Premium Only Content

Luke Gromen: Understanding the Sovereign Debt Bubble

Tom welcomes Luke Gromen back to the show to discuss the signposts in the markets. The global sovereign debt bubble is bursting, which last occurred a hundred years ago. They are nearly entirely out of options, and bond markets are beginning to understand this fact.

To subscribe to our newsletter and get notified of new shows, please visit http://palisadesradio.ca

The United States is running unprecedented massive trade and fiscal deficits. The rest of the world finances our debts, and this is quickly breaking down. Luke believes these obligations will be resolved through inflation both internally and externally. There is a lack of political will to default.

He discusses a Black Rock paper that predicted interest rate control and is what is now occurring. The Biden administration plans further stimulus. The US government is now driving economic growth through monetary and fiscal policy.

The Fed is actively testing yield curve management over the past several weeks by buying assets to back up the 10-year bonds. They are testing levels to determine where rates start to become a problem. They are likely to maintain this policy until something else breaks.

He thinks the Fed policy in the short-term may be bullish for the dollar. They want to reflate the global economy via fiscal spending while keeping currencies in the same overall channel.

He explains how gold could be revalued and how that could fund the treasury without increasing debt. However, this would be a last-ditch option for the United States.

The Fed wants inflation, but it doesn't want bonds to react. It can't have both, and ultimately we're going to get and are experiencing inflation. If the Fed doesn't buy enough debt, we see that as deflation This is the first cycle where if rates don't rise too much, we will default. At some point, defaults lead to weakening currencies.

Conceptually money velocity is important but measuring it isn't easy. There is the real economy, and then there are the financial markets. It's a marginally valuable metric, but it simply has too many moving pieces.

He discusses how bitcoin could be reflecting what gold should be doing. Bitcoin is not a centralized controlled market, and when big buyers enter the market, it moves higher. Physical gold takes a lot longer to obtain, but paper gold can be bought immediately, which accounts for the performance difference.

Time Stamp References:

0:00 - Intro

0:36 - Signposts

3:37 - Debt Bubbles

7:13 - Money Supply Control

10:30 - Yield Curve Control

13:00 - Dollar Path Forward

15:04 - Hail Mary's

16:29 - Gold & The Fed

17:46 - Foreign Treasuries/Gold

19:29 - Inflation Vs. Deflation

22:07 - Measuring Money Velocity

25:34 - Bitcoin and Gold

28:33 - Gold Short Positions

31:21 - Gold and the TLT

32:55 - Gold Investing Criteria

34:52 - Concluding Thoughts

Talking Points From This Episode

- Global sovereign debt bubble crisis.

- Yield curve management vs. control.

- Dollar outlook, money velocity, and inflation

- Why bitcoin reflects what gold should be doing.

Guest Links:

Twitter: https://twitter.com/lukegromen

Website: https://fftt-llc.com/

Luke Gromen began his career in the mid-1990s in Research at Midwest Research before moving over to institutional equity sales and becoming a partner. While in sales, Luke was a founding editor of Midwest's widely-read weekly summary ("Heard in the Midwest") for the firm's clients. He aggregated and combined proprietary research from Midwest with inputs from other sources.

In 2006, Luke left FTN Midwest to become a founding partner of Cleveland Research Company. At CRC, Luke continued to work in sales and edit CRC's flagship weekly research summary piece ("Straight from the Source") for the firm's customers.

In 2014, Luke left Cleveland Research to found FFTT, LLC ("Forest for the Trees"), a macro/thematic research firm catering to institutions and individuals that aggregates a wide variety of macroeconomic, thematic, and sector trends in an unconventional manner to identify investable developing economic bottlenecks.

Luke also provides strategic consulting services for corporate executives. He is a graduate of the University of Cincinnati and received his MBA from Case Western Reserve University and earned the CFA designation in 2003.

#LukeGromen #FFTT-LLC #DebtMarkets #Gold #Stimulus #Deficits #Bonds #FederalReserve #Gold #Inflation

-

58:25

58:25

Palisades Gold Radio

14 hours agoMichael Oliver: 'Quantum Leap' Higher for Silver, Gold, Stock Market Bubble, Oil & Gas and More

227 -

2:32:46

2:32:46

megimu32

4 hours agoOn The Subject: Why K-Pop Demon Hunters Feels Like 90s Disney Again

15K10 -

1:38:28

1:38:28

Glenn Greenwald

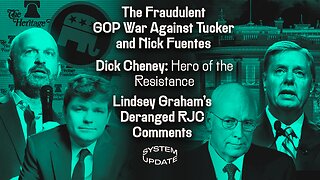

7 hours agoThe Fraudulent GOP War Against Tucker and Nick Fuentes; Dick Cheney: Hero of the Resistance; Lindsey Graham's Deranged RJC Comments | SYSTEM UPDATE #544

97.8K108 -

LIVE

LIVE

ThePope_Live

3 hours agoRedsack with the boys Cheap, Jah and Nova!

353 watching -

LIVE

LIVE

Hernandez2787

6 hours agoArc Raiders - 1st Playthrough/ Celebrating My Anniversary as Sergeant First Class in the US Army

64 watching -

48:42

48:42

Donald Trump Jr.

7 hours agoCommunism vs Common Sense, What's Next for NYC? | TRIGGERED Ep.289

141K279 -

LIVE

LIVE

JahBlessCreates

2 hours ago🎉Lil Music Ting

20 watching -

1:31:25

1:31:25

The Charlie Kirk Show

6 hours agoTHOUGHTCRIME Ep. 104 — Post-Election Palette Cleanser + Tucker/Fuentes Interview Reaction

103K41 -

4:22:59

4:22:59

tminnzy

5 hours agoSmooth Moves Only 💨 | Naraka: Bladepoint Chill Gameplay | !gx

33.6K5 -

1:04:33

1:04:33

BonginoReport

7 hours agoWill The LA Dodgers Dodge WH Visit?! - Nightly Scroll w/ Hayley Caronia (Ep.172) - 11/06/2025

65.1K78