Premium Only Content

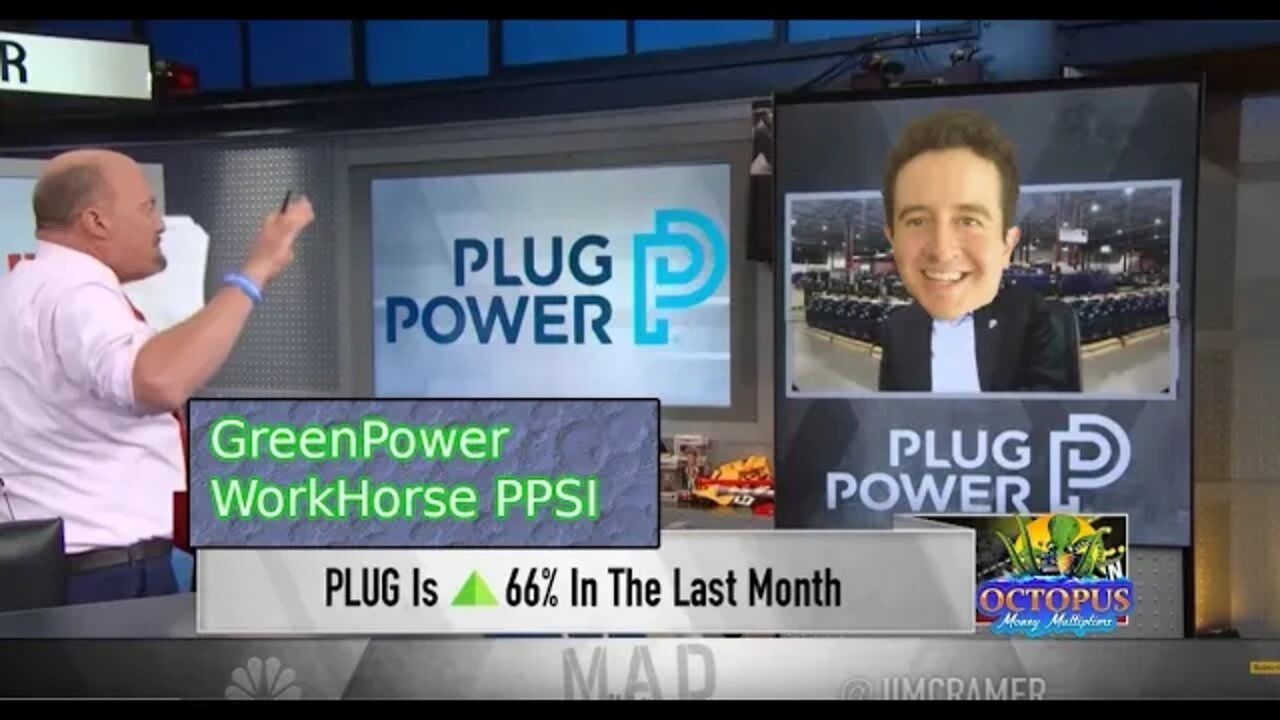

Plug Power 😋 GreenPower Bus WorkHorse Pioneer Power Solutions Stock News Analysis PPSI WKHS GPVRF

Get two free stocks, one valued from $12-$1400 on Webull:

https://act.webull.com/e/5zThWeyNVDe2/0vc/

Wanna be friends? Add Me Here!

https://twitter.com/MoneyOctopus

https://stocktwits.com/OctopusMoneyMultipliers

https://www.patreon.com/octopusmoneymultipliers

Wanna Buy Some Shirts Or Cups?

https://octopusmoneymultipliers.com/merchandise

Wanna Buy The Same Stuff I Use Or Help Support Us By Buying Your Amazon Stuff Through These Links?

My First Camera Stand:

https://amzn.to/318yjuk

My Second Camera Stand:

https://amzn.to/30pfPqr

My Camera:

https://amzn.to/3gqnPgv

Worlds Best Bluetooth Headset:

https://amzn.to/3gtzT0k

What I Use To Put My Camera Stand On To make It The Perfect Height:

https://amzn.to/2Dg4TCL

Buy Silver Gold Platinum Digitally Vault

https://www.onegold.com/join/54902b874e94473d8f7b49fbfbd141a0

Buy Silver Gold Platinum Physically

https://shrsl.com/2f4zo

Today's Video

https://octopusmoneymultipliers.com/2020/08/25/1099/

SPAC's

Plug Power GreenBus PPSI WKHS

adminnAugust 25, 2020

GreenPower Announces Launch of its U.S. Initial Public Offering

News provided by GreenPower Motor Company

Aug 25, 2020, 09:44 ET

Share this article

VANCOUVER, BC, Aug. 25, 2020 /PRNewswire/ — GreenPower Motor Company Inc. (TSXV: GPV) (OTCQB: GPVRF) (“Company”) today announced the launch of its initial public offering in the United States of 1,500,000 common shares pursuant to a registration statement filed with the Securities and Exchange Commission (“SEC”). GreenPower expects to grant the underwriters a 30-day option to purchase up to an additional 225,000 common shares at the initial public offering price less the underwriting discounts and commissions.

GreenPower has applied to have its common shares approved for listing on The Nasdaq Capital Market under the symbol “GP.”

Prior to this offering, the common shares of GreenPower have traded on the TSX Venture Exchange under the symbol “GPV” and on the OTCQB under the symbol “GPVRF.” In connection with this offering, GreenPower intends to effect a consolidation of its common shares on the basis of one new common share for seven old common shares.

GreenPower intends to use the net proceeds from this offering for the production of all-electric vehicles, including EV Stars, EV Star plus, EV Star cab and chassis, and B.E.A.S.T. school buses, EV250 thirty foot low floor transit style buses, product development and geographic expansion with the remainder, if any, for working capital.

WorkHorse Finnally Broke Its 1 Month Consolidation for Bull!

Pioneer Power Solustions over 30% GreenToday!

After Hours

BigGest Coming OUt Party Of All Time? Ants?

(Bloomberg Opinion) — Jack Ma’s Ant Group has filed for an initial public offering in Hong Kong and Shanghai, in what is likely to be one of the biggest debuts in years, potentially topping even Saudi Aramco’s $29 billion initial share sale in 2019.

The listing of China’s largest online payments platform, which is a third-owned by Alibaba Group Holding Ltd., has been keenly awaited for at least three years. Ant is targeting a valuation of about $225 billion, based on an IPO of about $30 billion if markets are favorable, people familiar with the matter told Scott Deveau and Lulu Yilu Chen of Bloomberg News last month.

Ant says it will use the proceeds to expand cross-border research and enhance its research and development capabilities. The filing shows the company had transaction volume totaling 118 trillion yuan ($17 trillion) in the 12 months ended in June, with 1 billion users and 80 million merchants offering the Alipay app.

Here’s what Bloomberg Opinion columnists have been saying about the company:

Ant Will Have an Elephant-Sized Coming Out Party: With one swoop, the dual listing will invigorate Shanghai’s technology-focused Star board and provide some welcome market buzz for Hong Kong. Chinese regulators held back approval for Ant to go public out of concern that the company had become too dominant. These concerns have since been assuaged. The regulatory push has turned Ant into more of a platform than a seller of its own proprietorial products. It now supplies digital infrastructure to financial institutions rather than competing with them. By last year, the company drew half its revenue from local merchants and finance firms, and forecasts that to rise to more than 80% in five years. — Nisha Gopalan

Gores 4 GHIV poped today

People excited now that GMHI is done and Gores 5 is already announced so 4 has to be right around the corner.

Buy list for tomorrow?

GreenPower Bus

Plug Power

407M Shares PLUG is the ticker

Who are they?

They now Own the WHole PIPE!

Replacable batteries

charging stations

care

-

2:00:10

2:00:10

Bare Knuckle Fighting Championship

3 days agoCountdown to BKFC on DAZN HOLLYWOOD & FREE LIVE FIGHTS!

39.5K3 -

2:53:01

2:53:01

Jewels Jones Live ®

1 day agoA MAGA-NIFICENT YEAR | A Political Rendezvous - Ep. 103

86.7K22 -

29:54

29:54

Michael Franzese

10 hours agoCan Trump accomplish everything he promised? Piers Morgan Article Breakdown

87.6K49 -

2:08:19

2:08:19

Tactical Advisor

14 hours agoThe Vault Room Podcast 006 | Farwell 2024 New Plans for 2025

173K11 -

34:12

34:12

inspirePlay

1 day ago $5.09 earned🏆 The Grid Championship 2024 – Cass Meyer vs. Kelly Rudney | Epic Battle for Long Drive Glory!

75.9K8 -

17:50

17:50

BlackDiamondGunsandGear

12 hours ago $1.70 earnedTeach Me How to Build an AR-15

50.7K6 -

9:11

9:11

Space Ice

1 day agoFatman - Greatest Santa Claus Fighting Hitmen Movie Of Mel Gibson's Career - Best Movie Ever

110K45 -

42:38

42:38

Brewzle

1 day agoI Spent Too Much Money Bourbon Hunting In Kentucky

74K12 -

1:15:30

1:15:30

World Nomac

20 hours agoMY FIRST DAY BACK in Manila Philippines 🇵🇭

54.6K9 -

13:19

13:19

Dr David Jockers

1 day ago $10.68 earned5 Dangerous Food Ingredients That Drive Inflammation

76.5K17