Premium Only Content

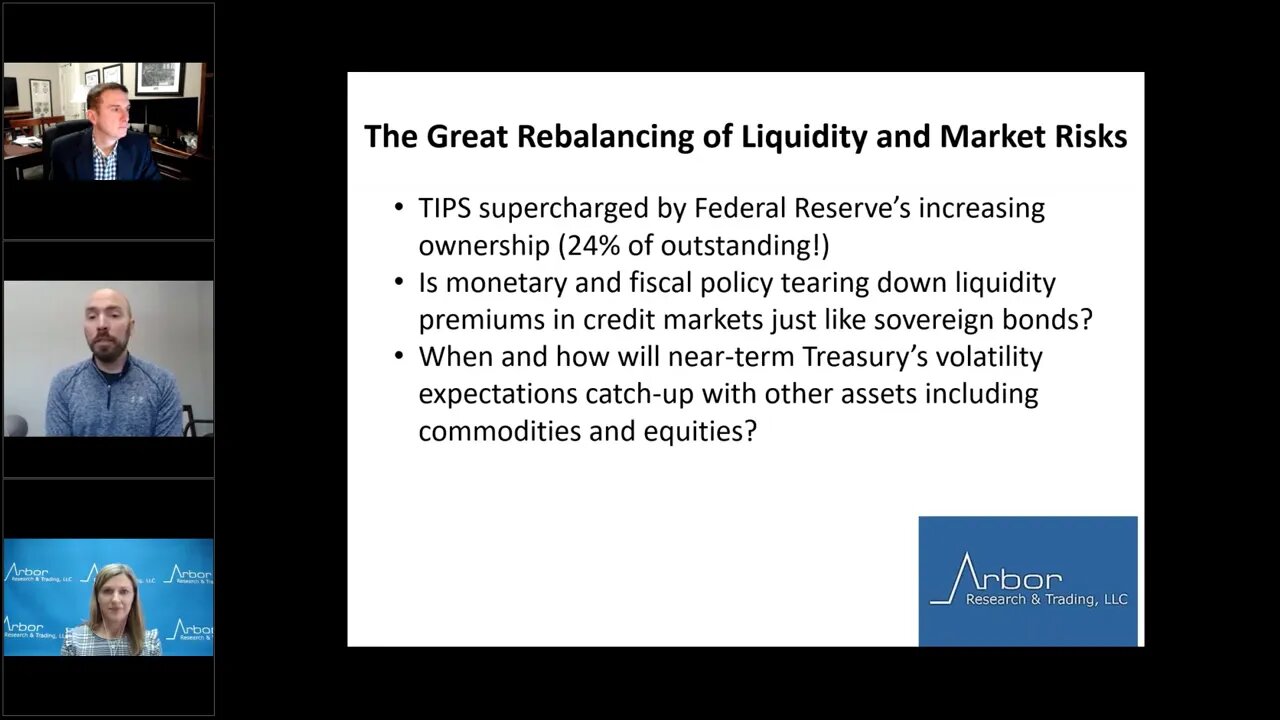

Talking Data Episode #39: The Great Rebalancing of Liquidity and Market Risks

Welcome to the latest edition of Talking Data. Our Talking Data series seeks to offer timely insights into macro market themes along with macro data and its impact on the economy and markets.

I am your host Kristen Radosh of Arbor Research and Trading. Our presenters today are Jim Bianco of Bianco Research and Ben Breitholtz of Arbor Data Science.

Today we’ll talk about the Great Rebalancing of Liquidity and Market Risks.

· TIPS supercharged by Federal Reserve’s increasing ownership (24% of outstanding!)

· Is monetary and fiscal policy tearing down liquidity premiums in credit markets just like sovereign bonds?

· When and how will near-term Treasury’s volatility expectations catch-up with other assets including commodities and equities?

Thank you for joining us today. As a reminder, Arbor Research & Trading is an institutional research and brokerage firm. Our two most prominent research offerings are Bianco Research & Arbor Data Science.

For further information on Arbor Research, Bianco Research and Arbor Data Science, please contact Gus Handler at gus.handler@arborresearch.com or call Arbor Research & Trading at 800-606-1872.

-

DVR

DVR

The Officer Tatum

3 hours agoLIVE: Left CANCELS Their Own, All White Town, NYC Shooter Update + MORE | EP 146

9.93K8 -

LIVE

LIVE

The Rabble Wrangler

14 hours agoRimWorld with The Best in the West!

13 watching -

LIVE

LIVE

MissesMaam

4 hours agoVariety Stream💚✨

86 watching -

LIVE

LIVE

blackfox87

27 minutes agoHot Droppin! | PREMIUM CREATOR | #DisabledVeteran

55 watching -

1:23:27

1:23:27

Redacted News

3 hours agoBREAKING! FBI DIRECTOR DROPS BOMBSHELL, REVEALS HIDDEN 'BURN BAGS' AND MISSING EPSTEIN FOOTAGE

128K112 -

1:21:25

1:21:25

vivafrei

4 hours agoJoey Swoll CANCELS Himself! Oprah Closing Roads for Tsunami Evacuees? Canada Can't Find Criminals?

77.6K28 -

1:47:35

1:47:35

Right Side Broadcasting Network

6 hours agoLIVE REPLAY: President Trump Delivers Remarks on Making Health Technology Great Again - 7/30/25

65.6K23 -

38:23

38:23

Members Club

3 hours ago $0.75 earnedShooter Strikes NYC, WNBA Wig Meltdown, and Sweeney’s Jeans Go Viral - MC05

14.5K5 -

33:41

33:41

The Finance Hub

5 hours ago $1.90 earnedBREAKING: NANCY PELOSI JUST GOT HIT WITH A MAJOR BOMBSHELL!!!

14.3K6 -

LIVE

LIVE

LFA TV

22 hours agoLFA TV ALL DAY STREAM - WEDNESDAY 7/30/25

948 watching