Premium Only Content

Real Estate Investment Calculations - Flip - Cash Needed at Closing - Holding Equity Profit

Property Flip or Hold - Flip - Cash Needed - Closing - Holding - Equity Profit - How to Calculate

Cash Needed (All In Closing) - The Total Cash needed to purchase property and rehab.

Cash Needed (Holding Cost x Mos.) - The Total Cash needed to maintain property during rehab and listing periods.

Equity Profit (At Closing) - The Profit you make at closing when Purchasing the Property using the ARV. In our case, we also take Repairs under consideration.

Property Flip or Hold helps the Real Estate Investor to calculate and compare profits when Flipping -vs- Holding a property. Flip and take profit now, or Hold/Rent for passive income.

Website: https://PropertyFlipOrHold.com/features

Quickly analyze properties in 2 easy steps.

Step 1: Enter Flip Assumptions

Step 2: Enter Hold Assumptions

Live Results: View results on the same screen

USES

Real Estate Property Investors for personal use or others

Flip Property

Rent Property

BRRRR

Wholesale Investors

Real Estate Agents

Agents for their investors

REAL ESTATE INVESTING

No Complex Calculations

No Long Drawn-out Analysis

Analyze Flip or Hold Scenarios from one screen

Twitter: https://twitter.com/JediPixels

Twitter: https://twitter.com/PixoliniInc.

Website: https://PropertyFlipOrHold.com

Blog: https://PropertyFlipOrHold.com/blog

-

0:27

0:27

Pixolini

3 years agoReal Estate Investment Calculations - Equity At Purchase

4 -

0:27

0:27

Pixolini

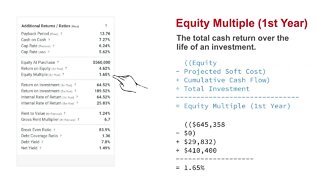

3 years agoReal Estate Investment Calculations - Equity Multiple 1st Year

1 -

0:27

0:27

Pixolini

3 years agoReal Estate Investment Calculations - Cash on Cash

-

0:27

0:27

Pixolini

3 years agoReal Estate Investment Calculations - Return on Equity 1st Year

2 -

0:26

0:26

Pixolini

3 years agoReal Estate Investment Calculations - Net Yield

3 -

0:26

0:26

Pixolini

3 years agoReal Estate Investment Calculations - Debt Yield

2 -

0:27

0:27

Pixolini

3 years agoReal Estate Investment Calculations - Payback Period Years

9 -

0:27

0:27

Pixolini

3 years agoReal Estate Investment Calculations - Break Even Ratio

1 -

0:27

0:27

Pixolini

3 years agoReal Estate Investment Calculations - Debt Coverage Ratio

8 -

0:27

0:27

Pixolini

3 years agoReal Estate Investment Calculations - Cap Rate ARV

6