Premium Only Content

Desperate Times Desperate Measures! XRP XLM BTC ETH ALGO

My analysis is for entertainment purposes only.

Join my patreon https://www.patreon.com/user?u=22374899

🔥Cryptocurrency and Precious Metal IRA's 🔥

Open An IRA With iTrustCapital To Grow Your Crypto Tax Free

Get your first month FREE!

Link: https://bit.ly/3mXgUOA

Code: DARREN

https://paypal.me/fame21moore?locale.x=en_US

https://www.coinbase.com/join/moore_6bw use that link and coinbase gives you 10 dollars

share.robinhood.com/darrenm72 use that link for a free share of stock. If you sign up I also get a free stock.

i'm not a financial advisor.

Download Brave Browser and earn BAT tokens while you browse the web. Also no more ads https://brave.com/qxb609

You can also donate directly to Fame21Moore:

rMdG3ju8pgyVh29ELPWaDuA74CpWW6Fxns

Destination tag 2664809513

... or donate to Fame21Moore using ILP:

$twitter.xrptipbot.com/Fame21Moore

@xrpDarren

on http://cinnamon.video

Hotbit refferal link buy low market cap coins like LIT, XOR,

https://www.hotbit.io/register?ref=537547

Probit Refferal link buy low marketcap coins like VXV

https://www.probit.com/r/78195009

Binance Referral link you can buy AGI PERL NEBL

https://www.binance.com/en/register?ref=18077362

The bitcoin inspired software is going to be adopted globally. Alt coins or alts are going to be integrated into a new blockchain based internet called the internet of value. The IOV is here to stay and will be networks like ethereum algorand stellar ripple working together to transfer value with central bank digital currencies available for everyone to use within their programming. CBDCS are the exit plan for the central banks the fiat system is imploding and they need options. Gold is a dangerous thing for governments and central banks because it makes them accountable for spending. This blockchain and crypto hybrid system will be the exit plan to fiat. Tune into my channel for the latest altcoin news! ripple news bitcoin news and price predictions

The private sector is inching their way closer and closer to the internet of value. The governments and central banks of the world are preparing for this internet of value. The central banks and governments have accommodated the markets with reckless monetary and fiscal policy. (meaning QE, Bail outs, Stimulus checks) The central banks and governments are also going to accommodate the markets with CBDCs. By updating to CBDC the central banks’ capabilities grow by exponents, for example, Negative interest rates, increased money velocity, conditional money, fiscal air drops of stimulus, a burn rate on currency to discourage saving… These aforementioned items are tools to facilitate complete control over the economy.

This technology changes the world fundamentally. The world is in a global recession and is saturated with debt, and the central bankers and governments have limited tools of inflation and deflation. There is biblical depression on the horizon. This new technology opens a Pandora’s box of monetary and fiscal tools to combat deflation.

As the central banks and governments lean in, who are they getting advice from? Answer: from the experts, the companies that are successfully building the internet of value. The businesses that successfully utilize crypto and block chain. Therefore, those companies and those crypto assets are laying the foundation of this next gen financial system.

The interledger protocol is an interoperability standard; it’s the HTTPS SMTP of the internet of value. For these cbdcs to transact with one another there needs to be a common ground, and there needs to be a protocol for these transactions to take place. Is it likely that central banks will have accounts for every CBDC in the world? A jurisdiction-free bridge asset is the needed solution. Why would china trust Canadas cbdc? Why would japan trust England’s CBDC? Trust is not needed with crypto. Cryptocurriences are trustless assets that facilitate countries fruitfully working together.

-

18:22

18:22

Liz Wheeler

3 hours agoWhat Ghislaine Maxwell Knows

4109 -

LIVE

LIVE

cosmicvandenim

5 hours agoWARZONE - Kenetik Energy Announcement - Discord Spy Bots

64 watching -

1:05:51

1:05:51

Jeff Ahern

3 hours ago $13.79 earnedThe Saturday Show with Jeff Ahern

82.9K10 -

LIVE

LIVE

Misfit Electronic Gaming

52 minutes ago"LIVE" RUMBLE HALO Spartans "Halo MCC" 23 Followers to go till we hit !000 RUMBLE TAKEOVER

18 watching -

1:57:13

1:57:13

Film Threat

4 hours agoLIVE FROM SAN DIEGO COMIC-CON! (Saturday) | Film Threat Live

7.69K -

31:40

31:40

Tactical Advisor

3 hours agoEveryone Talks About This AR15 Being The Best? | Vault Room Live Stream 034

53.1K3 -

1:08:53

1:08:53

Michael Franzese

17 hours agoHollywood Deaths & Political Secrets: A Nation at a Crossroads?

147K94 -

9:27

9:27

MattMorseTV

1 day ago $14.95 earnedHe just lost EVERYTHING.

56.1K78 -

1:40:30

1:40:30

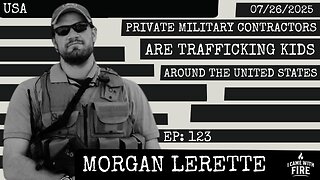

I_Came_With_Fire_Podcast

16 hours agoPrivate Military Contractors Are TRAFFICKING KIDS Around The United States

34.8K24 -

LIVE

LIVE

JdaDelete

17 hours ago $3.74 earnedFinal Fantasy VII Rebirth | Jdub's Journey Part 8 - Corel Prison

178 watching