Premium Only Content

This video is only available to Rumble Premium subscribers. Subscribe to

enjoy exclusive content and ad-free viewing.

Debt Discharge

chrissie1179

- 6 / 24

1

Who is responsible for paying debts

JoeLustica

In this video I show you who is responsible for paying debts. Especially public debt

https://www.law.cornell.edu/uscode/text/31/3123

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

4

comments

2

Is this HJR 192? United States government has to pay public debts

JoeLustica

In this video I show you the code that states the government can pay public debts. Enjoy this video.

Read it for yourself:

https://www.law.cornell.edu/uscode/text/31/5118

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1

comment

3

What is a negotiable instrument?

JoeLustica

In this video I give you the UCC meaning of negotiable instrument. This of course is not a simple subject to wrap your head around but I'm going to make a few videos regarding this and help you guys to make your own negotiable instruments.

https://www.law.cornell.edu/ucc/3/3-104#Note

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

4

The law that says you do not have to pay taxes

JoeLustica

In this video I show you the US code that says that you do not have to pay taxes and how they trick you into paying taxes. Also once you revoke your taxpayer status you are no longer able to join back into the taxpayer status.

https://www.law.cornell.edu/uscode/text/26/6013

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.53K

views

5

comments

5

The United States government has to pay you?

JoeLustica

This is a well hidden public law that might be of interest to you. The law states that the United states government has an obligation to the promissory notes of individuals

https://catalog.archives.gov/id/299829

1.93K

views

6

comments

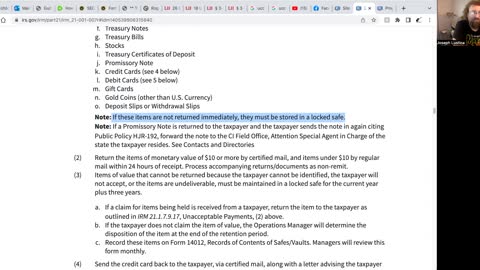

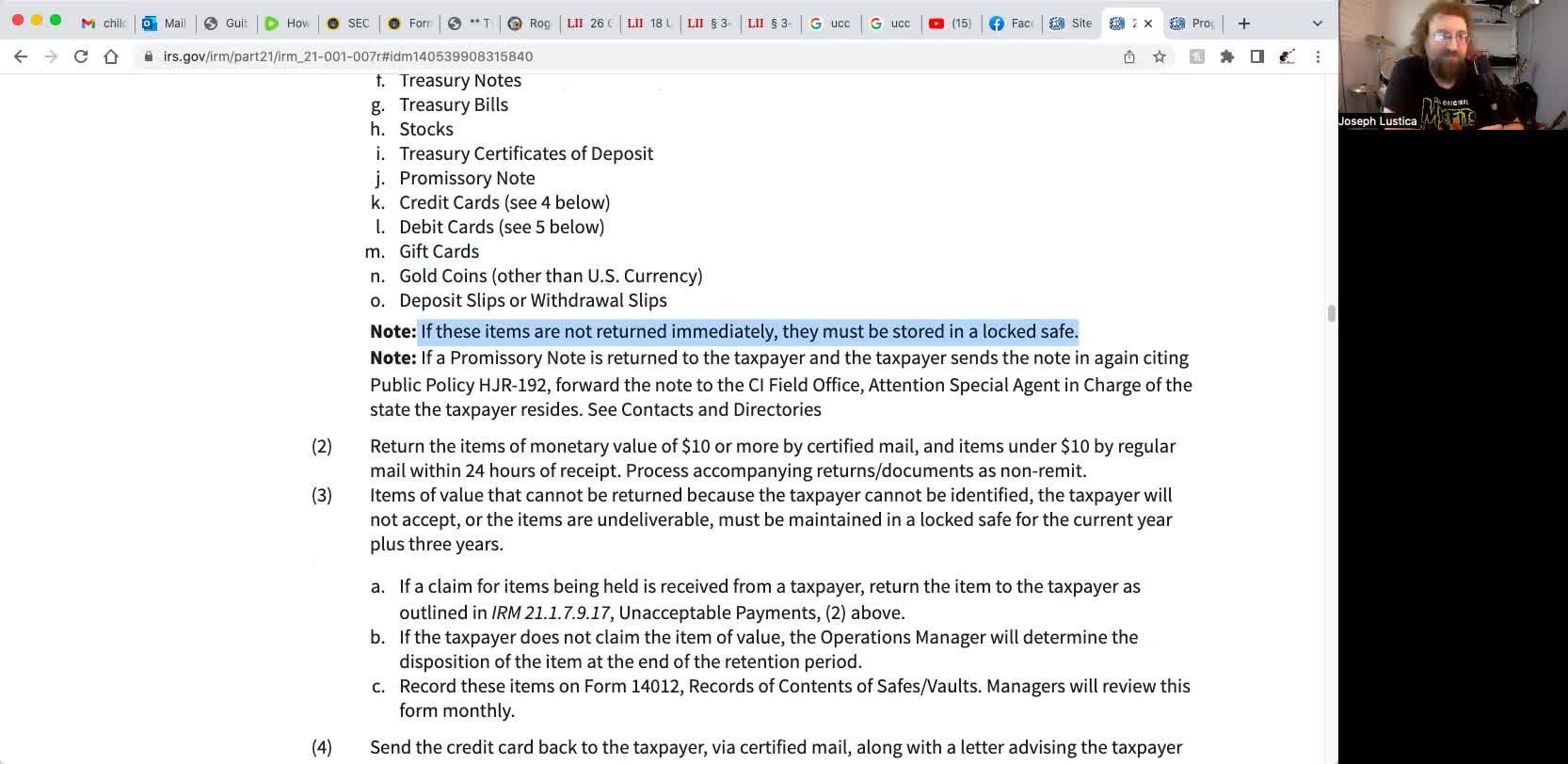

Don't cite HJR 192 when trying to pay taxes with a negotiable instrument

JoeLustica

In this video I show you that the IRS is well aware of HJR 192 and they do not like the fact that people are using it to pay their taxes.

https://www.irs.gov/irm/part21/irm_21-001-007r#idm140539908315840

https://www.irs.gov/compliance/criminal-investigation/program-and-emphasis-areas-for-irs-criminal-investigation

Here's the video that explains why they should be able to accept any of these forms of payment.

https://rumble.com/v13i9l3-when-a-business-refuses-your-payment.html

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.51K

views

6

comments

7

The power of your signature

JoeLustica

In this video I show you the power of your signature. I'm not even being hyperbolic just watch the video and see for yourself.

https://www.law.cornell.edu/ucc/8/8-102

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

4

comments

8

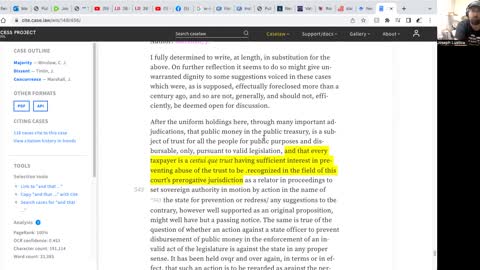

Cestui que trust and taxes

JoeLustica

In this video I go over how the cestui que trust is the taxpayer. Not you. But I go over a few definitions as well to clarify what that really means.

https://cite.case.law/wis/148/456/

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.11K

views

5

comments

9

United States government debt obligations

JoeLustica

In this video I show you the law that states the United States government has an obligation to discharge debts from any person.

https://law.justia.com/codes/us/2000/title12/chap2/subchapiv/sec95a

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

1.46K

views

2

comments

10

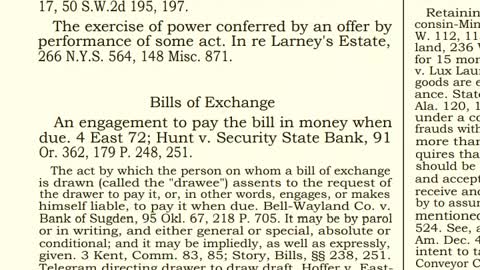

A rejected payment is still a payment

JoeLustica

In this video I show you the UCC that states that a rejected payment is still a payment. Use this to your advantage! The banks are taking advantage of your ignorance! A negotiable instrument can be made and used by you! You've done it before, you just didn't know.

https://www.law.cornell.edu/ucc/3/3-603

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3.21K

views

9

comments

11

Coupon payment not working? Try this!

JoeLustica

In this video I show you how those sneaky assholes have done it again. How they hide the UCC and refuse to enforce it. Look it up by STATE!!! Use the state codes instead of the UCC if that's the game they're playing. If you know they are using it then force them to abide by the laws!!!

https://www.law.cornell.edu/wex/table_ucc?fbclid=IwAR2CGneljbcmvg79nlD4cL-cSiRPMf7vpKxraWYPwUV7I2T8ynff-Zx9Iyk

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

9.73K

views

45

comments

12

How to enforce the coupon payment

JoeLustica

In this video I show you how you can use the form 39 49–8 to enforce your payment using the coupon that they send you.

https://www.irs.gov/pub/irs-pdf/f3949a.pdf

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

15.2K

views

57

comments

13

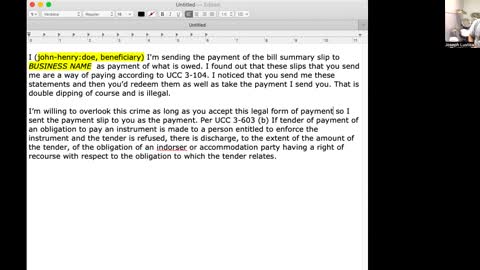

How to write the letter to the corporation for the coupon payment

JoeLustica

In this video I show you how I would write a letter to the corporation regarding a payment coupon. This letter is to let them know that you understand the legality of the negotiable instrument and how it works. You also informing them that even if they were to rejected that because it is a valid form of payment that they still have to discharge the debt. They do not have a choice in the matter if they want to stay in honor.

Here is a link to my Telegram group where I have the file that I wrote in this video: https://t.me/thefreedomfighter_1776

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

11.6K

views

51

comments

14

coupon payment letter update

JoeLustica

this is just an addendum to the coupon payment letter. They have to use a 1099C to discharge the debt.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3.71K

views

32

comments

15

The different types of acceptances

JoeLustica

In this video I go over the different types of acceptances and explain a little bit about what a conditional acceptance is. A conditional acceptance is a great remedy and a very powerful tool but it's very important to understand the basic components of it first before going into an entire conditional acceptance.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

2.1K

views

7

comments

16

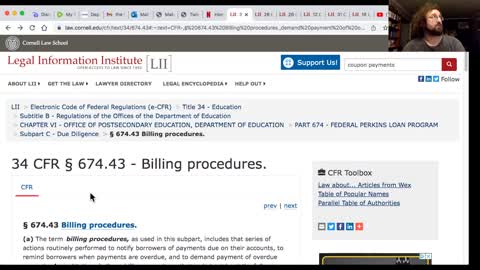

More on coupon payments

JoeLustica

In this video I go over a little more data about the coupon payments and even a company that processes them as deposits for the companies taking them as payments

https://www.law.cornell.edu/cfr/text/34/674.45

https://www.fiserv.com/

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

8.21K

views

15

comments

17

Coupon payment method FAQ

JoeLustica

These are questions I get pretty frequently regarding the coupon payment so watch this video first.

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

17.2K

views

70

comments

18

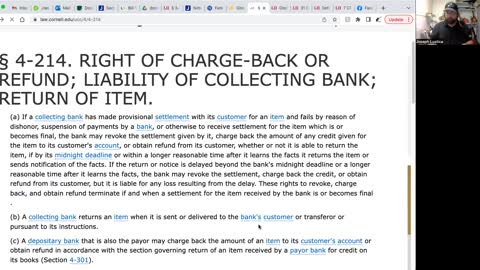

Coupon payment rejection validity

JoeLustica

In this video I go over the validity of a company to reject a coupon payment. There is some legality that they can use but once you know the rules and the guidelines if they cross any of those then they are liable and you can enforce that payment on them.

https://www.law.cornell.edu/ucc/4/4-214

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3.84K

views

14

comments

19

Fee schedule for coupon

JoeLustica

In this video I go over the fee schedule made specifically for the coupon payments or any other type of negotiable instruments that you may be using.

https://www.law.cornell.edu/ucc/3/3-307

https://www.law.cornell.edu/uscode/text/18/8

https://rumble.com/v1oe9y0-what-is-a-fee-schedule.html

https://rumble.com/v1ok6p1-fee-schedule-additional-information.html

https://rumble.com/v1ihzap-how-to-turn-the-payment-voucher-into-a-check.html

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

6.17K

views

25

comments

20

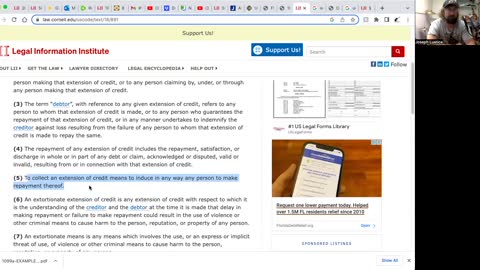

Who is obligated to pay all debts

JoeLustica

In this video I show you that it is up to the US government to pay all debts as they are the debtor and they have to pay all debts.

https://www.law.cornell.edu/uscode/text/18/891

https://www.law.cornell.edu/ucc/9/9-102#debtor

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3.54K

views

4

comments

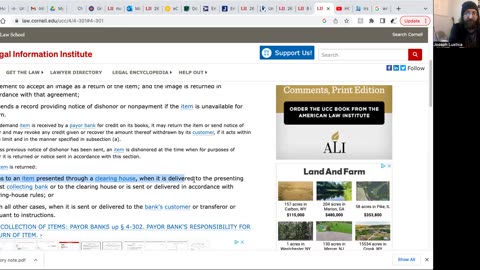

21

Dishonor

JoeLustica

In this video I go over what dishonor is according to the uniform commercial code. This also helps you understand why you have to put all the elements that you need to in order to correctly create a negotiable instrument. This also gives you the legal grounds behind doing a conditional acceptance or a notice of default to a company that refuses your payment or reverses your payment after the midnight deadline.

https://www.law.cornell.edu/ucc/3/3-502

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

3.36K

views

2

comments

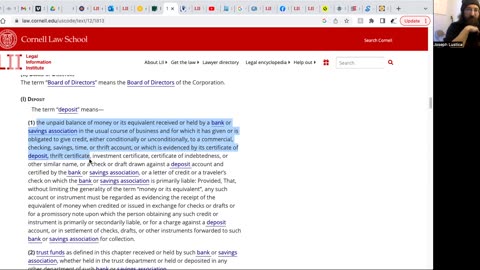

22

A promissory note is money

JoeLustica

This video I go over the code that states that banks treat promissory notes as money.

https://www.law.cornell.edu/uscode/text/12/1813

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

4.7K

views

14

comments

23

Corporations must take your negotiable instruments

JoeLustica

In this video I show you the US code that tells you that corporations can and will take negotiable instruments. We have leverage with this code in order to get our negotiable instruments accepted by these companies. Because they're not just breaking uniform commercial code but they are breaking federal law by rejecting them.

https://www.law.cornell.edu/uscode/text/12/615

Telegram: https://t.me/thefreedomfighter_1776

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information.

If you'd like to donate you can here:

cashapp: https://cash.app/$joelustica

venmo: https://venmo.com/code?user_id=1690745157189632408&created=1674743333

paypal or zelle: jlustica247@gmail.com

9.88K

views

16

comments

24

How to turn the payment voucher into a check

JoeLustica

Special note: this video is for entertainment and educational purposes only I am not offering any kind of legal or financial advice.

This video I show you how I use the coupon method to pay debts. You can follow these simple instructions to pay your own debts when you get these vouchers or coupons in the mail.

It is key that you write your own letter along with this explaining the laws of negotiable instruments that way they know that you know what you're talking about and if they do anything to your negotiable instrument or refuse it that the debt will still be discharged anyway.

I am linking the entire article 3 of the UCC because you should study the entire article 3 in order to have a full grasp and understanding of what a negotiable instrument is and the rights that you have.

https://www.law.cornell.edu/ucc/3

29.1K

views

129

comments

Don't cite HJR 192 when trying to pay taxes with a negotiable instrument

3 years ago

2.51K

In this video I show you that the IRS is well aware of HJR 192 and they do not like the fact that people are using it to pay their taxes.

https://www.irs.gov/irm/part21/irm_21-001-007r#idm140539908315840

Here's the video that explains why they should be able to accept any of these forms of payment.

https://rumble.com/v13i9l3-when-a-business-refuses-your-payment.html

This is for Educational and Entertainment purposes only. I am not giving any legal advice nor am I telling you what to do. Anything you do is done under your own determination and I have no liability to what you or another decides to do with this information

Loading 6 comments...

-

LIVE

LIVE

Matt Kohrs

9 hours agoStock Market Open: Bounce or Bust?! || The Best Live Trading Show

675 watching -

LIVE

LIVE

Wendy Bell Radio

5 hours agoHello And Good Night

7,591 watching -

LIVE

LIVE

LFA TV

3 hours agoLFA TV ALL DAY STREAM - WEDNESDAY 9/3/25

5,685 watching -

1:23:53

1:23:53

JULIE GREEN MINISTRIES

3 hours agoLIVE WITH JULIE

78.2K126 -

18:23

18:23

Producer Michael

20 hours agoWHAT REALLY HAPPENED IN DUBAI!

50.3K6 -

6:32

6:32

Blackstone Griddles

14 hours agoCajun Smashburgers with Bruce Mitchell | Blackstone Griddles

17.5K9 -

43:16

43:16

The Finance Hub

18 hours ago $5.33 earnedBREAKING: DONALD TRUMP JUST SHOCKED THE WORLD!

23.6K12 -

2:00:57

2:00:57

BEK TV

1 day agoTrent Loos in the Morning - 9/03/2025

17.1K -

LIVE

LIVE

The Bubba Army

1 day agoNick Hogan Sues Bubba to BLOCK the DOC - Bubba the Love Sponge® Show | 9/03/25

1,543 watching -

8:01

8:01

MattMorseTV

15 hours ago $12.75 earnedHe's ACTUALLY doing it...

90.5K88