Premium Only Content

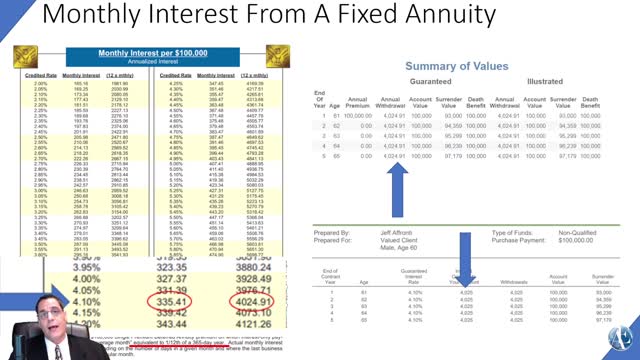

Monthly Annuity Interest Per $100,000 Annualized | $4,100 annually can equal $4,025 if taken monthly

The monthly interest withdrawal sometimes leaves clients confused and concerned if they have calculated the income based on a simple annual return and then divided by 12. A logical way to look at it but not financially correct.

A client with $100,000 offered a rate of 4.10% may just do a simple calculation of 4.10% of $100,000 = $4,100 and then divided by 12 = $341.66 per month. However, when the income does start, it is lower, changing monthly and at the end of the year is only $4,024.91 not $4,100.

Monthly Annuity Interest Per $100,000 Annualized is not the same as annual percentage rate.

$4,100 of income taken annually is $4,025 if taken monthly. Interest earns or does not earn interest.

PDF cheat sheet Monthly Interest Per $100,000 Annualized:

https://img1.wsimg.com/blobby/go/369500a8-c330-416e-9301-24889d16b18d/downloads/Monthly%20interest%20per%20%24100%2C000_4-18-11.pdf

MYGA Quote Request: https://www.annuityexperts.com/deferred-annuity-illustrations.html

Follow:

YouTube - https://www.youtube.com/channel/UCJA1PmQHt51tZ6VBx-XYyOw/videos

Facebook - https://www.facebook.com/annuityexperts/videos/

LinkedIn - https://www.linkedin.com/in/jeff-affronti-a1551834/

Rumble - https://rumble.com/c/c-1096761

Instagram - https://www.instagram.com/annuityexperts/

IMPORTANT INFORMATION

This material is for informational, educational & entertainment purposes.

It is not a recommendation to buy, sell, hold or rollover any asset.

It does not take into account the specific financial situation, investment objectives, or insurance need of an individual person.

Withdrawals may be subject to ordinary income taxes and, if made prior to age 59½, may be subject to a 10% IRS penalty.

Surrender charges may also apply for early or excess withdrawals.

All guarantees are backed by the claims-paying ability of the issuer.

Products are available only in all states where approved.

-

12:48

12:48

Degenerate Jay

14 hours agoUbisoft Hates Game Preservation

2.08K5 -

9:33

9:33

The Art of Improvement

19 hours agoHow to Bounce Back from Hard Times

1.3K4 -

4:53

4:53

The Official Steve Harvey

1 day agoNo Such Thing as Luck — Just God’s Grace

2.53K2 -

6:16

6:16

GBGunsRumble

19 hours agoGBGuns @ Alabama Arsenal Czech Weapons CSV-9

1.66K -

9:06

9:06

MattMorseTV

1 day ago $12.82 earnedTrump wants to END THE FED.

55.7K98 -

2:05:18

2:05:18

MG Show

19 hours agoBreaking: Ukrainian Whistleblower Letter to DNI Gabbard Exposes Biden Corruption

16.8K19 -

LIVE

LIVE

Biscotti-B23

2 hours ago $1.25 earned🔴 LIVE SEASON 12 🔥 TAMAKI AMAJIKI IS INSANE & NEW ENDEAVOR QUIRK SET 💥 MY HERO ULTRA RUMBLE

230 watching -

LIVE

LIVE

B2ZGaming

6 hours agoPlay All The Games?! | B2Z Gaming

108 watching -

2:17:23

2:17:23

Side Scrollers Podcast

20 hours agoIronmouse/Vshojo SCANDAL, Stripe DE-BANKING “Wrong Think”, RIP Theo | Side Scrollers

31.4K1 -

6:43:02

6:43:02

Outworldlive

8 hours agoGames, Nite Cap 106, more games!

3.87K1