Premium Only Content

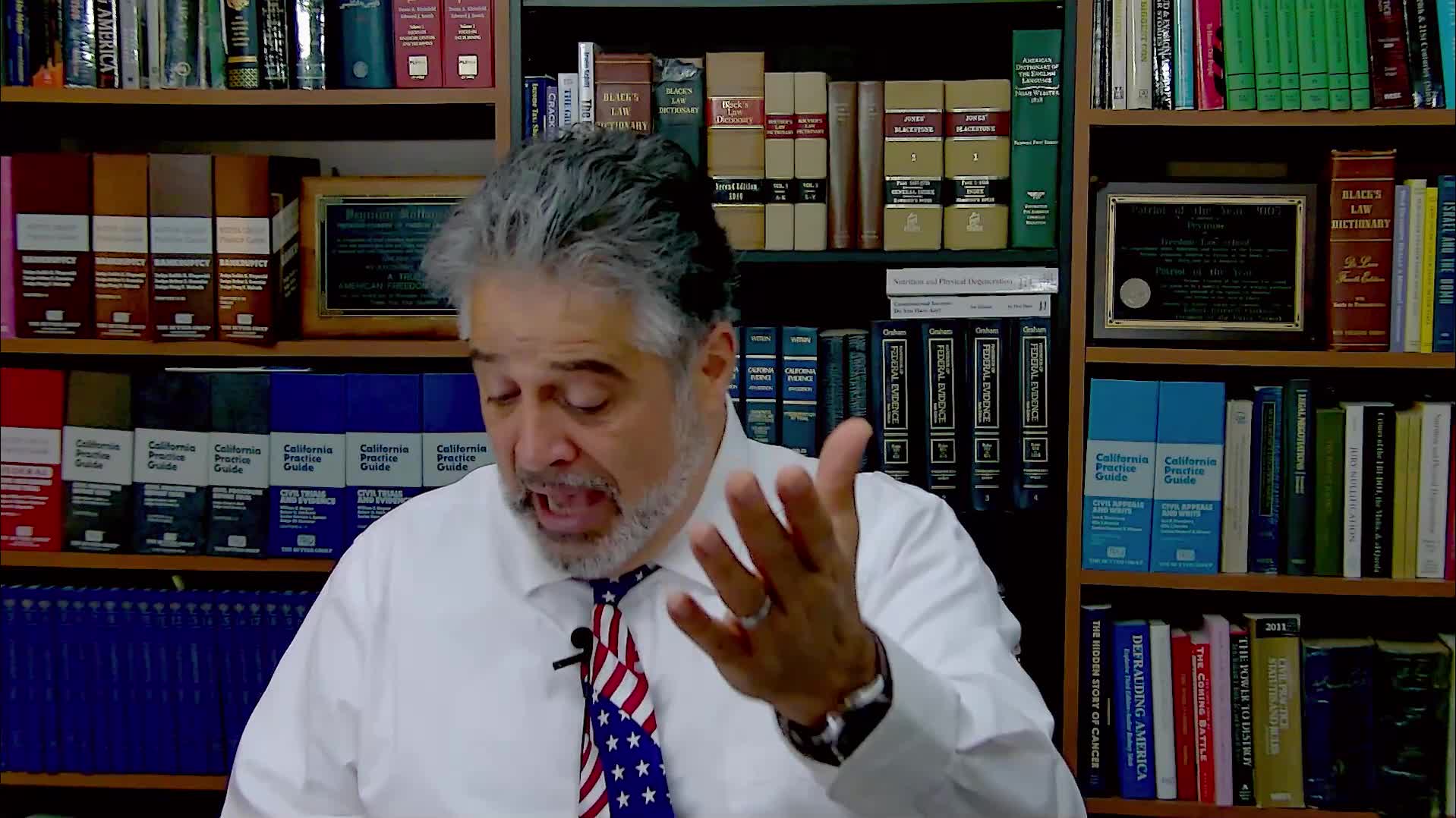

Are you really “SELF-EMPLOYED”? If so, do you owe income taxes according to US law?

"Most Americans are under the impression that if they are not an employee who has 7.65% of their wages deducted for FICA (payroll) tax (Social Security and Medicare taxes), that they need to pay 15.3% of their net income for self-employment income tax. This tax is a tremendous burden on independent contractors and small business owners, since no one deducts and withholds that money from their earnings and a whole year’s worth of these taxes becomes due every April 15th.

In this Freedom Hour presentation, Peymon Mottahedeh, founder and President of Freedom Law School, will show you how the law defines “self-employment income” and consequently, who owes an income tax on that income and who does NOT owe self-employment income tax.

You may be one of those Americans who does NOT owe self-employment income tax. Listen and find out!"

-

LIVE

LIVE

LindellTV

1 hour agoMIKE LINDELL LIVE AT THE WHITE HOUSE

367 watching -

1:05:33

1:05:33

Russell Brand

3 hours agoTrump Goes NUCLEAR on China - accuses Xi of CONSPIRING against US with Putin & Kim - SF627

93.7K35 -

1:14:47

1:14:47

Sean Unpaved

2 hours agoTrey Wingo's Gridiron Grab

9.68K1 -

13:43

13:43

The Kevin Trudeau Show Limitless

4 hours agoClassified File 3 | Kevin Trudeau EXPOSES Secret Society Brainwave Training

1.5K3 -

13:07

13:07

Silver Dragons

20 hours agoBullion Dealer Reacts to SILVER PRICE SURGING!

1.54K5 -

1:06:28

1:06:28

Timcast

3 hours agoTrump Admin Threatens GOP Who Vote To Release Epstein Files

129K88 -

2:13:09

2:13:09

Side Scrollers Podcast

3 hours agoDruski/White Face Controversy + Women “Experience Guilt” Gaming + More | Side Scrollers Live

22.5K3 -

1:39:53

1:39:53

The Mel K Show

3 hours agoMORNINGS WITH MEL K - Narratives Implode as Light Shines on Covid Deception 9-3-25

17.6K6 -

DVR

DVR

The Shannon Joy Show

2 hours agoExclusive With Congressman Tom Massie: "The Epstein Files Are NOT A Hoax. There Are Real Victims"

12.1K2 -

1:52:46

1:52:46

Steven Crowder

5 hours agoCongress Drops New Epstein Files and Trump Drops New Bombs on Venezuela Terrorists

307K171