Premium Only Content

Weekly Video Update for May 9-13, 2022.

Each day the market is open, a video is prepared which analyzes and evaluates current conditions of the S&P 500.

My Exclusive Free Workshop: The Four P's of Building a Successful Investing Program → https://spxinvesting.mailchimpsites.com

Free Stock Market Course: https://youtu.be/Bl8XZh1t3DI

Blog: https://spxinvestingblog.com

Facebook Private Group: https://www.facebook.com/groups/667271964721864

https://www.currentmarketvaluation.com/

https://www.isabelnet.com/

Weekly Video Update

For May 9-13, 2022

The Week’s Session

Recap 1: Week of May 2 - 6, 2022

For the Week:

Volatile week with continued concerns over earnings disappointments, rising interest rates, slowing growth, inflation and Fed policy.

Down: -0.21% for the week.

Volume:

Above Average

Fixation:

Technicals, inflation and interest rates, geopolitical concerns, China/Supply chain, Oil, Fed Speak, Earnings.

Trend Condition:

Strengthening Trend: Negative

Interest Rates Increased

As expected, the FOMC raised the Fed Funds Rate to 0.75% in the second rate hike of 2022.

Fears of future rate hikes of 0.75% were calmed during the post-FOMC press conference. The markets rallied on Wednesday only to surrender all gains on Thursday, and a continued choppy decline on Friday.

Sectors

Current Market Valuation

https://currentmarketvaluation.com/

Sentiment

FED Watch

Breadth Analysis

Advance/Decline, NH/NL Studies

Trend Analysis

Long Term

Months to Years

Chart Variations

Trading Systems

Broad Market

Stocks

Broad Market

Other Markets

Relative Studies

Outlook for May 9-13, 2022

Major Economic Reports to be released:

Wednesday:

CPI

Thursday

PPI

Friday:

University of Michigan Consumer Sentiment- Preliminary

Things to Watch:

Technicals, inflation and interest rates, geopolitical concerns, Russia/Ukraine, China/Supply chain, Oil, Fed Speak, Earnings, Japan.

Monday, May 9, 2022 Scenarios

1. Down (Negative)

A. Rising interest rates and inflation fears.

Earnings and Fed Speak that spooks the markets.

B. Technicals negative and not ST oversold.

2. Up (Positive)

B. Possible positive scenarios

B. Technicals: MAs and pivots may provide support/resistance.

3. Sideways: (Neutral)

ADX is above 20, starting but declining and showing a negative trend.

Thank You!

John Clay

The SPX Investing Program

[email protected]

-

38:52

38:52

The SPX Investing Program

5 days agoS&P 500 Daily Update for Thursday September 25, 2025

23 -

LIVE

LIVE

Nikko Ortiz

3 hours agoPTSD Is Fun Sometimes | Rumble LIVE

507 watching -

23:02

23:02

Jasmin Laine

6 hours ago"Carney BROKE Ethics Laws!"—Liberal SPEECHLESS After Being Cornered On CTV

84112 -

31:50

31:50

iCkEdMeL

1 hour ago $3.13 earnedMassive Protest Shuts Down Downtown Chicago Over ICE Crackdown

37.7K42 -

17:17

17:17

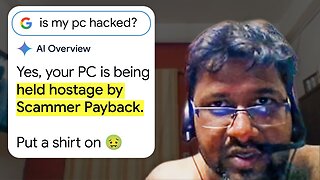

Scammer Payback

6 hours agoHolding a Scammer's Computer HOSTAGE

664 -

LIVE

LIVE

Flyover Conservatives

9 hours agoWhy Christians Should Embrace the Term “Christian Nationalist” | FOC Show

93 watching -

LIVE

LIVE

Patriots With Grit

2 hours agoFinancial Reset, Charlie Kirk, Is The Military In Control? | Scotty Saks

57 watching -

LIVE

LIVE

Anthony Rogers

6 hours agoEpisode 384 - Tristan Tritt

58 watching -

LIVE

LIVE

LFA TV

22 hours agoBREAKING NEWS ALL DAY! | TUESDAY 9/30/25

636 watching -

LIVE

LIVE

putther

2 hours ago $0.37 earned⭐ GTA IV STORY PART 1❗(GTA RP after)

77 watching