Premium Only Content

Short and Long Positions

In the trading of assets, an investor can take 2 types of positions.

1: Short Postion

2: Long. Positin

In the case of a short position, traders are hoping that a currency will decrease in the future so they sell it at a higher price and buy it back at a lower price in the future. This option is known as it GOING SHORT. For example if the New Zealand dollar against the US dollar is worth 0.7000 and the trader analysis shows that it might depreciate in the future 0.6980 the trader would sell at the high price or in other words go SHORT. Once the price depreciates to 0.6980, they buy back and make money from the price movement. In the case of the LONG POSTIONS it's the typical opposite of the short position - In which you buy low and sell high, some traders hoping for a currency to increase in the future. They usually buy at a lower price and sell it back at a higher price. This option is known as going long, these are short and long positions in a nutshell.

-

41:08

41:08

Grant Stinchfield

1 hour agoDemocrats Try to Turn California Into Predator Playground with Proposed "Child Predator Dream Bill"

16.7K2 -

1:21:06

1:21:06

Rebel News

2 hours agoCdn troops in Ukraine? Poilievre backs self-defence, Hamas thugs cancel Ottawa Pride | Rebel Roundup

6.09K17 -

24:58

24:58

Neil McCoy-Ward

2 hours ago⚠️ OUTRAGE! What They Just Announced For YOUR HOME!!! 🚨

18.4K9 -

LIVE

LIVE

IrishBreakdown

3 hours agoNotre Dame and Miami Set To Reignite Intense Rivalry

351 watching -

1:57:07

1:57:07

The Charlie Kirk Show

2 hours agoChicago Next! + The Blue Slip Problem | Sen. Tuberville, Alex Clark | 8.25.2025

54.3K14 -

1:20:52

1:20:52

Benny Johnson

4 hours ago🚨Trump LIVE Now: Signs Executive Order ENDING Cashless Bail | Dem Cities PANIC, Which City NEXT?...

68.1K48 -

1:31:26

1:31:26

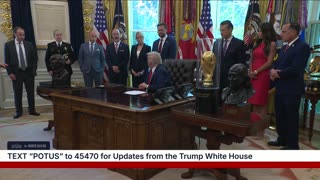

The White House

5 hours agoPresident Trump Signs Executive Orders, Aug. 25, 2025

40.8K21 -

1:36:43

1:36:43

The Mel K Show

3 hours agoMORNINGS WITH MEL K - Starving the Globalist Funded Color Revolution in America 8-25-25

20.5K10 -

1:21:10

1:21:10

The Shannon Joy Show

4 hours ago🔥🔥Stressflation Incoming - Coffee Up 25% Veggies Up 40% As Trumps Tariff Taxes Detonate On American Families.🔥🔥

16K9 -

LIVE

LIVE

LFA TV

19 hours agoLFA TV ALL DAY STREAM - MONDAY 8/25/25

2,777 watching