Premium Only Content

Why are No Politicians Campaigning on Abolishing Income Tax?

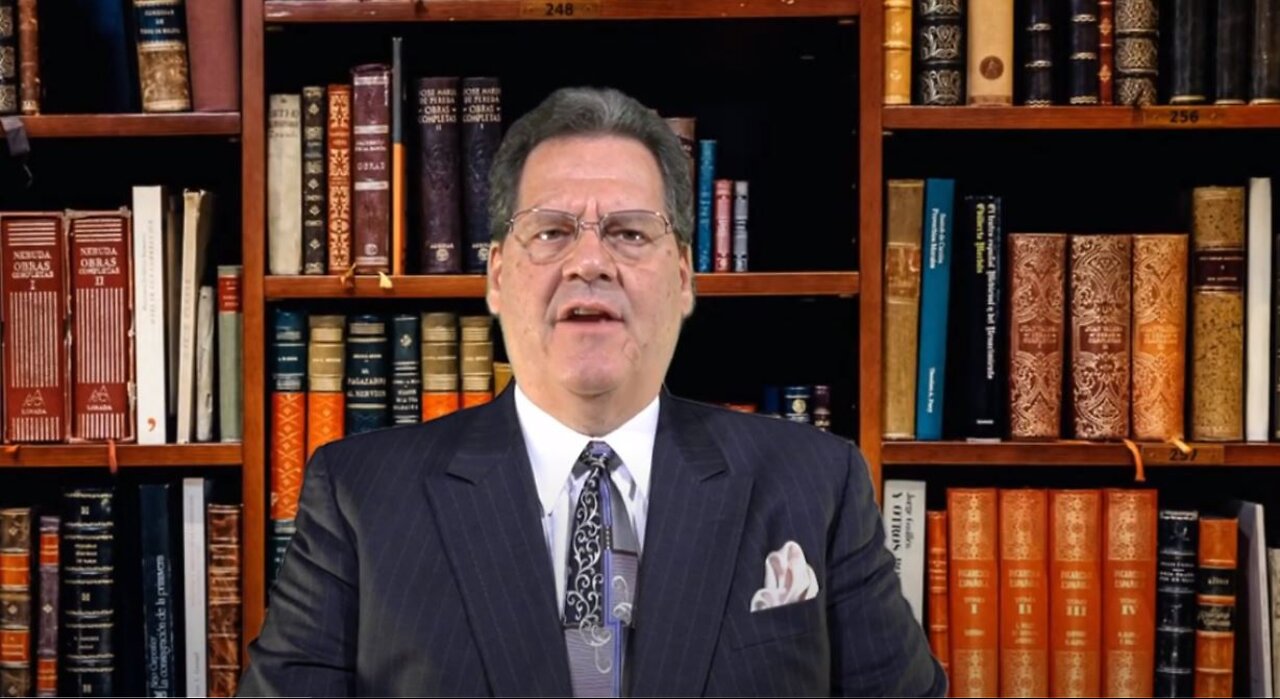

Dan Pilla, Inventor of the Natl Sales Tax Solution

taxhelponline.com

In the heady days after Speaker Gingrich’s 1994 Republican revolution against decades of Democrat control, Majority Leader Armey debated his income tax “flattening” proposal with Dan Pilla’s idea to junk the income tax, and instead just collect tax at the point of retail sales. Twenty-eight years later – in 2022 – what’s now called the “FairTax” proposal still has only a few dozen co-sponsors (as part of H.R. 25). So, why are the inhabitants of a once-great-America so lame when it comes to tax policy?

Income taxation is so abhorrent – or was so abhorrent – that emergency reliance on it in the past, such as during the Civil War, quickly was repealed following the emergency. With the globalist pawn, Woodrow Wilson, reviving the income tax in 1913 – as well as foisting the oppressive, Federal Reserve, and criminal central banking system on America, tax historian Charles Adams wrote how

“...the IRS paid agents according to how many foreclosures they caused. How quick the IRS has been to take cars, homes, or money, yet unbearably slow to fix its mistakes or the damage it caused to innocent people’s lives!”

Adams also discusses the high death tax and how it causes the elimination of over 90 percent of family businesses after the founders die. More recently, we’ve seen the IRS weaponized against Americans holding traditional values, such as liberty and personal responsibility. Meanwhile, the Constitution prohibits direct taxes, such as income tax - without some form of apportionment among the states. Indirect taxes, like those on sales or imports, comport more with the vision of our Founders.

With rebates to spare the poor, a national sales tax – it would need to be around 20% – could actually be collected by the states, allowing for the abolition of the IRS. Some transactions and situations, of course, would be exempted from this. But, the best part is its equality. Everyone pays the same rate, which means the rich would necessarily pay more since their purchases generally cost more – making it fair. In summary, enacting a national sales tax program that eliminates the costs, inequities, and financial burdens of the federal income tax would be a godsend – for our lives, our liberty, and the economy.

-

1:17:31

1:17:31

FREEDOMHUB

2 months agoThe WORLDS Beneath our Feet

1.01K10 -

1:12:39

1:12:39

Man in America

13 hours agoThe Frightening Truth About Weather Warfare & Depopulation w/ Kim Bright

108K46 -

2:59:21

2:59:21

TimcastIRL

7 hours agoTrump Calls Epstein Case A HOAX By Democrats, GOP Votes TO BLOCK Release | Timcast IRL

236K260 -

10:17

10:17

Dr Disrespect

16 hours agoIt's Time To Get Serious

34.8K9 -

7:55:30

7:55:30

SpartakusLIVE

9 hours agoDuos w/ Sophie || Charity stream tomorrow!

63K -

58:43

58:43

Sarah Westall

8 hours agoBecause Voluntary Extermination is a Thing: Israel-Gaza w/ Award Winning Journalist James Robins

46.5K13 -

4:44:13

4:44:13

BubbaSZN

9 hours ago🔴 LIVE - TRYING TO NOT BUST A$$ THIS TIME (THPS3+4)

32.4K1 -

8:42:11

8:42:11

sophiesnazz

12 hours ago $2.56 earnedGENUINE BELTERS IN ERE l LIVE WITH @SpartakusLIVE!socials

49.2K1 -

1:15:18

1:15:18

Glenn Greenwald

10 hours agoTrump Promises More Weapons for Ukraine; Trump Again Accuses Dems of Fabricating Epstein Files | SYSTEM UPDATE #487

142K89 -

3:48:04

3:48:04

This is the Ray Gaming

5 hours ago $1.76 earnedTuesday Night is FOR THE BOYS | Rumble Premium Creator

21.4K3