Premium Only Content

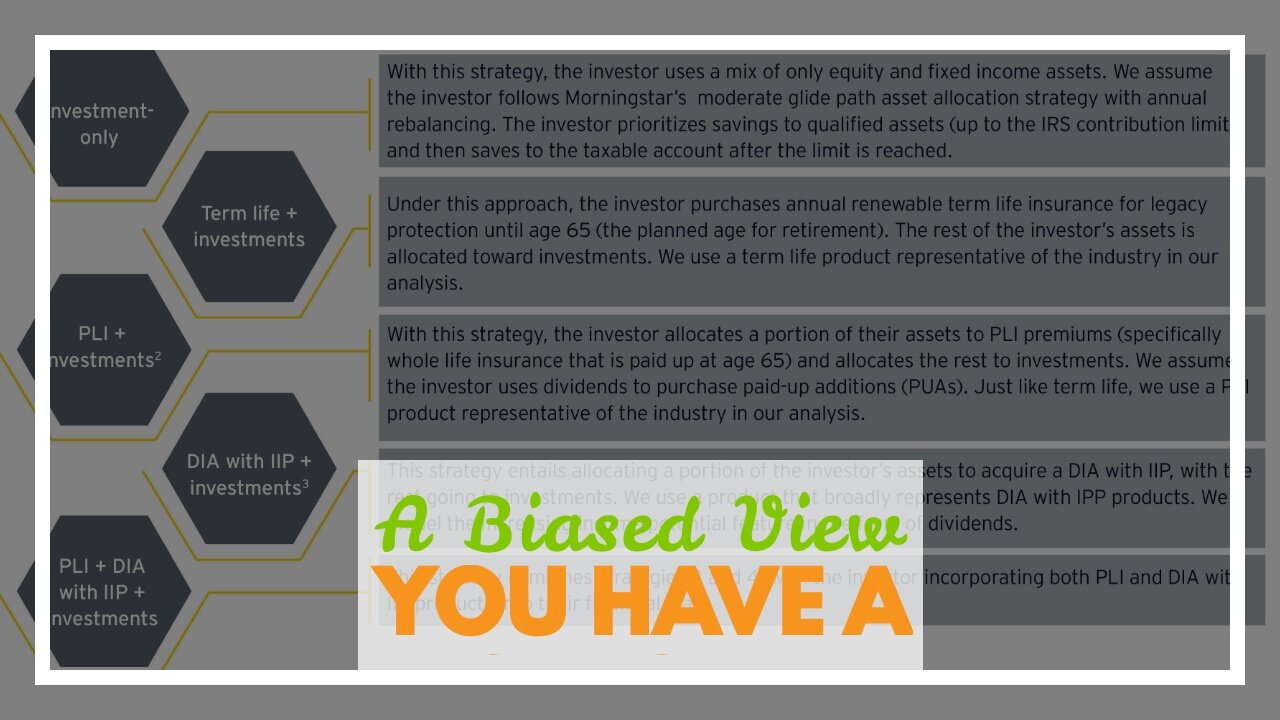

A Biased View of Retirement savings & investing for individuals - Principal

https://rebrand.ly/Goldco6

Join Now

A Biased View of Retirement savings & investing for individuals - Principal, retirement savings investment plan

Goldco assists customers secure their retirement savings by rolling over their existing IRA, 401(k), 403(b) or various other certified pension to a Gold IRA. ... To find out just how safe haven precious metals can help you construct and also safeguard your riches, and also also secure your retirement telephone call today retirement savings investment plan.

Goldco is just one of the premier Precious Metals IRA companies in the United States. Secure your wealth as well as source of income with physical precious metals like gold ...retirement savings investment plan.

You have a special needs. You are using the distribution to purchase a first home (life time limit: $10,000). You have died (and your recipient receives the circulations). Unlike standard Individual retirement accounts, Roth IRAs have earnings limitations for contributions. In other words, if you make too much cash, you can't contribute to a Roth.

Try to choose according to which plan lead to lower taxes and more income (given, determining this may not be simple). In general, a Roth is the much better choice if you anticipate to be in a higher tax bracket in retirement, or if you anticipate to have substantial earnings in the account.

401(k) Plans Like IRAs, 401(k) strategies are tax-advantaged accounts utilized to conserve for retirement. However instead of being set up by people (that's the "I" in IRA), they're used by employers. Note that 401(k)s are defined contribution strategies. Employees make contributions to their 401(k)s through automated payroll withholding. And the employer can include money, too, through something called an employer match.

If your company uses a match, do whatever you can to max out your contributions to get that matchit's essentially totally free cash. 401(k) Contribution Limits For 2021, you can contribute up to $19,500 to your 401(k), or $26,000 if you're age 50 or older (since of a $6,500 catch-up contribution).

Employers can contribute, too. For 2021, there's a $58,000 limit on combined staff member and company contributions, or $64,500 if you're age 50 or older. For 2022, this increases to $61,000, or $67,500. These high contribution limits are one benefit that 401(k)s have more than conventional and Roth IRAs. What if You Can Add to a 401(k) or an individual retirement account? It might be that you are eligible to make traditional IRA or Roth individual retirement account contributions along with salary deferral contributions to a 401(k) plan.

You should decide what is most useful to youto make one, 2, or all three work. A few of the following concepts can likewise apply if you have the choice of contributing to both a traditional 401(k) and a Roth 401(k). Let's look at Casey, who works for Company A and is qualified to make a wage deferral to Company A's 401(k) strategy., retirement savings investment plan

#goldinvesting#RAWealth#investingingoldandsilver

retirement savings investment plan

California, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia,

AK, AL, AR, AS, AZ, CA, CO, CT,

-

54:47

54:47

Side Scrollers Podcast

1 day agoSide Scroller Presents KING OF THE KART | MASSIVE MARIO KART TOURNAMENT

86.9K2 -

LIVE

LIVE

Astral Doge Plays!

3 hours agoZelda NES Randomizer ~LIVE!~ Let the Randomization Begin!

80 watching -

33:18

33:18

Athlete & Artist Show

13 hours ago $2.81 earnedHockey Is Back In Europe!

32.5K4 -

5:33:30

5:33:30

Total Horse Channel

6 hours ago2025 URCHA Futurity | Derby & Horse Show | Sunday

38.6K3 -

LIVE

LIVE

GhillieSuitGaming

3 hours ago $0.47 earnedThe Evil Within 2: Part 4 - Art Destruction!

55 watching -

LIVE

LIVE

Chi-Town Gamers Livestreams

3 hours ago $0.56 earnedGears 5 Ep. 4 W/ CTG | Into Kait's Mental Issues | GOW: RELOADED LATER & SHENANIGANS 😎

34 watching -

LIVE

LIVE

Scottish Viking Gaming

6 hours agoSUNDAY FUNDAY :|: Still in the original packaging! Mint!

26 watching -

2:20:14

2:20:14

LumpyPotatoX2

4 hours agoKOMPETE: Quick Gameplay - #RumbleGaming

13.8K1 -

2:16:57

2:16:57

XxXAztecwarrior

5 hours agoSearching for more Reds!!

15.8K1 -

2:44:34

2:44:34

TheItalianCEO

5 hours agoWhat about an Italian for breakfast?

20.5K2