Premium Only Content

EMERGENT SEA PODCAST - ECONOMIC LOCKDOWNS (WITH MELISSA CIUMMEI)

Melissa Ciummei – “We have been fooled into believing that currency is money. People have this idea that ‘that’s my money in the bank’, it’s not.”

During an interview with EMeRgent Sea, Melissa Ciummei, a Northern Irish investor and researcher, discussed the economic impact of lockdowns and what she believes are the real reasons why Governments are enforcing stringent measures across the world. “Inflation is here and people need to prepare for it,” Ciummei warned.

Earlier this year, Ciummei released a video message (below) lauding the “success” of lockdowns in ruining global economies and livelihoods. Her video message went viral across social media.

The Truth About the Global Lockdown – A Warning!

Ciummei’s concerns are the economic aspects about events since the beginning of 2020 and this is the aspect where she has focused her research. In her interview with EMeRgent Sea, Ciummei explained that things started to go wrong when the United States dollar, the reserve currency, “came off the gold standard”.

In early August 1971 France sent a warship to New York harbour with instructions to bring back its gold from the New York Federal Reserve Bank. On 15 August 1971, President Richard Nixon suspended convertibility of the US dollar into gold. This was the beginning of an era of “fiat money.” This enabled the United States to live beyond its means through annual budget and trade deficits and a growing national debt. This debt-based system that was created, said Ciummei, “in truth, collapsed in 2008. [Events of 2020/21] all should have happened really around then. But they managed to reinflate the balloon.”

They managed to reinflate the “balloon” using Quantitative Easing and the printing of money by Central Banks. “There’s an ability that they can create money out of nothing and loan it to the government who pay them back with interest,” Ciummei said.

In August 2019, there was an annual meeting of economists and bankers, at the Jackson Hole Economic Symposium, where they decided to “go direct.” In an article ‘Summary – Going Direct Reset’, John Titus wrote that at Jackson Hole “BlackRock instructed the Fed to get money into wholesale and retail hands when “the next downturn” arrived—which, as luck would have it, occurred less than a month later. This was, in its essence, BlackRock’s “going direct” plan, and it anticipates exactly what the Fed began doing—quite successfully—under the cover of the pandemic.”

The downturn Titus was referring to was what Ciummei described as “a crisis in the repo market.”

“We have been fooled into believing that currency is money. People have this idea that ‘that’s my money in the bank’, it’s not. Should that bank become insolvent you will be given shares of an insolvent bank currency representing money,” Ciummei said.

-

Tundra Tactical

4 hours ago $2.93 earned🛑LIVE NOW!! This spits in the face of the Second Amendment.🛑

15.8K -

LIVE

LIVE

DLDAfterDark

3 hours ago $0.62 earnedIt's SHTF! Do You Have What You Need?? Let's Review Items & Priorities

137 watching -

28:58

28:58

Stephen Gardner

4 hours ago🚨Explosive allegations: Rosie O’Donnell connects Trump to Epstein scandal!?

20K45 -

LIVE

LIVE

SavageJayGatsby

1 day agoSpicy Saturday | Let's Play: Grounded

434 watching -

2:06:27

2:06:27

MattMorseTV

6 hours ago $45.19 earned🔴Vance just went SCORCHED EARTH.🔴

121K160 -

46:41

46:41

The Mel K Show

10 hours agoMel K & Corey DeAngelis | The Hopelessly Captured Teacher’s Unions: Biggest Threat to Our Children & Future | 9-6-25

31.9K4 -

2:52:42

2:52:42

Mally_Mouse

1 day ago🔥🍺Spicy HYDRATE Saturday!🍺🔥-- Let's Play: Grounded

27.4K2 -

1:32:27

1:32:27

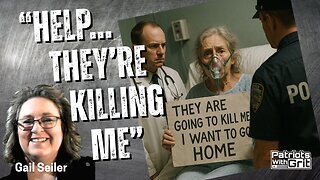

Patriots With Grit

6 hours ago"HELP... They're Killing Me" | Gail Seiler

11.4K1 -

3:07:51

3:07:51

Barry Cunningham

9 hours agoPRESIDENT TRUMP ANNOUNCES THE CHIPOCALYPSE! AND I'M HERE FOR IT! (AND MORE NEWS)

136K69 -

13:37

13:37

Exploring With Nug

12 hours ago $3.09 earnedTrying to Uncover Secrets in St Augustine’s Waters Missing Person Search!

28.4K3