Premium Only Content

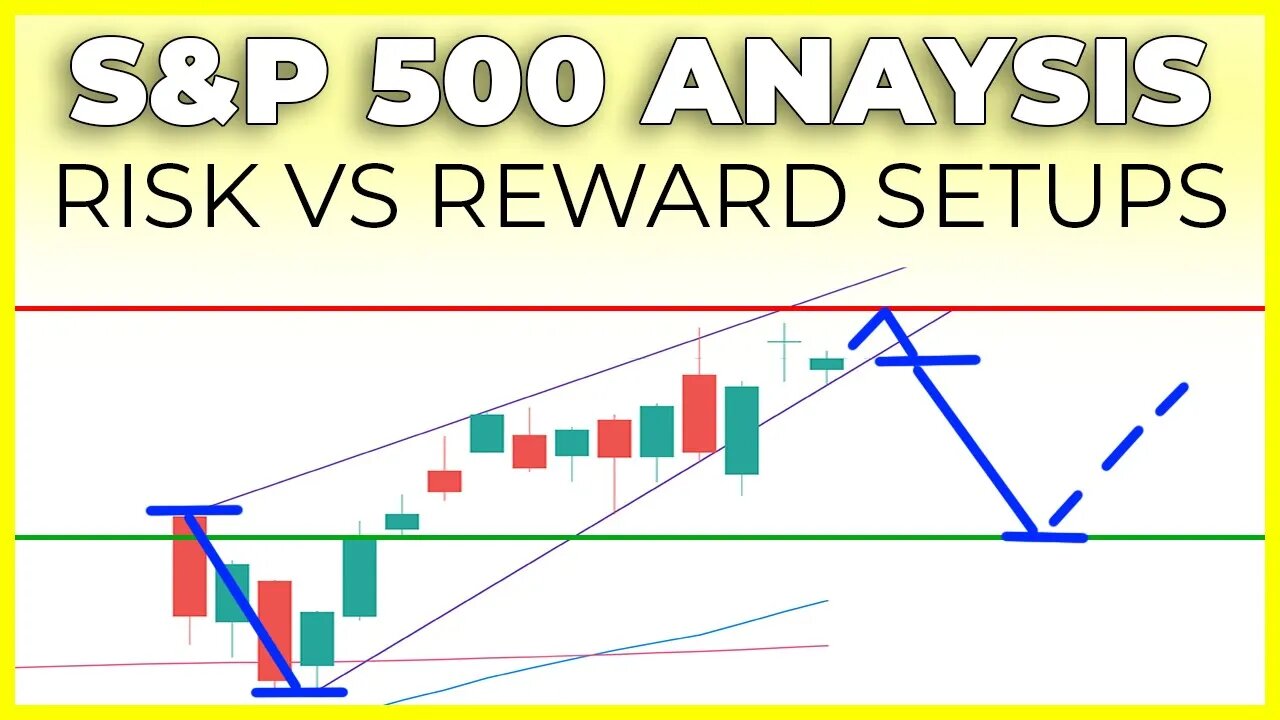

SP500 PULLBACK TO 3100 LOOKS PROBABLE (My Thought Process) | S&P 500 Technical Analysis

In today's S&P 500 (SP500) Technical Analysis forecast, I explain why it could be very possible to see the stock market pullback to 3100. A rule of thumb with a rising wedge pattern is to see the technical pattern break down matching the size of the base (start of technical pattern).

Nothing is certain in the markets, especially when trading the sp500 and individual stocks within it. To be a successful stock market trader you need to look at multiple different angles to draw a conclusion and ultimately create a trade plan.

Trading is all about taking educated risks. Based on my experience this rising wedge pattern in the sp500 I wouldn't be shocked or surprised to see a pullback and ultimately a move higher. however during earnings season, anything can happen. So as I always say, focus on risk management.

TIMESTAMPS:

Intro: 00:00

SP500 Daily: 00:27

SP500 30 Min: 06:04

My Scalp Trade Today: 10:34

MY FAVORITES - https://amz.run/3JLv

○ Book Recommendations

○ My Studio Setup

○ Morning Coffee

STOCK TRADING PLATFORM

○ Webull (GET 2 FREE STOCKS): https://bit.ly/37wobNT

COME SAY HI:

Instagram: https://www.instagram.com/figuringoutmoney

Twitter: https://twitter.com/mikepsilva

Make sure to SUBSCRIBE to my channel!

DISCLAIMER: I am not a professional investment advisor, nor do I claim to be. All my videos are for entertainment and educational purposes only. This is not trading advice. I am wrong all the time. Everything you watch on my channel is my opinion. Links included in this description might be affiliate links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel :)

#StockMarket #SP500 #TechnicalAnalysis

-

23:55

23:55

Figuring Out Money

1 year agoWeird Things Are Happening Right Now

53 -

LIVE

LIVE

Dr Disrespect

11 hours ago🔴LIVE - DR DISRESPECT - 10 WINS CHALLENGE - BIG ANNOUNCEMENT AT 12PM PT

1,756 watching -

LIVE

LIVE

Man in America

5 hours ago🚨 ALERT: Hospitals in the U.S. Are KILLING Patients… for Their Organs!

1,752 watching -

LIVE

LIVE

TimcastIRL

2 hours agoObama Referred To DOJ For TREASON, Criminal Investigation, CIVIL WAR!! | Timcast IRL

8,910 watching -

LIVE

LIVE

RalliedLIVE

9 hours ago $2.36 earned10 WINS WITH THE SHOTTY BOYS

676 watching -

LIVE

LIVE

Badlands Media

13 hours agoAltered State S3 Ep. 38

3,595 watching -

LIVE

LIVE

SpartakusLIVE

1 hour agoLAST Stream Until NEXT WEEK || Going to Florida to hang out w/ a SPECIAL Gaming Buddy

154 watching -

10:19

10:19

MattMorseTV

1 day ago $8.86 earnedTrump just went SCORCHED EARTH.

50.5K57 -

1:36:49

1:36:49

RiftTV

3 hours agoHow Much is the Government SPYING on You and STEALING Your DATA?! | Almost Serious | Guest: Matt Kim

13.5K3 -

1:31:26

1:31:26

Glenn Greenwald

4 hours agoAaron Maté on More Russiagate Fallout, Protests in Ukraine, and Israel's Strikes on Syria With Special Guests John Solomon, Marta Havryshko, and Joshua Landis | SYSTEM UPDATE #491

95K28