Premium Only Content

The 4-Minute Rule for How does investing work? - Principal Financial

https://rebrand.ly/Goldco2

Sign up Now

The 4-Minute Rule for How does investing work? - Principal Financial, retirement investing basics

Goldco assists clients protect their retirement savings by rolling over their existing IRA, 401(k), 403(b) or various other qualified pension to a Gold IRA. ... To find out just how safe haven precious metals can aid you develop and also safeguard your wide range, and also also secure your retirement telephone call today retirement investing basics.

Goldco is just one of the premier Precious Metals IRA companies in the United States. Safeguard your riches and also resources with physical rare-earth elements like gold ...retirement investing basics.

Still, it's simple to see that the longer you can put your cash to work, the better the outcome. Beginning early is one of the simplest ways to make sure a comfy retirement. 3. Determine Your Net Worth You make cash, you spend money: For some individuals, that has to do with as deep as the cash conversation gets.

Possessions usually consist of: Money and cash equivalentsthings like cost savings accounts, Treasury costs, and CDs, Investmentsfor example, stocks, shared funds, and ETFs, Genuine propertyyour house and any rental residential or commercial properties or a second home, Personal propertyboats, collectibles, jewelry, vehicles, and home home furnishings Liabilities, on the other hand, consist of financial obligations such as: Mortgages, Vehicle loan, Charge card outstanding balances, Medical expenses, Student loans To determine your net worth, subtract your liabilities from your possessions.

Of course, net worth is most useful when you track it over timesay, as soon as a year. That method, you can see if you're heading in the best direction, or if you require to make some modifications. You ought to calculate your net worth a minimum of as soon as a year to ensure your retirement goals can stay on track.

If you don't develop specific objectives, it's hard to discover the reward to conserve, invest, and put in the time and effort to guarantee you're making the very best choices. Specific and written goals can offer the motivation you need. Here are some examples of written retirement goals. I want to retire when I'm 65.

I want a $1 million nest egg to money the retirement I visualize. Routine net worth "check-ups" are a reliable way to track your development as you work toward these goals. 4. Keep Your Emotions in Examine Investments can be affected by your emotions much more quickly than you might understand.

You put all your money into low-risk money and bonds and can't take advantage of a market healing. You do not make any cash. Psychological reactions make it challenging to construct wealth with time. Prospective gains are screwed up by overconfidence, and fear makes you offer (or not purchase) financial investments that might grow., retirement investing basics

#investinbitcoin##goldco#investinginbitcoin

retirement investing basics

Guam, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana,

NV, NY, OH, OK, OR, PA, PR, RI, SC, SD, TN,

-

1:04:36

1:04:36

BonginoReport

3 hours agoDems Play Blame Game In Wake Of Tragedy - Nightly Scroll w/ Hayley Caronia (Ep.121) - 08/27/2025

39K28 -

1:06:26

1:06:26

TheCrucible

3 hours agoThe Extravaganza! EP: 28 (8/27/25)

91.5K3 -

1:30:22

1:30:22

Kim Iversen

4 hours agoNetanyahu Says Armenian Genocide Was Real — But Gaza Deaths Are A “Mishap"

40.1K95 -

1:08:47

1:08:47

vivafrei

2 hours agoAnother "Trans" Mass Shooter? Rampage Jackson Keeps Digging? Democrats are Just Awful AND MORE!

33.2K34 -

LIVE

LIVE

The Mel K Show

1 hour agoLive Q&A with Mel K 8-27-25

443 watching -

LIVE

LIVE

Quite Frankly

5 hours ago"Planet Chaos, Life on Mars, Open Lines" ft. Oppenheimer Ranch Project 8/27/25

549 watching -

LIVE

LIVE

The Mike Schwartz Show

7 hours agoTHE MIKE SCHWARTZ SHOW Evening Edition 08-27-2025

3,962 watching -

1:34:24

1:34:24

Redacted News

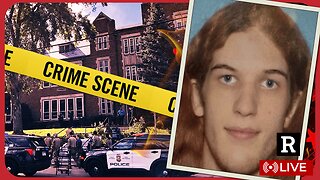

3 hours agoLIVE: Minnesota School Shooter’s Shocking Motive Revealed – Plus Trump Targets Soros w AG Ken Paxton

140K140 -

4:55:15

4:55:15

StoneMountain64

6 hours agoHUNTING FOR THE FIRST WIN BACK ON WARZONE

70.2K2 -

1:09:06

1:09:06

The Officer Tatum

4 hours agoBREAKING: Shooter IDENTIFIED TR*NS , Cracker Barrel CAVES To Pressure + MORE | EP 162

37K78