Premium Only Content

More About Gold is everyone's asset · See why on invest.gold

https://rebrand.ly/Goldco5

Sign up Now

More About Gold is everyone's asset · See why on invest.gold, gold investor gold

Goldco aids customers safeguard their retirement savings by rolling over their existing IRA, 401(k), 403(b) or other professional pension to a Gold IRA. ... To find out just how safe haven rare-earth elements can aid you develop and also shield your wealth, and also protect your retired life telephone call today gold investor gold.

Goldco is among the premier Precious Metals IRA companies in the United States. Safeguard your riches as well as livelihood with physical precious metals like gold ...gold investor gold.

The U.S. abandoned the gold requirement in 1971 when its currency ceased to be backed by gold. Gold in the Modern Economy Despite the fact that gold no longer backs the U.S. dollar (or other worldwide currencies for that matter), it still brings importance in today's society. It is still crucial to the worldwide economy.

Currently, these organizations are accountable for holding nearly one-fifth of the world's supply of above-ground gold. In addition, numerous main banks have contributed to their present gold reserves, reflecting issues about the long-lasting worldwide economy. Gold Maintains Wealth The factors for gold's importance in the contemporary economy center on the reality that it has successfully protected wealth throughout countless generations.

To put things into point of view, think about the following example: In the early 1970s, one ounce of gold equaled $35. Let's say that at that time, you had an option of either holding an ounce of gold or just keeping the $35. They would both purchase you the very same things, like a brand new business suit or an expensive bicycle.

Simply put, you would have lost a considerable quantity of your wealth if you chose to hold the $35 as opposed to the one ounce of gold due to the fact that the value of gold has actually increased, while the value of a dollar has been eroded by inflation. Gold As a Hedge Against the Dollar The idea that gold maintains wealth is even more important in a financial environment where financiers are confronted with a declining U.S.

Historically, gold has actually acted as a hedge versus both of these scenarios. With increasing inflation, gold normally appreciates. When financiers realize that their money is declining, they will start positioning their financial investments in a tough asset that has traditionally preserved its worth. The 1970s provide a prime example of rising gold costs in the middle of increasing inflation.

dollar is due to the fact that gold is priced in U.S. dollars worldwide. There are 2 reasons for this relationship. Initially, financiers who are taking a look at buying gold (i. e., central banks) should sell their U.S. dollars to make this transaction. This eventually drives the U.S. dollar lower as international financiers look for to diversify out of the dollar., gold investor gold

#howtoinvestincryptocurrency#goldco#howtobuybitcoin

gold investor gold

California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia,

DC, DE, FL, GA, GU, HI, IA, ID, IL,

-

LIVE

LIVE

Dear America

1 hour agoFBI Discovers THOUSANDS Russia Hoax Docs In “Burn Bags”!! + Pelosi EXPOSED For Insider Trading!!

20,811 watching -

LIVE

LIVE

Matt Kohrs

10 hours agoHUGE Earnings Beat, Inflation Data & New Record Highs || Live Trading Options & Futures

753 watching -

LIVE

LIVE

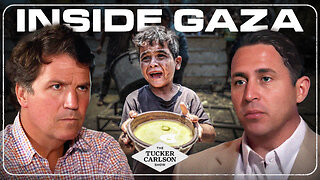

Tucker Carlson

1 hour agoTony Aguilar Details the War Crimes He’s Witnessing in Gaza

3,471 watching -

LIVE

LIVE

Wendy Bell Radio

6 hours agoBurn Baby Burn

7,218 watching -

LIVE

LIVE

JuicyJohns

1 hour ago $0.63 earned🟢#1 REBIRTH PLAYER 10.2+ KD🟢$500 GIVEAWAY SATURDAY!

154 watching -

LIVE

LIVE

LFA TV

11 hours agoLFA TV ALL DAY STREAM - THURSDAY 7/31/25

5,290 watching -

1:02:45

1:02:45

Game On!

18 hours ago $2.56 earnedFootball is BACK! NFL Hall of Fame Game 2025

17.3K2 -

FusedAegisTV

23 hours ago3rd Party Partner Showcase Nintendo Direct! REACTION 7.31.2025 | FusedAegis Presents

13.2K -

13:30

13:30

WhaddoYouMeme

17 hours ago $3.66 earnedIt All Makes Sense Now

20.5K22 -

2:00:05

2:00:05

Nick Freitas

16 hours agoIs Conservatism Dead?

22.8K23