Premium Only Content

Rumored Buzz on Retirement savings plans - UK Human Resources

https://rebrand.ly/Goldco6

Join Now

Rumored Buzz on Retirement savings plans - UK Human Resources, retirement savings investment plan

Goldco assists customers secure their retired life savings by surrendering their existing IRA, 401(k), 403(b) or other qualified retirement account to a Gold IRA. ... To find out exactly how safe haven rare-earth elements can help you develop as well as shield your riches, as well as even safeguard your retired life call today retirement savings investment plan.

Goldco is one of the premier Precious Metals IRA firms in the United States. Protect your wealth and income with physical precious metals like gold ...retirement savings investment plan.

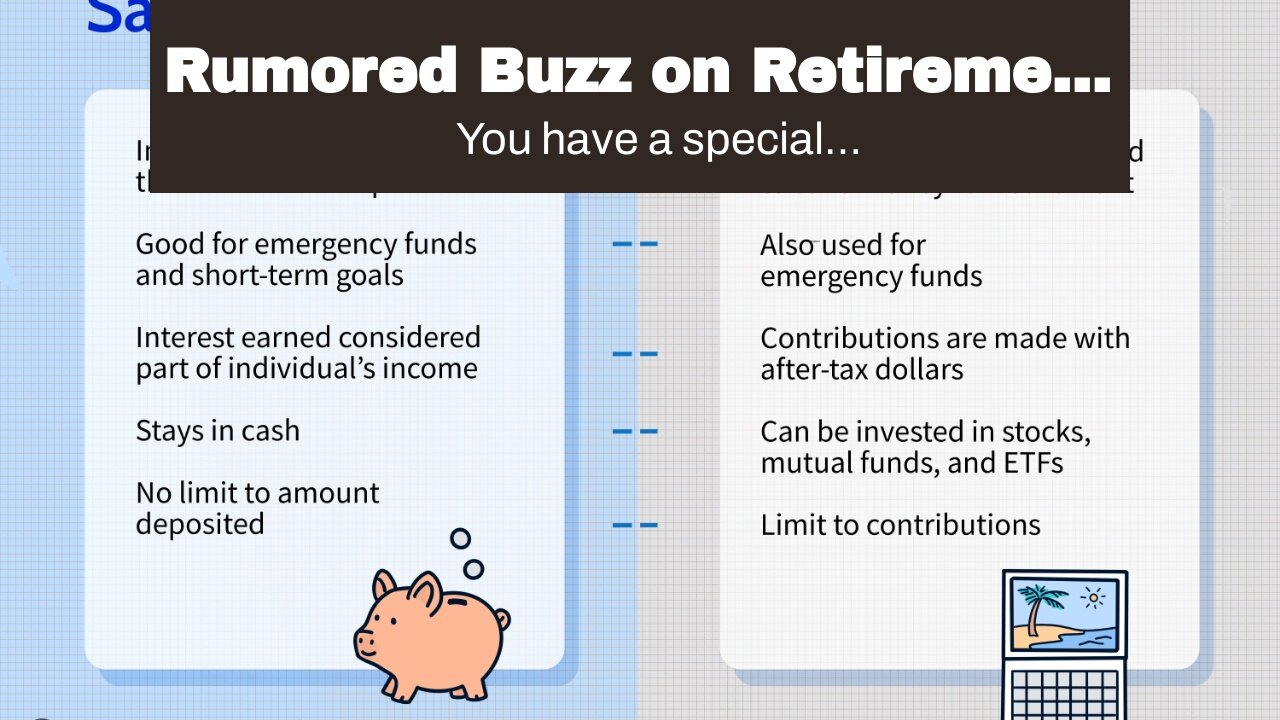

You have a special needs. You are using the circulation to purchase a very first house (lifetime limit: $10,000). You have died (and your recipient receives the circulations). Unlike traditional Individual retirement accounts, Roth IRAs have earnings limits for contributions. In short, if you make excessive cash, you can't contribute to a Roth.

Attempt to choose according to which plan outcomes in lower taxes and more earnings (approved, determining this might not be easy). In basic, a Roth is the better choice if you expect to be in a greater tax bracket in retirement, or if you anticipate to have significant revenues in the account.

401(k) Strategies Like Individual Retirement Accounts, 401(k) strategies are tax-advantaged accounts used to save for retirement. But rather of being established by people (that's the "I" in IRA), they're used by employers. Keep in mind that 401(k)s are specified contribution strategies. Workers make contributions to their 401(k)s through automated payroll withholding. And the employer can include cash, too, through something called a company match.

If your company provides a match, do everything you can to max out your contributions to get that matchit's basically complimentary money. 401(k) Contribution Limitations For 2021, you can contribute up to $19,500 to your 401(k), or $26,000 if you're age 50 or older (due to the fact that of a $6,500 catch-up contribution).

Companies can contribute, too. For 2021, there's a $58,000 limitation on combined staff member and employer contributions, or $64,500 if you're age 50 or older. For 2022, this increases to $61,000, or $67,500. These high contribution limits are one benefit that 401(k)s have over standard and Roth IRAs. What if You Can Add to a 401(k) or an individual retirement account? It may be that you are eligible to make standard individual retirement account or Roth IRA contributions in addition to wage deferral contributions to a 401(k) plan.

You need to decide what is most helpful to youto make one, two, or all 3 work. Some of the following principles can likewise use if you have the choice of adding to both a standard 401(k) and a Roth 401(k). Let's look at Casey, who works for Business A and is qualified to make an income deferral to Business A's 401(k) strategy., retirement savings investment plan

#howtoinvestincryptocurrency#goldco#howtobuybitcoin

retirement savings investment plan

Alabama, Alaska, American Samoa, Arizona, Arkansas

AK, AL, AR, AS, AZ, CA, CO, CT,

-

4:53:38

4:53:38

Due Dissidence

15 hours agoTaibbi DEFENDS Weiss-CBS Deal, Pakman Producer SPILLS TEA, Massie CALLS OUT Trump Informant Claims

26.4K34 -

2:33:47

2:33:47

TheSaltyCracker

7 hours agoMedia Silent on Metro Attack ReeEEStream 9-07-25

142K272 -

56:27

56:27

Sarah Westall

8 hours agoEnd of Aging, Hydrogen Bomb Research, Serial Killers & Violent Behavior, Bipolar Research w/Dr Walsh

37.2K6 -

4:36:53

4:36:53

MattMorseTV

10 hours ago $15.67 earned🔴Sunday Gaming🔴

68.4K5 -

2:31:16

2:31:16

Joker Effect

6 hours agoINTERVIEWING Rumble Gaming community members: Viewbotting and how they see the current landscape.

28.7K3 -

1:45:53

1:45:53

Nerdrotic

9 hours ago $16.05 earnedUnravelling the Secrets of Skinwalker Ranch | Forbidden Frontier #115

94.7K6 -

41:56

41:56

Athlete & Artist Show

10 hours ago $1.31 earnedAustin Ekeler: Going From "0 Star Recruit" To Leading The NFL In TD's, New Fan App | FROM THE VAULT

35.8K1 -

2:46:49

2:46:49

Barry Cunningham

15 hours agoNOW THEY FEAR US! | RFKJR STRIKES BACK | JD VANCE ON PRESIDENT TRUMP | AND MORE NEWS!

77.6K57 -

8:13:45

8:13:45

Spartan

9 hours agoCharlotte Qualifier watch party + Ranked and Expedition 33

37K1 -

6:09:54

6:09:54

bigbossrobinson

13 hours agoLIVE - DOUBLE IMPACT - RESIDENT EVIL 4 & METAL GEAR SOLID Δ: SNAKE EATER

36.7K2