Premium Only Content

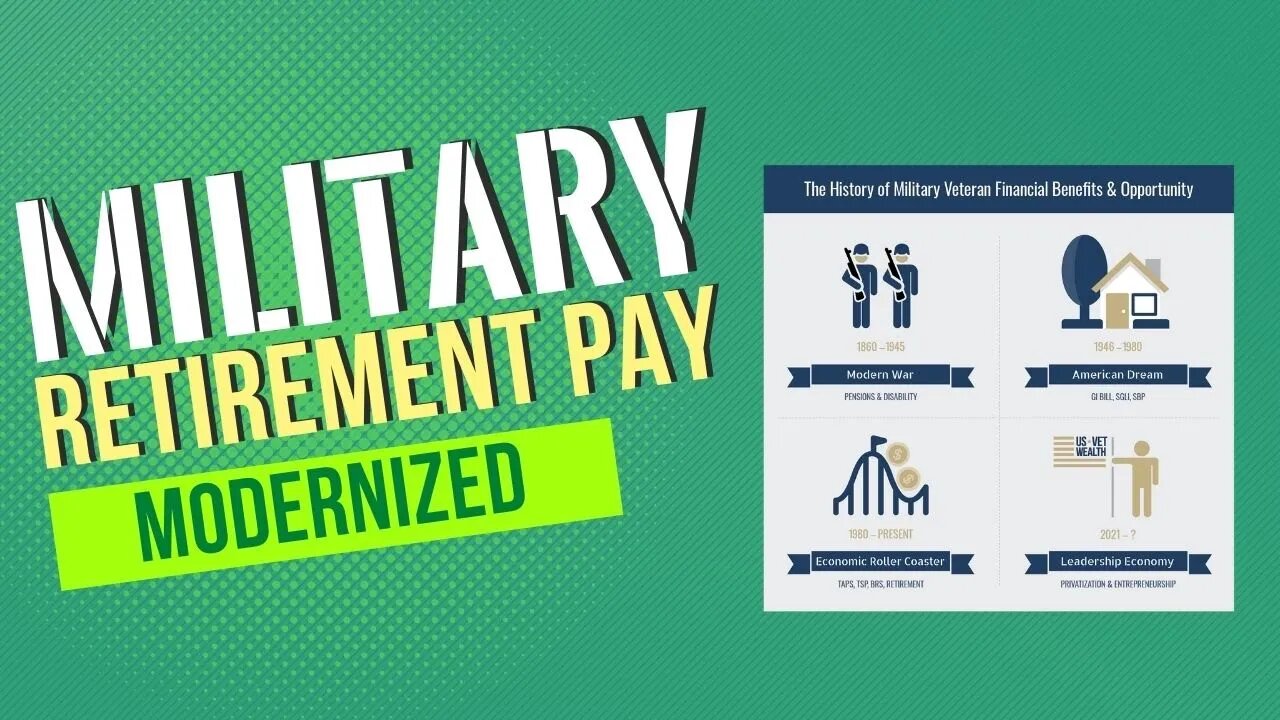

How to Privatize Your Military Retirement Planning Financial Strategy

You're watching this because you know that you need to take your military retirement planning finances more seriously. You may not know where to start, but I'm going to show you the best way to modernize and privatize your finances for a brighter future.

You're smart to be taking your military retirement planning finances more seriously. It can be a complicated and confusing process, but I'm here to help. I'm Scott, a former United States Army officer and the founder of US VetWealth. I've worked with hundreds of people in your situation and I know how to get you the best possible results.

In this video, I'll show you the best way to modernize and privatize your finances so that you can enjoy life after service without worrying about money. I'll guide you step-by-step through the process and show you how to make the most of your hard-earned money.

So watch this video and let's get started!

_____

When it comes to military retirement planning, many service members find the process to be overwhelming and confusing. However, with the help of reliable military pension advice, it is possible to streamline and simplify this complex process.

One of the most important things to consider when planning your retirement is whether you will continue to receive military benefits or opt for more modern privatized options. Military life insurance plans such as SGLI, VGLI, and SBP are explained as benefits but have costs and negative consequences if not fully understood.

Furthermore, your individual situation and goals will impact how you should approach your retirement strategy, so it is vital to work with an experienced financial advisor who can help you develop a plan that reflects your specific needs and circumstances.

Ultimately, with the right guidance and careful planning, navigating the military retirement planning process can be an effective way to help ensure your financial security for years to come.

-

28:36

28:36

Afshin Rattansi's Going Underground

1 day agoDoug Bandow: ENORMOUS DAMAGE Done to US’ Reputation Over Gaza, Trump ‘Easily Manipulated’ by Israel

28.8K29 -

2:45:13

2:45:13

Barry Cunningham

16 hours agoCBS CAUGHT AGAIN! CHICAGO A MESS! LISA COOK IS COOKED AND MORE LABOR DAY NEWS!

114K51 -

6:39:17

6:39:17

StevieTLIVE

10 hours agoMASSIVE Warzone Wins on Labor Day w/ Spartakus

34.1K1 -

10:46:42

10:46:42

Rallied

16 hours ago $18.27 earnedWarzone Challenges w/ Doc & Bob

202K4 -

3:26:25

3:26:25

Joe Donuts Live

9 hours ago🟢 Lost in Space with My Clones: The Alters Adventure Begins

38.6K5 -

7:20:22

7:20:22

Dr Disrespect

18 hours ago🔴LIVE - DR DISRESPECT - TRIPLE THREAT CHALLENGE - WINNING AT EVERYTHING

225K12 -

2:35:33

2:35:33

Chrono

10 hours agoBirthday-eve Stream | Helldivers II

32.6K1 -

54:40

54:40

BonginoReport

1 day agoLABOR DAY SPECIAL! The Best of Nightly Scroll - Nightly Scroll w/ Hayley Caronia (Ep.124)

139K15 -

2:39:21

2:39:21

Joker Effect

8 hours agoReviewing the downfall of Kick Streaming. Kick streamers welcome to Rumble! Stake bombshell found!

39.8K1 -

1:06:10

1:06:10

Russell Brand

17 hours agoThe Greatest Lie Ever Told? - SF625

105K136