Premium Only Content

Short-lived QT, revisited – we will soon all be Japanese

(Pardon the background noise at the outset of the audio. Plus, due to protracted software issues, upload on to rumble two days after creation date, namely April 27th.)

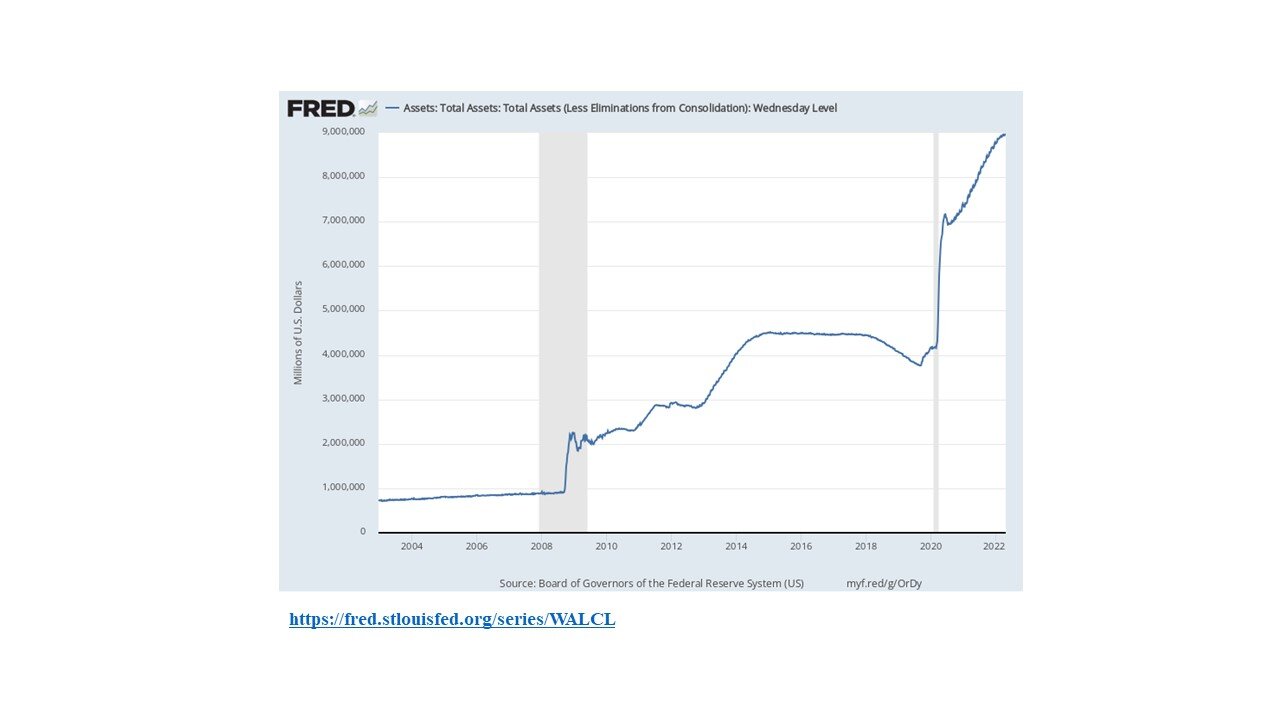

Short-lived QT, revisited, a topic that I published on numerous times, including in a post from 2018, Post #44, where one of the sections was titled: “That Fed QT (bond sales) will morph into record Fed QE (bond purchases or debt monetization) amidst reversion beyond the mean.” Note that between November 2016 and September 2019, the Fed’s balance sheet fell from $4.47trn to $3.78trn, a reduction of nearly $700bn over 2.8 years, or an average annual reduction of $250bn.

From that $3.78trn low point, the Fed’s balance sheet, mostly consisting of short-term US debt and to a lesser degree mortgage bonds, has ballooned to $8.96trn in just 2.7 years, an increase of 137% or a whopping $5.2trn. Makes the $700bn balance sheet reduction over a similar time period look puny.

For the past few years, the Fed has been counterfeiting at the rate of $125bn per month or $1.5trn p.a.. These bond purchases have not only soaked up bonds at an artificially low rate (financial repression or the enablement of outsized government spending and deficits), but the central bank bond purchases have increased the monetary base by a similar magnitude, again opening the door to widespread growth in the money supply in a fractional reserve monetary system such as ours/the world’s.

That same Fed now wants to revisit QT, which is the same as selling bonds and thus shrinking its balance sheet or the monetary base. The Fed has targeted doing this at a $95bn monthly rate, which amounts to $1.1trn a year in bonds that it will sell, in the process taking the same amount of money out of the system. Mopping it up, if you will.

Now, $1.5trn in less money created/printed coupled with $1.1trn p.a. of money absorbed and effectively disappearing from the monetary system spells a sea change of $2.6trn p.a. in liquidity. That’s huge.

Juxtapose this against a fiscal 2021 US federal deficit of $2.8trn prior to a formal recession, a spending binge-fueled deficit, BTW, Congress enacted $7trn in new spending over the past 18 months. The spending fueled deficit which is already expanding markedly half way through fiscal 2022, a deficit that will likely bloat by $1trn to $2trn dollars given lower tax revenues and higher transfer payments associated with an even stouter recession prior to another $5.8trn in the spending pipeline on entitlements ($1.8trn) and green energy cronyism ($4trn), which will pulverize leveraged output and affordability even further. The gathering recession will feature greatly reduced consumer purchasing power and heightened poverty in an increasingly stagflationary environment -- official US consumer inflation is now running at 8.5% on an annualized basis or about 17% in street terms … As such, the federal deficit could be even larger than $3.8trn to $4.8trn as goods and services people need continue to get ever pricier and those that they want yet have to forgo inevitably become cheaper, but don’t define Main Street consumer inflation.

Also juxtapose Fed QT against a trade deficit in goods and services moving into the $1trn plus range annually, and you have a financing dilemma that by definition will exert substantial pressure on the cost of money or capital.

In aggregate, if the Fed really commences with substantial and sustained bond sales, about $2.6trn in less liquidity will be set against something on the order of $3.8trn plus in federal government deficit financing needs in a gathering recession. Note that average total federal receipts amount to “only” about $4trn in a non-recession year, about $2.5trn below total federal outlays. Fed QT or bond sales would also make it substantially more difficult to finance a $1trn trade deficit with foreigners increasingly reluctant to finance US deficits and possibly even moving to sell some of their NET US dollar based assets of over $18trn given the growing weaponization of the US dollar. The US is a net overseas debtor of $18trn. All said, there could suddenly be a major, multi-trillion dollar shortfall of capital to finance something like $4.8trn in USD-based financing needs at the governmental and trade deficit levels BEFORE any net sales of US assets by foreigners.

Short of WWIII, please tell me how this won’t ultimately result in higher, potentially significantly higher, interest rates for an economy as a heavily indebted private sector, both corporate and households, will require a greater incentive to purchase government bonds now that the Fed wants to get out of the game on the one hand and even sell bonds (QT) into the market on the other hand.

To add insult to injury, a misallocated, $1.9trn annual compliance cost bubble economy with ever more regulatory cost and regulatory insanity that also has a) total interest-bearing debt of $88trn, b) very short-term financing, and c) a de facto increased interest expense of roughly $880bn for every 100 BP increase in the average cost of financing is a very fragile economy indeed. I’ve long called it the progeny of a highly toxic public policy stew enabled by the printing press. A wealth of nations’ poison. Now consider this epic mess against a backdrop of a bubble economy and a long-standing zero interest rate policy that, together with Fed and foreign financing of US deficits via money printing, has resulted in deeply negative real US interest rates of around MINUS 14.2% (17% real world consumer inflation and a 10-year Treasury yielding 2.8%). How long until bond vigilantes return? Will they want to sell bonds together with the Fed, or will they start front running it?

Moreover, dwell on a 40-year bond bull market that is set to reverse powerfully into a very deep and long bear market given our extreme money printing induced indebtedness, raging inflation, and ever-growing solvency risks in both the public and private sectors. Again, the only ugly caveat here would be if the Russian/Ukrainian war spills over into wider Europe, which would then cause a flight into the dollar, again letting America get away with fiscal, monetary, and rule of law murder. In fact, this may already be occurring. This is the big wild card, although obviously no one will be able to hide if the war goes nuclear. Then the only concern will soon be survival. Globally. In other words, everything else will be rendered academic.

Assuming we are spared such a horror despite our psychopath politicians, how long does the Fed think it can carry forward a tightening policy in an over-indebted economy with short-term financing on the one hand and asset bubbles that rising interest rates would pop on the other hand? It was already tried between ’16 and ’19, and it was an utter failure. Debt, misallocations, cronyism, Coronacrat Main Street destruction, and even more onerous, freedom and property right pummeling legislation or policies, including even more insidious social, environmental, and government engineering, promise to increase the political and economic straight jacket further still, requiring yet more money printing as productivity and the economy wilt further.

Therefore, look for a rapid, even more outrageous return to QE and a reversal of any baby steps on the Fed Funds rate front sooner rather than later, which, in a high inflation landscape, promise to further entrench consumer goods inflation and add even more pressure to the dollar’s reserve currency and leading commercial currency (the petrodollar) role beyond that which is already beckoning in Russia, China, Iran, and Saudi Arabia. Add to that the corporate shift from jit to jic inventory practices, consumer hoarding, the rising proclivity to spend increasingly rapidly depreciating dollars, euros, pounds, and yen, and you have the HUGE global increase in the monetary base of leading central banks all the sudden getting a lot of money multiplier traction to yield way too many counterfeit currencies chasing a deficit of goods and services made much worse by the plandemic lockdowns AND THE RELATED supply chain destruction.

Note that there are pundits pointing to the deflationary impact from rising prices of goods and services that you need, such as food, energy, lodging, and insurance and those that you want, such as Netflix streaming and Disney entertainment, which will come under pressure – as if this will moderate overall inflation substantially in a fiat currency world. As said, It won’t. Things that you need will go up in price, and things that you don’t need but want will suffer less demand and less pricing power. This is called Main Street price inflation, and thus national price inflation, which the Fed and other central banks will inevitably stoke even further in an effort to rescue their asset bubbles, their political friends’ election prospects, and, as regards the Fed, the money center bank balance sheets and earnings – in short, the balance sheets and earnings of the Fed’s owners.

For perspective on just what central banks will do to save asset bubbles, consider the BOJ’s decision to launch unlimited bond purchases to keep the 10-year JGB from rising above 0.25% as inflation in Japan and in Germany are soaring on the back of unprecedented counterfeiting by the BOJ over decades and the ECB since 2008. This is called spiking the inflationary punch bowl. We will all soon be Japanese.

There's more in the audio, including the misnomers about how clot-shot induced economic weakness and societal havoc will be deflationary. NOT TRUE, it will be inflationary. Details in the audio.

Perhaps you will find it of interest?

-

51:11

51:11

Kimberly Guilfoyle

2 hours agoFull Recap of The Foreign Relations Committee Hearing | Ep.236

24.5K8 -

42:39

42:39

Candace Show Podcast

1 hour agoBREAKING NEWS: Brigitte Macron Loses In Court! (It’s A Dude.) | Candace Ep 214

1.96K14 -

51:43

51:43

Redacted News

1 hour agoGiza Pyramid Cover-Up: Massive City, Hidden Water Tunnels and Ancient Tech Beneath the Pyramids!

2.95K18 -

LIVE

LIVE

Sarah Westall

45 minutes agoThe Future: 1000 Years of Peace is Starting Soon - Psychic and Spiritual Medium Eddie Connor

226 watching -

LIVE

LIVE

Nikko Ortiz

18 minutes agoLIVE STREAM!!!

919 watching -

LIVE

LIVE

freecastle

4 hours agoTAKE UP YOUR CROSS- Time To Reverse The Effects Of Moral Decay

277 watching -

LIVE

LIVE

LFA TV

21 hours agoLFA TV ALL DAY STREAM - THURSDAY 7/10/25

1,349 watching -

1:12:09

1:12:09

vivafrei

3 hours agoSecret Service Agents SUSPENDED! Epstein Fallout Continues! Meme Troll EXONERATED! & MORE!

115K53 -

1:18:47

1:18:47

The Quartering

3 hours agoSuperman Actually Good? Deranged Youtuber Arrested & Huge Social Media Study

107K13 -

LIVE

LIVE

Barry Cunningham

4 hours agoIF YOU'RE REALLY UPSET WITH PRESIDENT TRUMP...CONSIDER YOUR FUTURE!

1,175 watching