Premium Only Content

House Committee on Financial Services: When Banks Leave: The Impacts of De-Risking on the Caribbean and Strategies for...

U.S. House Committee on Financial Services:

On Wednesday, September 14, 2022, at 10:00 a.m. (ET) full Committee Chairwoman Waters and Ranking Member McHenry will host a virtual hearing entitled, “When Banks Leave: The Impacts of De-Risking on the Caribbean and Strategies for Ensuring Financial Access."

Witness for this one-panel hearing will be:

First Panel:

• The Hon. Mia Amor Mottley, K.C., M.P., Prime Minister of Barbados; Minister of Finance, Economic Affairs and Investment; Minister of National Security and the Public Service (with responsibility for Culture and CARICOM Matters)

Second Panel:

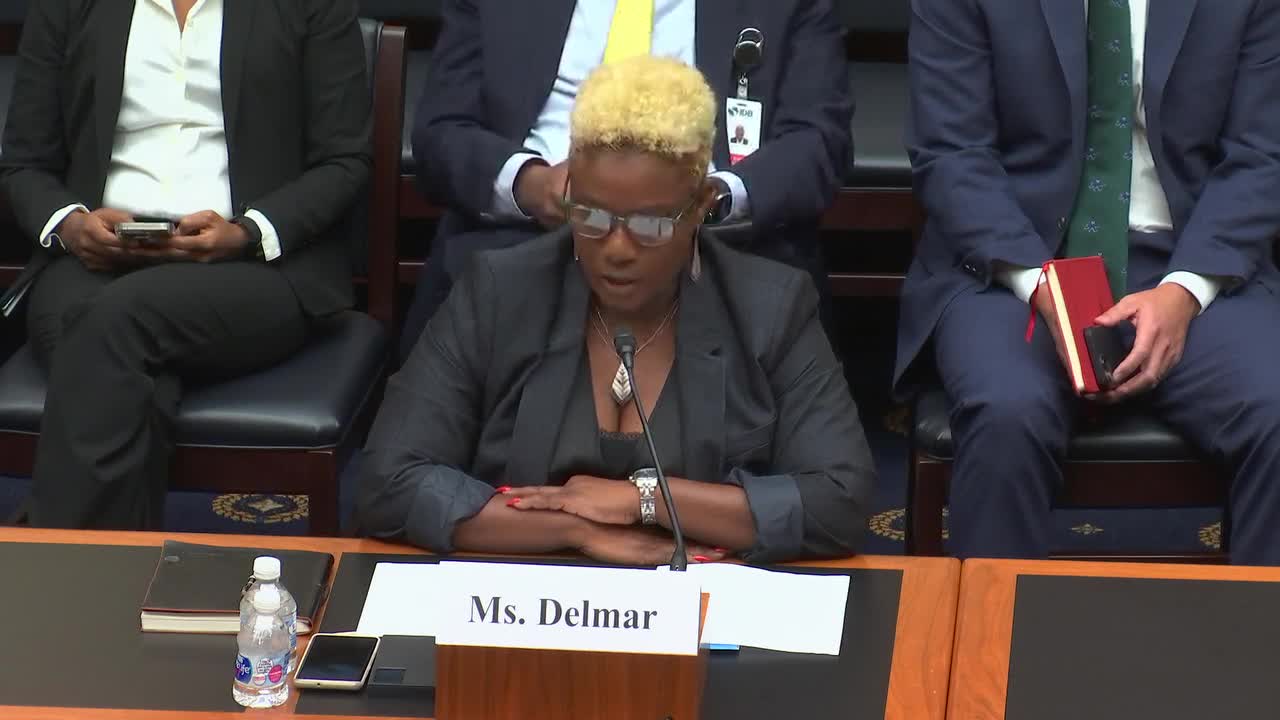

• Ms. Wendy Delmar, CEO, Caribbean Association of Banks

• Mr. Wazim Mohamed Mowla, Assistant Director and Lead of the Caribbean Initiative, Adrienne Arsht Latin America Center, Atlantic Council

• Mr. I. Wayne Shah, Senior Vice President, Financial Institutions – Head of Caribbean Region, Wells Fargo Bank, N.A., and Executive Director, Financial & International Business Association (FIBA)

• Mr. Amit Sharma, CEO, Founder, and Director, FinClusive

• Ms. Liat Shetret, Director of Global Policy and Regulation, Elliptic

Background

Access to financial services, such as receiving or sending funds, is critical for individuals and businesses to thrive in an economy and for nations to grow and remain resilient in the face of short-and long-term challenges. Globally, much of this financial access occurs through correspondent banking relationships (CBRs), which are “agreements or contractual relationships between banks to provide payment services for each other.” CBRs are often used for cross-border payments, such as “wire transfers, trade finance, cash and treasury management, check clearing and collection, securities and foreign exchange purchases, and participation in large loans,” where two financial institutions (“respondent banks”) are customers of a third party, a separate FI known as a “correspondent bank,” that serves as the conduit for their transactions. It is through these CBRs that international trade, immigrant remittances, and humanitarian aid flow. Further, most payment solutions that do not involve a traditional bank account (such as a money service business [MSB] like Western Union or MoneyGram) rely on CBRs for the actual transfer of funds. Because of the broad international reach required to provide CBR services, correspondent banks tend to be the largest institutions in the industry.

While this is a global concern, the steadily reduced access to financial services in the Caribbean region, which is comprised of 13 sovereign states and nearly two dozen non-sovereign territories, affects the prosperity and security of its people, countries, and the wider region, including the U.S. This hearing continues the efforts of the Committee to elevate this issue, bring together stakeholders, and identify solutions for the region and the United States.

-

1:08:20

1:08:20

R.C. Davis

4 hours agoIntercepting Terror: Strengthening Ukrainian Air Defense - July 24, 2025

16 -

LIVE

LIVE

The Quartering

2 hours agoOn To The Big Bosses! Act 2 Of Expedition 33

802 watching -

1:24:56

1:24:56

Glenn Greenwald

6 hours agoGlenn Takes Your Questions on Tulsi's Russiagate Revelations, Columbia's $200M Settlement, and More | SYSTEM UPDATE #492

94.1K44 -

2:11:56

2:11:56

megimu32

3 hours agoOTS: With Great Power: Every Spider-Man Movie Unmasked w/ @thisistheraygaming

6.83K3 -

LIVE

LIVE

WickedVirtue

2 hours agoSailing w/ The Crew

139 watching -

4:29:37

4:29:37

Meisters of Madness

5 hours agoThe Finals with Redd

9.8K -

1:27:11

1:27:11

Omar Elattar

10 hours agoThe Dating Expert: "I've Helped 4,000 Men Find LOVE!" - The #1 Alpha Trait Women Secretly Crave!

20K -

LIVE

LIVE

VOPUSARADIO

9 hours agoPOLITI-SHOCK! "END THE FED, END THE LIES & END THE DEEP STATE ONCE AND FOR ALL"!

168 watching -

1:43:38

1:43:38

LumpyPotatoX2

5 hours agoRumble Creator Round-Table - Let's Talk About It

22.2K2 -

32:38

32:38

The Mel K Show

8 hours agoMel K & Dr. James Thorp, MD | Sacrifice: The Targeting of the Most Vulnerable | 7-24-25

27.6K12