattern Charting

18 -

1:06

1:06

Ascencore

6 months agoCandlestick Charting Patterns: Tips And Practice Project

25 -

4:56

4:56

Ascencore

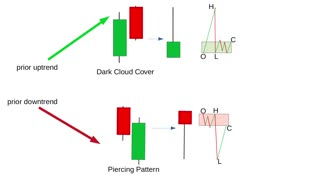

7 months agoEasy Candlestick Pattern Guide To Dark Cloud Cover, Piercing, & Kicking Candlestick Patterns

15 -

6:23

6:23

Ascencore

6 months agoPractice Candlestick Chart Patterns: Case Study Example Nikkei

24 -

1:11:20

1:11:20

AdamMac1974

2 years agoThe ULTIMATE Beginners Guide to CANDLESTICK PATTERNS

16