Tax Liens & Vacant Properties

You can get a vacant property list from your municipality, or you can find out from your tax office about tax sales.

In New Jersey, a property owner is required to register a vacant property. Many people fail to do this due to their financial situation – it’s around $1500 a year to register a vacant property. Sometimes towns foreclose on vacant properties and have the deeds to those properties.

There are two types of tax sales: tax liens and tax deeds.

With tax deeds, you buy the lien, and you own the property.

With tax liens, you buy the tax lien of the person living in the property who may have fallen behind on their taxes, and you can start the foreclosure process and within a year, if they pay, you make money. If they don’t pay, you can foreclose and take the property.

Tax liens are great for passive investment, and can be done from a laptop/cell phone.

nngcapitalfund.com

#taxlien #taxdeeds #passiveinvestment #taxsales #realestateinvestment #realestateinvestors #realestateinvesting #noteinvesting

-

2:09

2:09

WMAR

2 years agoBaltimore Mayor to discuss 30-day review of vacant properties

2 -

2:14

2:14

WMAR

2 years agoBaltimore woman raises concerns about vacant properties after home is damaged in fire

8 -

0:11

0:11

WMAR

2 years agoVacant Homes

12 -

0:05

0:05

WMAR

2 years agoVacant homes cont.

3 -

1:10

1:10

LeeRipka

2 years agoWhitetail Properties Pa

20 -

0:25

0:25

KMTV

2 years agoFire at vacant Flora Apartments

1 -

14:34

14:34

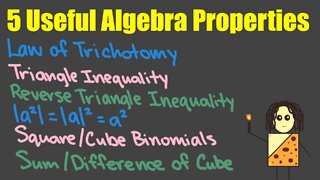

Learn Math with Caveman Chang

2 years ago5 Useful Algebra Properties

9 -

14:57

14:57

High School Math

2 years agoIM3 Alg2 CC 8.3 Log Properties

46 -

2:03

2:03

WSYM

2 years agoCity ratcheting up efforts to sell of vacant lots and foreclosed properties

111 -

2:06:37

2:06:37

Steven Crowder

3 days agoREBUTTAL: Jon Stewart is WRONG about Gun Violence

549K925